Question: Exercise 2 2 - 7 Departmental contribution to overhead P 3 Below are departmental income statements for a guitar manufacturer. The company classifies advertising, rent,

Exercise

Departmental contribution to overhead

P

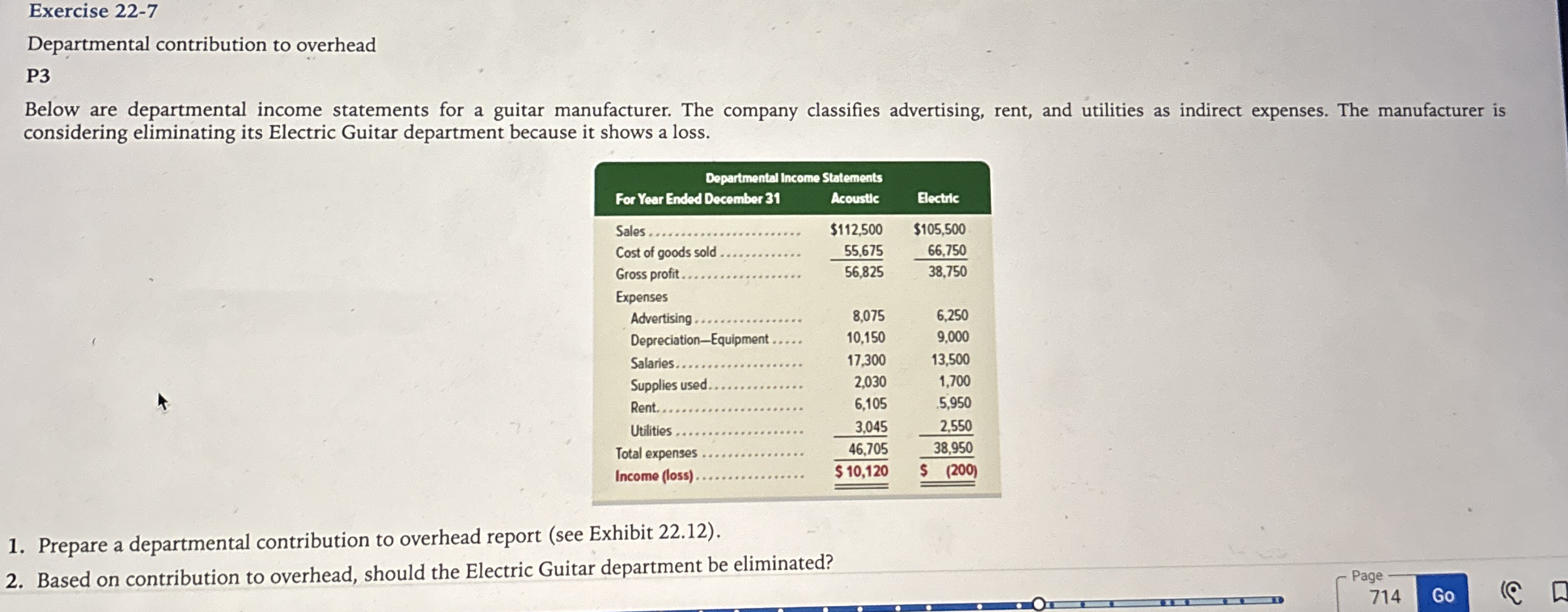

Below are departmental income statements for a guitar manufacturer. The company classifies advertising, rent, and utilities as indirect expenses. The manufacturer is considering eliminating its Electric Guitar department because it shows a loss.

tableDepartmental Income StatementsFor Year Ended December Acoustic,BectricSales $$Cost of goods sold Gross profit..................,ExpensesAdvertising DepreciationEquipment SalariesSupplies used...............,RentUtilities Total expenses Income loss$$

Prepare a departmental contribution to overhead report see Exhibit

Based on contribution to overhead, should the Electric Guitar department be eliminated?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock