Question: Accounting Questions ( 7, 8, & 9) Question 7 Refer to Question 7.png , use the list of accounts provided below for the journal entries.

Accounting Questions ( 7, 8, & 9)

Question 7

Refer to Question 7.png, use the list of accounts provided below for the journal entries.

List Of Accounts

- Accounts Payable

- Accounts Receivable

- Allowance to Reduce Inventory to NRV

- Biological Assets

- Buildings

- Cash

- Cost of Goods Sold

- Equipment

- Interest Expense

- Interest Income

- Interest Payable

- Interest Receivable

- Inventory

- Inventory Over and Short

- Land

- Liability for Onerous Contracts

- Loss on Inventory Due to Decline in NRV

- Loss on Purchase Contracts

- No Entry

- Purchase Discounts

- Purchase Discounts Lost

- Purchase Returns and Allowances

- Purchases

- Raw Materials

- Realized Gain or Loss

- Rebate Receivable

- Recovery of Loss on Inventory Due to Decline in NRV

- Refund Liability

- Retained Earnings

- Sales Returns and Allowances

- Sales Revenue

- Supplies Expense

- Unrealized Gain or Loss

Question 7.png

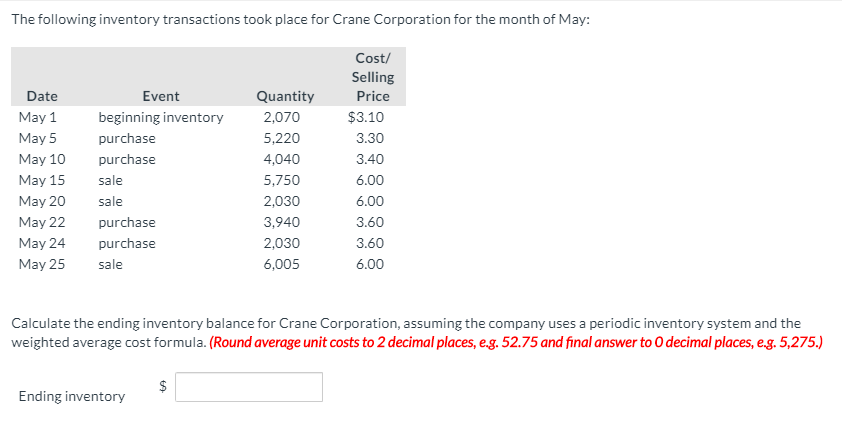

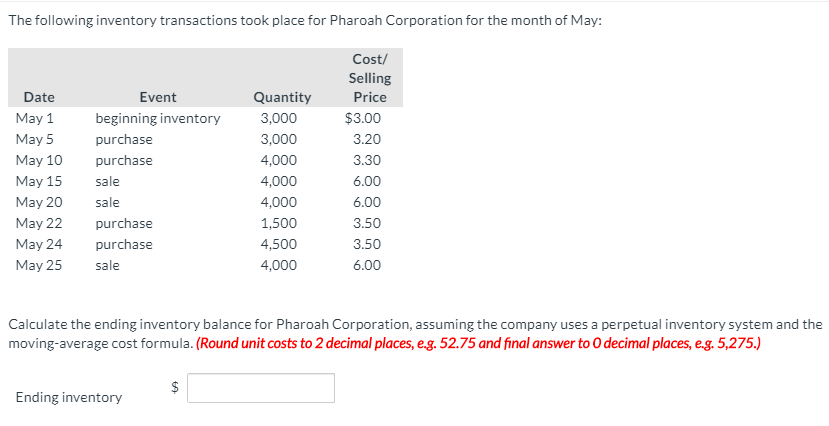

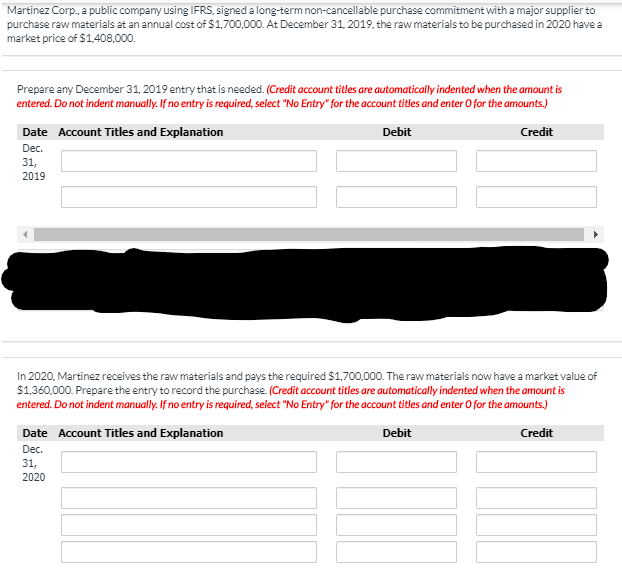

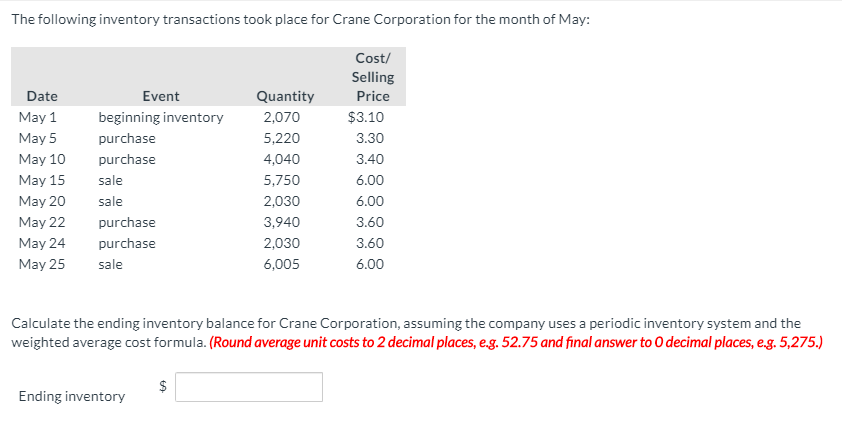

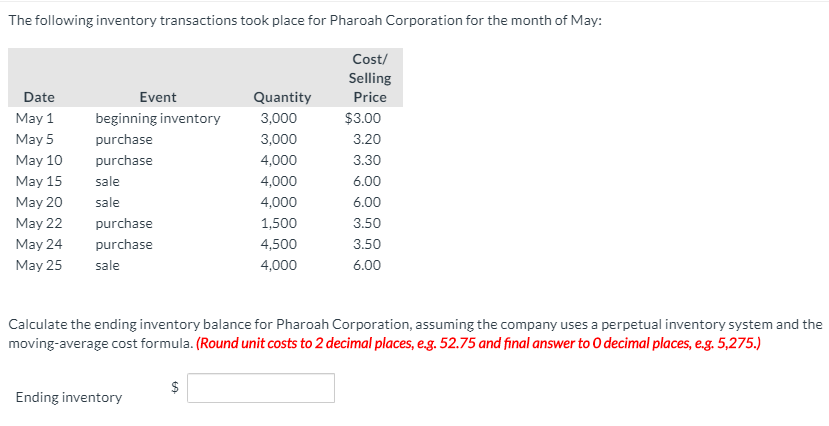

Martinez Corp., a public company using IFRS, signed a long-term non-cancellable purchase commitment with a major supplier to purchase raw materials at an annual cost of $1,700,000. At December 31, 2019. the raw materials to be purchased in 2020 have a market price of $1,408,000. Prepare any December 31, 2019 entry that is needed. