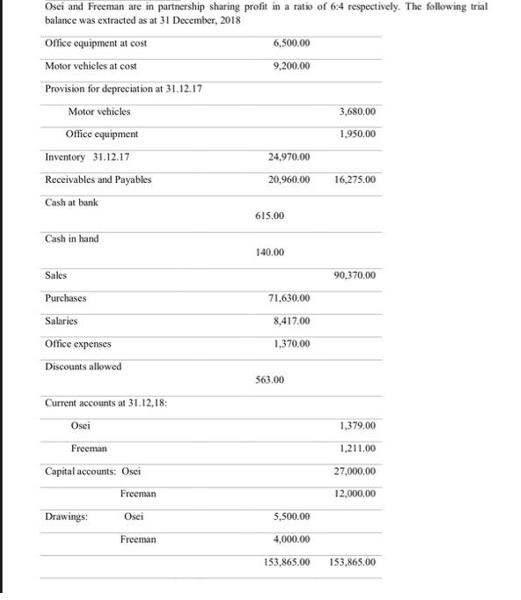

Question: Osei and Freeman are in partnership sharing profit in a ratio of 6:4 respectively. The following trial balance was extracted as at 31 December,

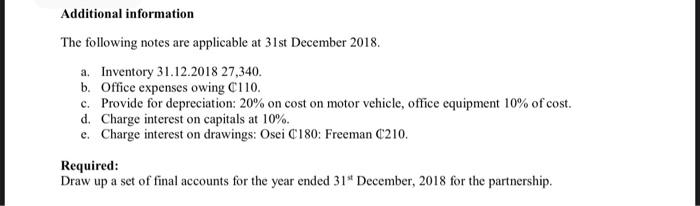

Osei and Freeman are in partnership sharing profit in a ratio of 6:4 respectively. The following trial balance was extracted as at 31 December, 2018 Office equipment at cost 6,500.00 Motor vehieles at cost 9,200.00 Provision for depreciation at 31.12.17 Motor vehicles 3,680,00 Ofice equipment 1,950.00 Inventory 31.12.17 24,970.00 Receivables and Payables 20,960.00 16,275.00 Cash at bank 615.00 Cash in hand 140.00 Sales 90,370.00 Purchases 71,630.00 Salaries 8,417.00 Office expenses 1,370.00 Discounts alowed 563.00 Current accounts at 31.12,18: Osei 1,379,00 Freeman 1,211.00 Capital accounts: Osci 27,000.00 Freeman 12,000,00 Drawings: Osei 5,500.00 Freeman 4,000.00 153,865.00 153,865.00 Additional information The following notes are applicable at 31st December 2018. a. Inventory 31.12.2018 27,340. b. Office expenses owing C110. c. Provide for depreciation: 20% on cost on motor vehicle, office equipment 10% of cost. d. Charge interest on capitals at 10%. e. Charge interest on drawings: Osei C180: Freeman C210. Required: Draw up a set of final accounts for the year ended 31* December, 2018 for the partnership.

Step by Step Solution

3.32 Rating (149 Votes )

There are 3 Steps involved in it

Following are the set of accounts for the year ended 31st December 2018 for the partnership company of Osei and Freeman Balance Sheet as of 31st Decem... View full answer

Get step-by-step solutions from verified subject matter experts