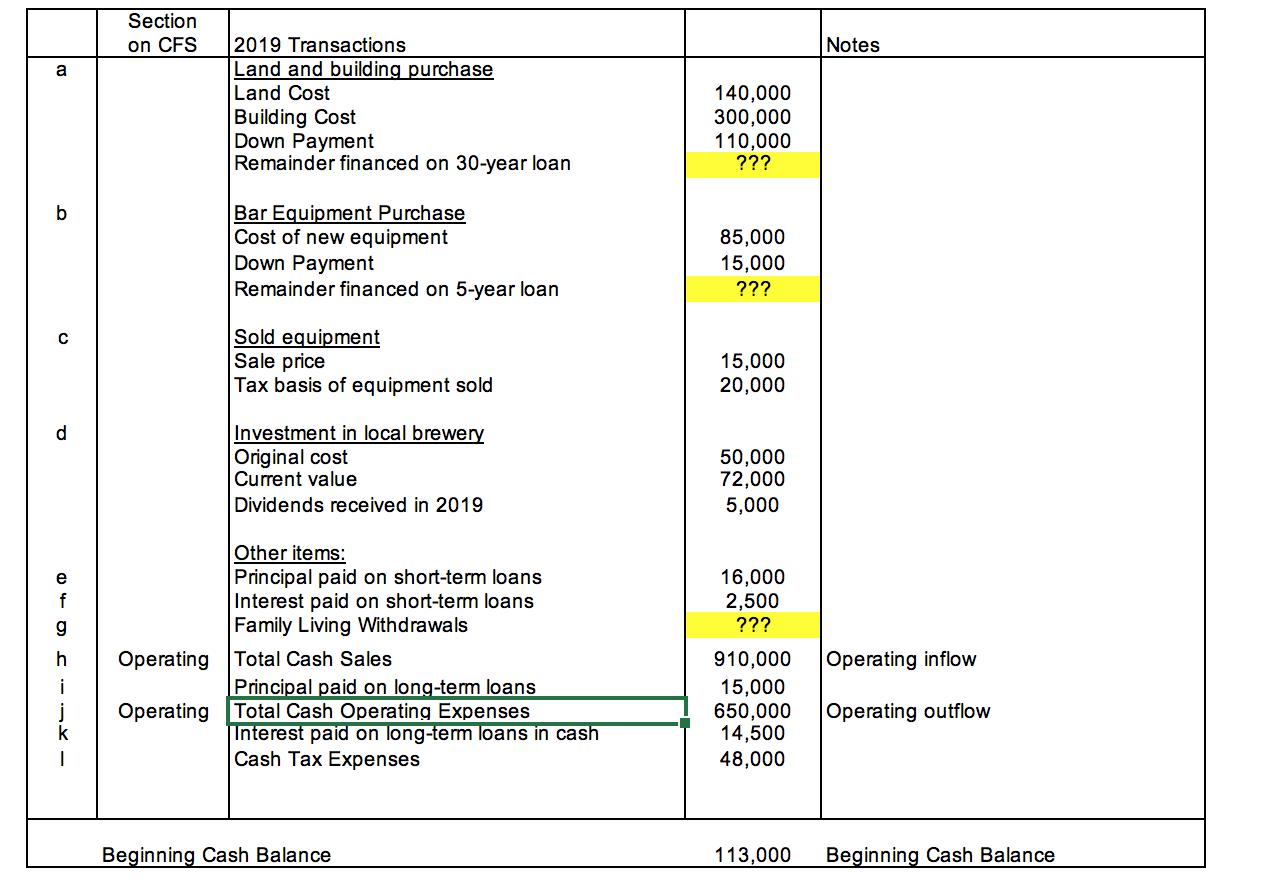

Question: a b C d (4 552 e f g h Section on CFS Operating Operating 2019 Transactions Land and building purchase Land Cost Building

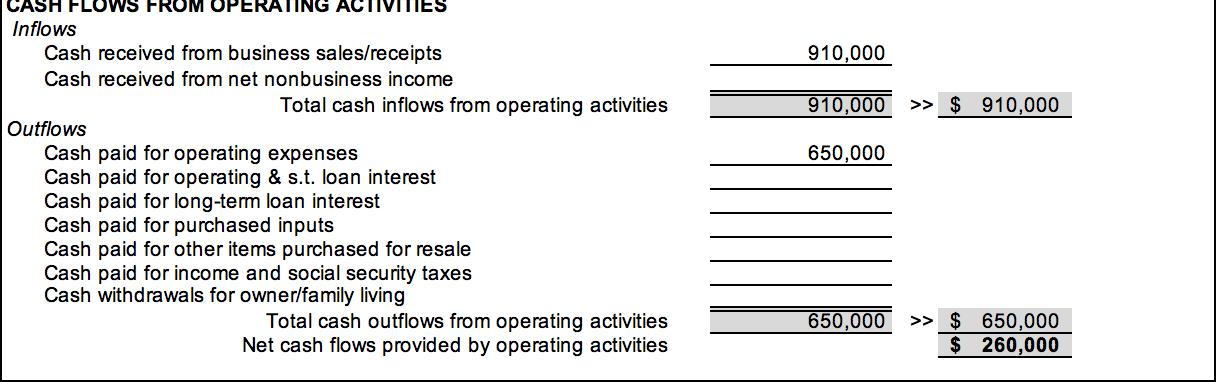

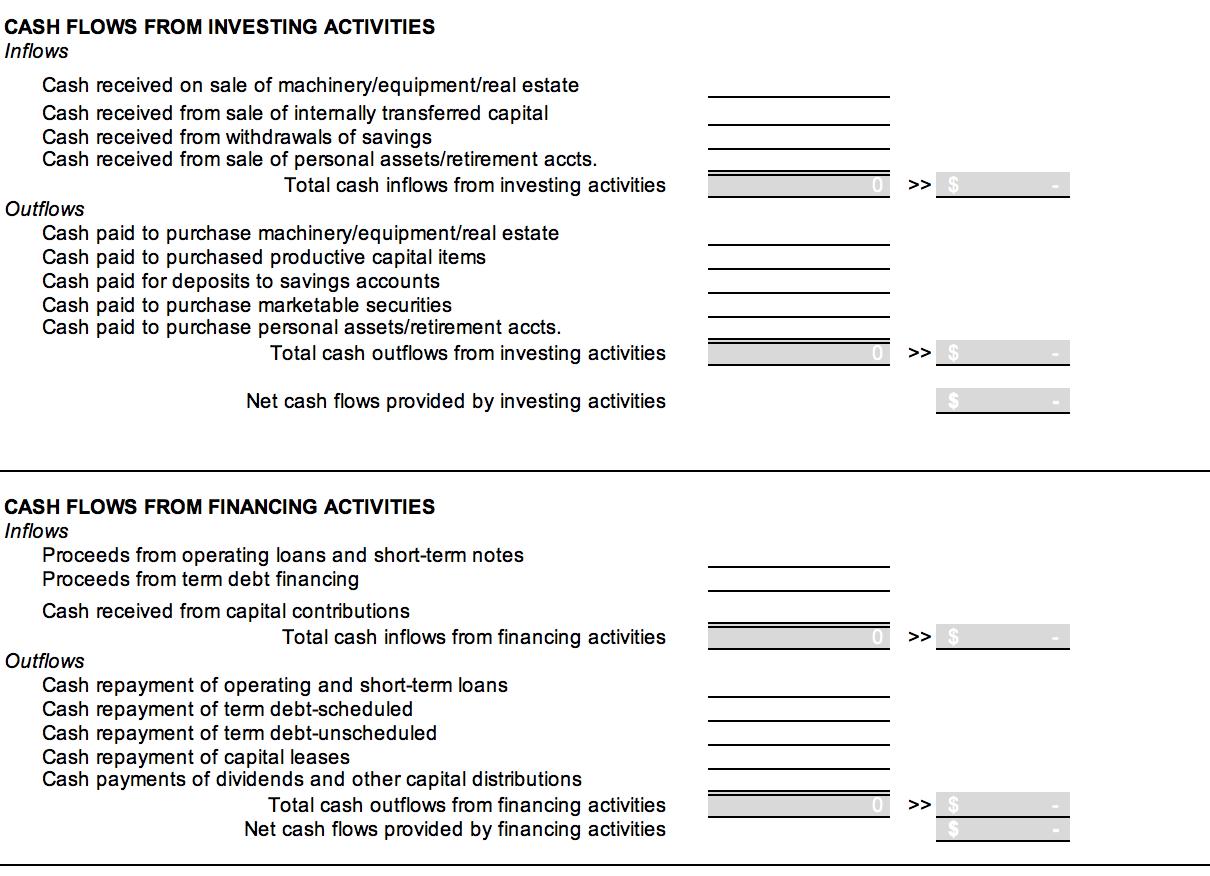

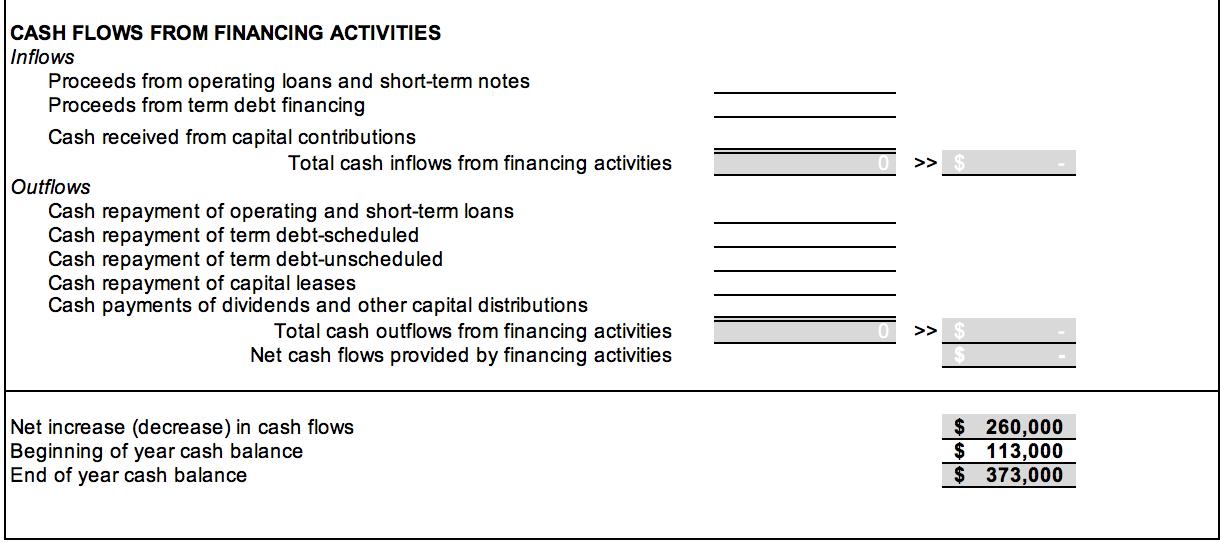

a b C d (4 552 e f g h Section on CFS Operating Operating 2019 Transactions Land and building purchase Land Cost Building Cost Down Payment Remainder financed on 30-year loan Bar Equipment Purchase Cost of new equipment Down Payment Remainder financed on 5-year loan Sold equipment Sale price Tax basis of equipment sold Investment in local brewery Original cost Current value Dividends received in 2019 Other items: Principal paid on short-term loans Interest paid on short-term loans Family Living Withdrawals Total Cash Sales Principal paid on long-term loans Total Cash Operating Expenses Interest paid on long-term loans in cash Cash Tax Expenses Beginning Cash Balance 140,000 300,000 110,000 ??? 85,000 15,000 ??? 15,000 20,000 50,000 72,000 5,000 16,000 2,500 ??? 910,000 15,000 650,000 14,500 48,000 113,000 Notes Operating inflow Operating outflow Beginning Cash Balance CASH FLOWS FROM OPERATING ACTIVITIES Inflows Cash received from business sales/receipts Cash received from net nonbusiness income Outflows Total cash inflows from operating activities Cash paid for operating expenses Cash paid for operating & s.t. loan interest Cash paid for long-term loan interest Cash paid for purchased inputs Cash paid for other items purchased for resale Cash paid for income and social security taxes Cash withdrawals for owner/family living Total cash outflows from operating activities Net cash flows provided by operating activities 910,000 910,000 650,000 650,000 >> $ 910,000 $ 650,000 $ 260,000 CASH FLOWS FROM INVESTING ACTIVITIES Inflows Cash received on sale of machinery/equipment/real estate Cash received from sale of internally transferred capital Cash received from withdrawals of savings Cash received from sale of personal assets/retirement accts. Total cash inflows from investing activities Outflows Cash paid to purchase machinery/equipment/real estate Cash paid to purchased productive capital items Cash paid for deposits to savings accounts Cash paid to purchase marketable securities Cash paid to purchase personal assets/retirement accts. Total cash outflows from investing activities Net cash flows provided by investing activities CASH FLOWS FROM FINANCING ACTIVITIES Inflows Proceeds from operating loans and short-term notes Proceeds from term debt financing Cash received from capital contributions Total cash inflows from financing activities Outflows Cash repayment of operating and short-term loans Cash repayment of term debt-scheduled Cash repayment of term debt-unscheduled Cash repayment of capital leases Cash payments of dividends and other capital distributions Total cash outflows from financing activities Net cash flows provided by financing activities CASH FLOWS FROM FINANCING ACTIVITIES Inflows Proceeds from operating loans and short-term notes Proceeds from term debt financing Cash received from capital contributions Total cash inflows from financing activities Outflows Cash repayment of operating and short-term loans Cash repayment of term debt-scheduled Cash repayment of term debt-unscheduled Cash repayment of capital leases Cash payments of dividends and other capital distributions Total cash outflows from financing activities Net cash flows provided by financing activities Net increase (decrease) in cash flows Beginning of year cash balance End of year cash balance $ 260,000 $ 113,000 $ 373,000

Step by Step Solution

3.54 Rating (161 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts