Question: Accounting Research Group Project: Operating Lease ( I need help with the lessee part, I have attached the Demo Problem ) Part A . FASB

Accounting Research Group Project: Operating Lease I need help with the lessee part, I have attached the Demo Problem

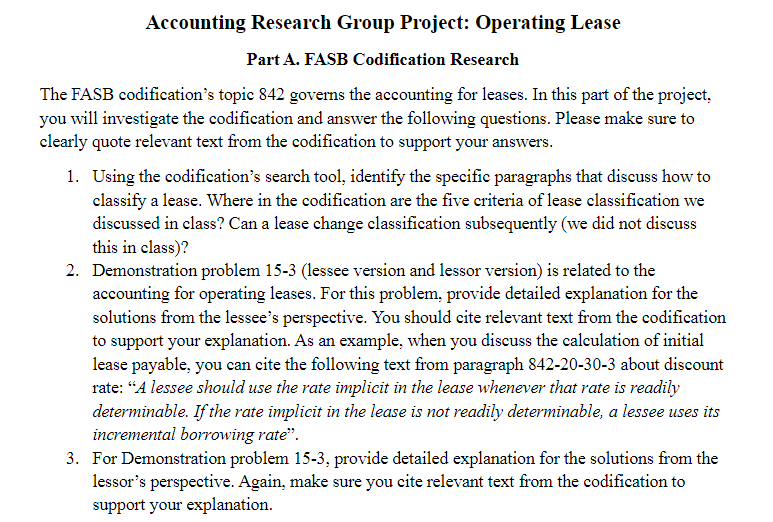

Part A FASB Codification Research

The FASB codification's topic governs the accounting for leases. In this part of the project,

you will investigate the codification and answer the following questions. Please make sure to

clearly quote relevant text from the codification to support your answers.

Using the codification's search tool, identify the specific paragraphs that discuss how to

classify a lease. Where in the codification are the five criteria of lease classification we

discussed in class? Can a lease change classification subsequently we did not discuss

this in class

Demonstration problem lessee version and lessor version is related to the

accounting for operating leases. For this problem, provide detailed explanation for the

solutions from the lessee's perspective. You should cite relevant text from the codification

to support your explanation. As an example, when you discuss the calculation of initial

lease payable, you can cite the following text from paragraph about discount

rate: "A lessee should use the rate implicit in the lease whenever that rate is readily

determinable. If the rate implicit in the lease is not readily determinable, a lessee uses its

incremental borrowing rate".

For Demonstration problem provide detailed explanation for the solutions from the

lessor's perspective. Again, make sure you cite relevant text from the codification to

support your explanation. lessee version

On December Ajax Inc. is the lessee in a lease contract for an equipment with a term of years, minimum annual payment of $ with the first payment due immediately. The equipment has a useful life of years with no salvage value and the lease has no purchase option. Ajax classifies the lease as an operating lease. Ajax's cost of capital is

Required:

a Prepare Ajax's journal entries on Dec for the inception of lease and the first lease payment. What is Ajax's yearend balance for lease payable?

b Prepare Ajax's journal entry on Dec for the second lease payment. What is Ajax's yearend balance for lease payable?

c Prepare the journal entry on Dec to recognize Ajax's amortization expense for the rightofuse asset in What is Ajax's yearend balance for rightofuse asset?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock