Question: Mr Leung is a Hong Kong resident and the marketing manager of Tin's Limited, a company incorporated in Hong Kong and carries on business

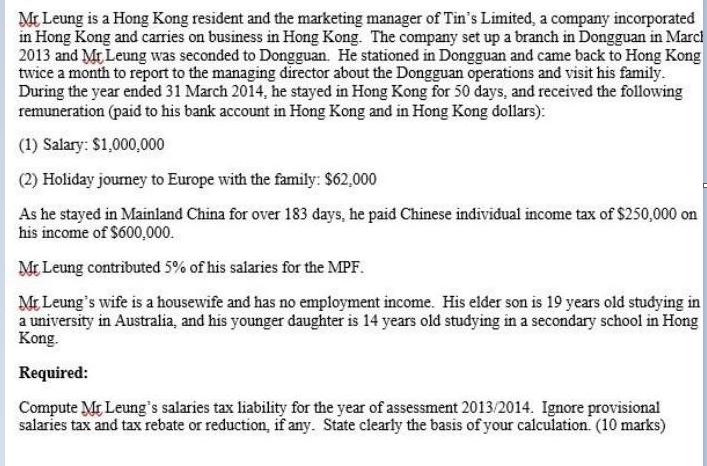

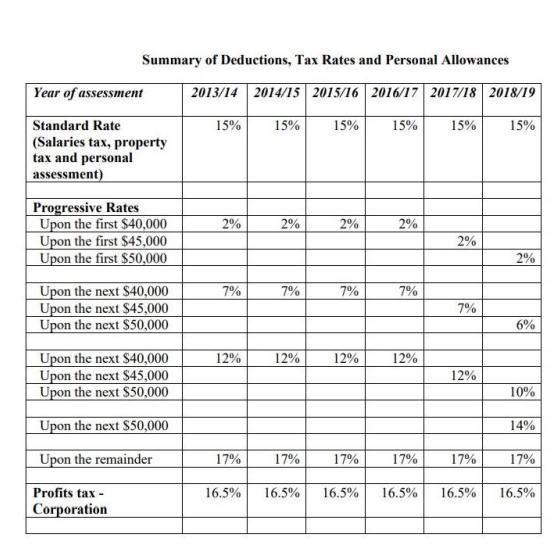

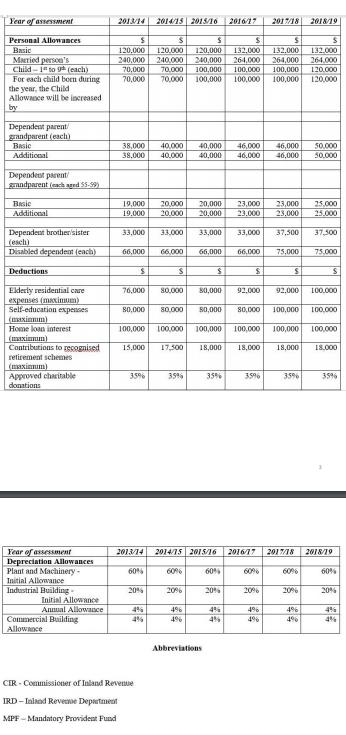

Mr Leung is a Hong Kong resident and the marketing manager of Tin's Limited, a company incorporated in Hong Kong and carries on business in Hong Kong. The company set up a branch in Dongguan in March 2013 and Mr Leung was seconded to Dongguan. He stationed in Dongguan and came back to Hong Kong twice a month to report to the managing director about the Dongguan operations and visit his family. During the year ended 31 March 2014, he stayed in Hong Kong for 50 days, and received the following remuneration (paid to his bank account in Hong Kong and in Hong Kong dollars): (1) Salary: $1,000,000 (2) Holiday journey to Europe with the family: $62,000 As he stayed in Mainland China for over 183 days, he paid Chinese individual income tax of $250,000 on his income of $600,000. Mr Leung contributed 5% of his salaries for the MPF. Mr Leung's wife is a housewife and has no employment income. His elder son is 19 years old studying in a university in Australia, and his younger daughter is 14 years old studying in a secondary school in Hong Kong. Required: Compute Mr Leung's salaries tax liability for the year of assessment 2013/2014. Ignore provisional salaries tax and tax rebate or reduction, if any. State clearly the basis of your calculation. (10 marks) Summary of Deductions, Tax Rates and Personal Allowances 2013/14 2014/15 2015/16 2016/17 2017/18 2018/19 15% 15% 15% 15% 15% 15% 2% 2% 2% 2% 2% 7% 7% 7% 7% 7% 6% 12% 12% 12% 12% 12% 10% 14% 17% 17% 17% 17% 17% 17% 16.5% 16.5% 16.5% 16.5% 16.5% 16.5% Year of assessment Standard Rate (Salaries tax, property tax and personal assessment) Progressive Rates Upon the first $40,000 Upon the first $45,000 Upon the first $50,000 Upon the next $40,000 Upon the next $45,000 Upon the next $50,000 Upon the next $40,000 Upon the next $45,000 Upon the next $50,000 Upon the next $50,000 Upon the remainder Profits tax- Corporation 2% 2013/14 2014/15 2015/16 2016/17 2017/18 2018/19 $ $ $ $ 120,000 120,000 240,000 240,000 264,000 120,000 132.000 240,000 264.000 100,000 100,000 100,000 100,000 132.000 132,000 264,000 100,000 100,000 70,000 70,000 70,000 70,000 120.000 120,000 38,000 40,000 40,000 50.000 46,000 46,000 46.000 46,000 50,000 38,000 40,000 40,000 20,000 20,000 19,000 19.000 23,000 23,000 25,000 20.000 20,000 23.000 23,000 25.000 33,000 33.000 33,000 33,000 37,500 37,500 66,000 66,000 66,000 66,000 75.000 75.000 $ S $ $ S S 76,000 80,000 80,000 92,000 92.000 100,000 80,000 80,000 80,000 80,000 100,000 100,000 100,000 100,000 100,000 100,000 100,000 100,000 15,000 17,500 18,000 18,000 18,000 18.000 35% 35% 35% 3.5% 35% 35% 2014/15 2015/16 2016/17 2018/19 60% 60% 60% 20% 20% 20% 4% 4% 4% 4% 4% 4% Abbreviations Year of assessment Personal Allowances Basic Married person's Child-1 to 9h (each) For each child born during the year, the Child Allowance will be increased by Dependent parent/ grandparent (each) Basic Additional Dependent parent/ grandparent (each aged 55.99) Basic Additional Dependent brother sister (esch) Disabled dependent (each) Deductions Elderly residential care expenses (maximum) Self-education expenses (maximum) Home loan interest (maximum) Contributions to recognised retirement schemes (usxitum) Approved charitable donations Year of assessment Depreciation Allowances Plant and Machinery- Initial Allowance Industrial Building- Initial Allowance Annual Allowance Commercial Building Allowance CIR- Commissioner of Inland Revenue IRD-Inland Revenue Department MPF Mandatory Provident Fund 2013/14 60% 20% 4% 4% JE --- [""] III 2017/18 60% 20% 4% 4% COALI 60% 20% 4% 4%

Step by Step Solution

3.32 Rating (149 Votes )

There are 3 Steps involved in it

Solution Profit and Loss Appropriation Acco... View full answer

Get step-by-step solutions from verified subject matter experts