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) Date Account Titles and Explanation Debit Credit Dec. 31, 2019 In 2020, Martinez receives the raw materials and pays the required $1,700,000. The raw materials now have a market value of $1,360,000. Prepare the entry to record the purchase (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) Date Account Titles and Explanation Debit Credit Dec. 31, 2020The following inventory transactions took place for Crane Corporation for the month of May: Cost/ Selling Date Event Quantity Price May 1 beginning inventory 2,070 $3.10 May 5 purchase 5,220 3.30 May 10 purchase 4,040 3.40 May 15 sale 5,750 6.00 May 20 sale 2,030 6.00 May 22 purchase 3,940 3.60 May 24 purchase 2,030 3.60 May 25 sale 6,005 6.00 Calculate the ending inventory balance for Crane Corporation, assuming the company uses a periodic inventory system and the weighted average cost formula. (Round average unit costs to 2 decimal places, e.g. 52.75 and final answer to O decimal places, e.g. 5,275.) Ending inventoryThe following inventory transactions took place for Pharoah Corporation for the month of May: Cost/ Selling Date Event Quantity Price May 1 beginning inventory 3,000 $3.00 May 5 purchase 3,000 3.20 May 10 purchase 4,000 3.30 May 15 sale 4,000 6.00 May 20 sale 4,000 6.00 May 22 purchase 1,500 3.50 May 24 purchase 4,500 3.50 May 25 sale 4,000 6.00 Calculate the ending inventory balance for Pharoah Corporation, assuming the company uses a perpetual inventory system and the moving-average cost formula. (Round unit costs to 2 decimal places, e.g. 52.75 and final answer to 0 decimal places, e.g. 5,275.) Ending inventory

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts