Question: The net realizable values presentod below were esimatod on 31 Decomber 2019 and re-estimaned en 31 Janary 200. Cont SS20,000 520.000 NaRealicate Yal 31

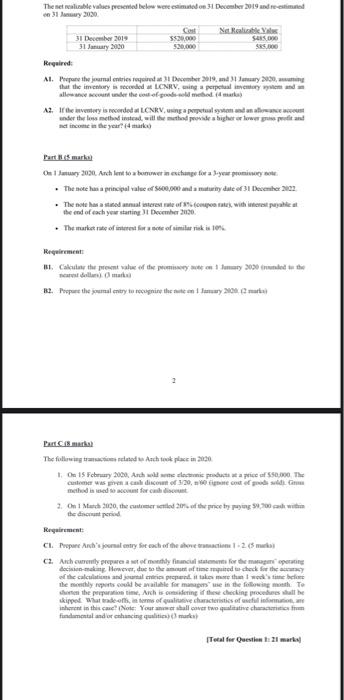

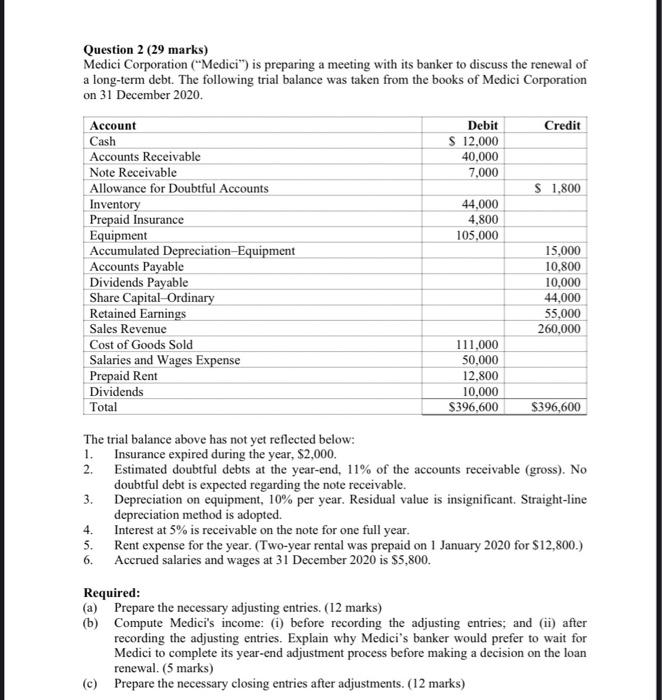

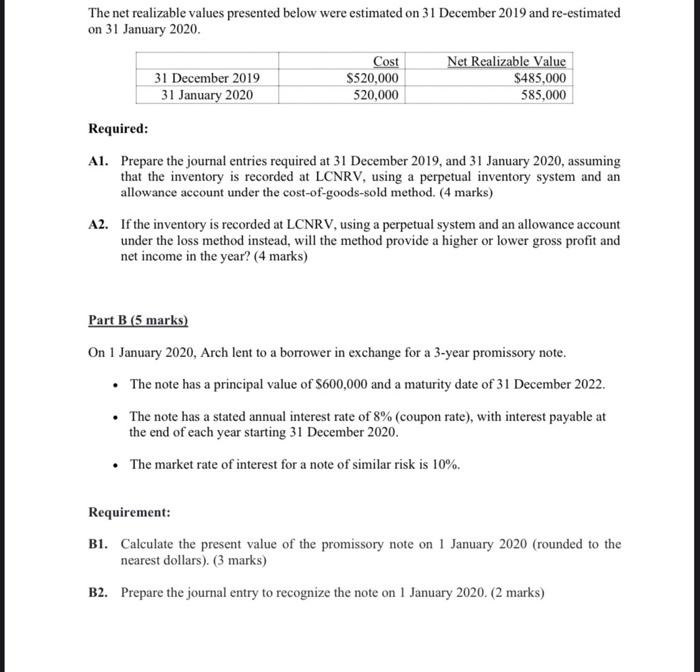

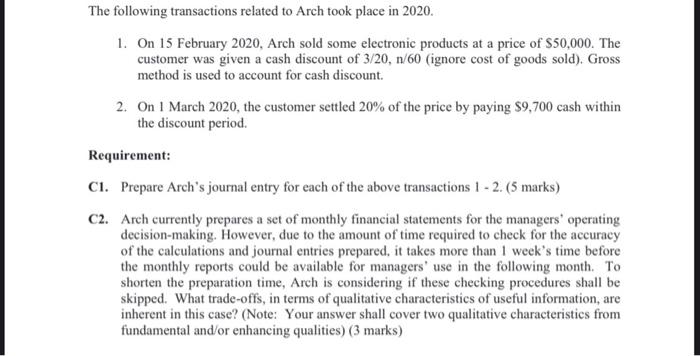

The net realizable values presentod below were esimatod on 31 Decomber 2019 and re-estimaned en 31 Janary 200. Cont SS20,000 520.000 NaRealicate Yal 31 December 2019 31 January 2000 SRS Required: AL. Prepane the jourmal entries required at 31 ecember 2019, and 31 Jamuary 2000, auming that the imentury is reconded at LCNRV, aing a perpetual imemtory ytem and a allowance secunt under the cot of goodeld method (4 marka A2. Irhe inventery is recorded at LCNRV, using a perpetual syston and an alaneu under the loss method instead, will the metd proides higher or lower gs podit and net income in the year? (4 mark Part s markal On i Jamury 2020. Arch lent to a bomower in exchange for a yer promisory note The note has a principal value of S00,000 and a maturiny date of 31 December 2022 The note han a stated annal interest ate of tonpon ate, with innorest payahle at the end of each yew stanting I December 220 The market rate of interest for a note of similar rik is 10 Requirement BI, Cakulanr the present value of the peomissory ate on 1 lumary 2030 inunded t the nearest dellar Omak 82. Propure the joumal entry tu recognire the nute on 1 January 20 2marka) Part Cmarka The folrwing tranactions related Aach teok place in 2020 1. On 15 Februry 2000, Anch wold ame elecmic producta ta price of S50.000. The custemer was given a canh discot of 320, n0 rignane cost of grod sldi. Cin method is sed to acconunt for cah disount 2. On 1 March 2020, the customer setled 20 of the price by paying 00 cadh within the dincount period Reguirement: CI. Propane Anch's jounal entry Soe cach of the ahove tranaction 1-2 (5 muka C2. Anch curenty propare atof mondhly financial statemes for the maagn operating docision-making However, due to the amount of time mpuired to check for the aracy of the calculatioms and jountal entries prepeed it takes mre than I wedk's time belane the monthly reports could be available for manage" use in the following month. Te heten the preparation time, Arch is omsidering if these checking procedres sall be skipped What rade-off, in terms of qualitutive characteristies of useful indonation inherent in this cae (Note: Your anet shall cover two qualitative characeritics fm findumental andior cnhancing qualitien) () marka (Tetal for Questien 2l marka Question 2 (29 marks) Medici Corporation ("Medici") is preparing a meeting with its banker to discuss the renewal of a long-term debt. The following trial balance was taken from the books of Medici Corporation on 31 December 2020. Debit S 12.000 40,000 Account Credit Cash Accounts Receivable Note Receivable 7,000 Allowance for Doubtful Accounts S 1,800 44,000 4,800 Inventory Prepaid Insurance Equipment Accumulated Depreciation-Equipment Accounts Payable Dividends Payable Share Capital-Ordinary Retained Earnings 105,000 15,000 10,800 10,000 44,000 55,000 Sales Revenue 260,000 Cost of Goods Sold Salaries and Wages Expense Prepaid Rent 111,000 50,000 12,800 Dividends 10,000 $396,600 Total $396,600 The trial balance above has not yet reflected below: 1. Insurance expired during the year, S2,000. 2. Estimated doubtful debts at the year-end, 11% of the accounts receivable (gross). No doubtful debt is expected regarding the note receivable. 3. Depreciation on equipment, 10% per year. Residual value is insignificant. Straight-line depreciation method is adopted. 4. Interest at 5% is receivable on the note for one full year. 5. Rent expense for the year. (Two-year rental was prepaid on 1 January 2020 for S12,800.) 6. Accrued salaries and wages at 31 December 2020 is $5,800. Required: (a) Prepare the necessary adjusting entries. (12 marks) (b) Compute Medici's income: (i) before recording the adjusting entries; and (ii) after recording the adjusting entries. Explain why Medici's banker would prefer to wait for Medici to complete its year-end adjustment process before making a decision on the loan renewal. (5 marks) (c) Prepare the necessary closing entries after adjustments. (12 marks) The net realizable values presented below were estimated on 31 December 2019 and re-estimated on 31 January 2020. Cost S520,000 Net Realizable Value $485,000 31 December 2019 31 January 2020 520,000 585,000 Required: Al. Prepare the journal entries required at 31 December 2019, and 31 January 2020, assuming that the inventory is recorded at LCNRVV, using a perpetual inventory system and an allowance account under the cost-of-goods-sold method. (4 marks) A2. If the inventory is recorded at LCNRV, using a perpetual system and an allowance account under the loss method instead, will the method provide a higher or lower gross profit and net income in the year? (4 marks) Part B (5 marks) On 1 January 2020, Arch lent to a borrower in exchange for a 3-year promissory note. The note has a principal value of S600,000 and a maturity date of 31 December 2022. The note has a stated annual interest rate of 8% (coupon rate), with interest payable at the end of each year starting 31 December 2020. The market rate of interest for a note of similar risk is 10%. Requirement: B1. Calculate the present value of the promissory note on 1 January 2020 (rounded to the nearest dollars). (3 marks) B2. Prepare the journal entry to recognize the note on 1 January 2020. (2 marks) The following transactions related to Arch took place in 2020. 1. On 15 February 2020, Arch sold some electronic products at a price of $50,000. The customer was given a cash discount of 3/20, n/60 (ignore cost of goods sold). Gross method is used to account for cash discount. 2. On 1 March 2020, the customer settled 20% of the price by paying $9,700 cash within the discount period. Requirement: C1. Prepare Arch's journal entry for each of the above transactions 1 - 2. (5 marks) C2. Arch currently prepares a set of monthly financial statements for the managers' operating decision-making. However, due to the amount of time required to check for the accuraey of the calculations and journal entries prepared, it takes more than 1 week's time before the monthly reports could be available for managers' use in the following month. To shorten the preparation time, Arch is considering if these checking procedures shall be skipped. What trade-offs, in terms of qualitative characteristics of useful information, are inherent in this case? (Note: Your answer shall cover two qualitative characteristics from fundamental and/or enhancing qualities) (3 marks) The net realizable values presentod below were esimatod on 31 Decomber 2019 and re-estimaned en 31 Janary 200. Cont SS20,000 520.000 NaRealicate Yal 31 December 2019 31 January 2000 SRS Required: AL. Prepane the jourmal entries required at 31 ecember 2019, and 31 Jamuary 2000, auming that the imentury is reconded at LCNRV, aing a perpetual imemtory ytem and a allowance secunt under the cot of goodeld method (4 marka A2. Irhe inventery is recorded at LCNRV, using a perpetual syston and an alaneu under the loss method instead, will the metd proides higher or lower gs podit and net income in the year? (4 mark Part s markal On i Jamury 2020. Arch lent to a bomower in exchange for a yer promisory note The note has a principal value of S00,000 and a maturiny date of 31 December 2022 The note han a stated annal interest ate of tonpon ate, with innorest payahle at the end of each yew stanting I December 220 The market rate of interest for a note of similar rik is 10 Requirement BI, Cakulanr the present value of the peomissory ate on 1 lumary 2030 inunded t the nearest dellar Omak 82. Propure the joumal entry tu recognire the nute on 1 January 20 2marka) Part Cmarka The folrwing tranactions related Aach teok place in 2020 1. On 15 Februry 2000, Anch wold ame elecmic producta ta price of S50.000. The custemer was given a canh discot of 320, n0 rignane cost of grod sldi. Cin method is sed to acconunt for cah disount 2. On 1 March 2020, the customer setled 20 of the price by paying 00 cadh within the dincount period Reguirement: CI. Propane Anch's jounal entry Soe cach of the ahove tranaction 1-2 (5 muka C2. Anch curenty propare atof mondhly financial statemes for the maagn operating docision-making However, due to the amount of time mpuired to check for the aracy of the calculatioms and jountal entries prepeed it takes mre than I wedk's time belane the monthly reports could be available for manage" use in the following month. Te heten the preparation time, Arch is omsidering if these checking procedres sall be skipped What rade-off, in terms of qualitutive characteristies of useful indonation inherent in this cae (Note: Your anet shall cover two qualitative characeritics fm findumental andior cnhancing qualitien) () marka (Tetal for Questien 2l marka Question 2 (29 marks) Medici Corporation ("Medici") is preparing a meeting with its banker to discuss the renewal of a long-term debt. The following trial balance was taken from the books of Medici Corporation on 31 December 2020. Debit S 12.000 40,000 Account Credit Cash Accounts Receivable Note Receivable 7,000 Allowance for Doubtful Accounts S 1,800 44,000 4,800 Inventory Prepaid Insurance Equipment Accumulated Depreciation-Equipment Accounts Payable Dividends Payable Share Capital-Ordinary Retained Earnings 105,000 15,000 10,800 10,000 44,000 55,000 Sales Revenue 260,000 Cost of Goods Sold Salaries and Wages Expense Prepaid Rent 111,000 50,000 12,800 Dividends 10,000 $396,600 Total $396,600 The trial balance above has not yet reflected below: 1. Insurance expired during the year, S2,000. 2. Estimated doubtful debts at the year-end, 11% of the accounts receivable (gross). No doubtful debt is expected regarding the note receivable. 3. Depreciation on equipment, 10% per year. Residual value is insignificant. Straight-line depreciation method is adopted. 4. Interest at 5% is receivable on the note for one full year. 5. Rent expense for the year. (Two-year rental was prepaid on 1 January 2020 for S12,800.) 6. Accrued salaries and wages at 31 December 2020 is $5,800. Required: (a) Prepare the necessary adjusting entries. (12 marks) (b) Compute Medici's income: (i) before recording the adjusting entries; and (ii) after recording the adjusting entries. Explain why Medici's banker would prefer to wait for Medici to complete its year-end adjustment process before making a decision on the loan renewal. (5 marks) (c) Prepare the necessary closing entries after adjustments. (12 marks) The net realizable values presented below were estimated on 31 December 2019 and re-estimated on 31 January 2020. Cost S520,000 Net Realizable Value $485,000 31 December 2019 31 January 2020 520,000 585,000 Required: Al. Prepare the journal entries required at 31 December 2019, and 31 January 2020, assuming that the inventory is recorded at LCNRVV, using a perpetual inventory system and an allowance account under the cost-of-goods-sold method. (4 marks) A2. If the inventory is recorded at LCNRV, using a perpetual system and an allowance account under the loss method instead, will the method provide a higher or lower gross profit and net income in the year? (4 marks) Part B (5 marks) On 1 January 2020, Arch lent to a borrower in exchange for a 3-year promissory note. The note has a principal value of S600,000 and a maturity date of 31 December 2022. The note has a stated annual interest rate of 8% (coupon rate), with interest payable at the end of each year starting 31 December 2020. The market rate of interest for a note of similar risk is 10%. Requirement: B1. Calculate the present value of the promissory note on 1 January 2020 (rounded to the nearest dollars). (3 marks) B2. Prepare the journal entry to recognize the note on 1 January 2020. (2 marks) The following transactions related to Arch took place in 2020. 1. On 15 February 2020, Arch sold some electronic products at a price of $50,000. The customer was given a cash discount of 3/20, n/60 (ignore cost of goods sold). Gross method is used to account for cash discount. 2. On 1 March 2020, the customer settled 20% of the price by paying $9,700 cash within the discount period. Requirement: C1. Prepare Arch's journal entry for each of the above transactions 1 - 2. (5 marks) C2. Arch currently prepares a set of monthly financial statements for the managers' operating decision-making. However, due to the amount of time required to check for the accuraey of the calculations and journal entries prepared, it takes more than 1 week's time before the monthly reports could be available for managers' use in the following month. To shorten the preparation time, Arch is considering if these checking procedures shall be skipped. What trade-offs, in terms of qualitative characteristics of useful information, are inherent in this case? (Note: Your answer shall cover two qualitative characteristics from fundamental and/or enhancing qualities) (3 marks) The net realizable values presentod below were esimatod on 31 Decomber 2019 and re-estimaned en 31 Janary 200. Cont SS20,000 520.000 NaRealicate Yal 31 December 2019 31 January 2000 SRS Required: AL. Prepane the jourmal entries required at 31 ecember 2019, and 31 Jamuary 2000, auming that the imentury is reconded at LCNRV, aing a perpetual imemtory ytem and a allowance secunt under the cot of goodeld method (4 marka A2. Irhe inventery is recorded at LCNRV, using a perpetual syston and an alaneu under the loss method instead, will the metd proides higher or lower gs podit and net income in the year? (4 mark Part s markal On i Jamury 2020. Arch lent to a bomower in exchange for a yer promisory note The note has a principal value of S00,000 and a maturiny date of 31 December 2022 The note han a stated annal interest ate of tonpon ate, with innorest payahle at the end of each yew stanting I December 220 The market rate of interest for a note of similar rik is 10 Requirement BI, Cakulanr the present value of the peomissory ate on 1 lumary 2030 inunded t the nearest dellar Omak 82. Propure the joumal entry tu recognire the nute on 1 January 20 2marka) Part Cmarka The folrwing tranactions related Aach teok place in 2020 1. On 15 Februry 2000, Anch wold ame elecmic producta ta price of S50.000. The custemer was given a canh discot of 320, n0 rignane cost of grod sldi. Cin method is sed to acconunt for cah disount 2. On 1 March 2020, the customer setled 20 of the price by paying 00 cadh within the dincount period Reguirement: CI. Propane Anch's jounal entry Soe cach of the ahove tranaction 1-2 (5 muka C2. Anch curenty propare atof mondhly financial statemes for the maagn operating docision-making However, due to the amount of time mpuired to check for the aracy of the calculatioms and jountal entries prepeed it takes mre than I wedk's time belane the monthly reports could be available for manage" use in the following month. Te heten the preparation time, Arch is omsidering if these checking procedres sall be skipped What rade-off, in terms of qualitutive characteristies of useful indonation inherent in this cae (Note: Your anet shall cover two qualitative characeritics fm findumental andior cnhancing qualitien) () marka (Tetal for Questien 2l marka Question 2 (29 marks) Medici Corporation ("Medici") is preparing a meeting with its banker to discuss the renewal of a long-term debt. The following trial balance was taken from the books of Medici Corporation on 31 December 2020. Debit S 12.000 40,000 Account Credit Cash Accounts Receivable Note Receivable 7,000 Allowance for Doubtful Accounts S 1,800 44,000 4,800 Inventory Prepaid Insurance Equipment Accumulated Depreciation-Equipment Accounts Payable Dividends Payable Share Capital-Ordinary Retained Earnings 105,000 15,000 10,800 10,000 44,000 55,000 Sales Revenue 260,000 Cost of Goods Sold Salaries and Wages Expense Prepaid Rent 111,000 50,000 12,800 Dividends 10,000 $396,600 Total $396,600 The trial balance above has not yet reflected below: 1. Insurance expired during the year, S2,000. 2. Estimated doubtful debts at the year-end, 11% of the accounts receivable (gross). No doubtful debt is expected regarding the note receivable. 3. Depreciation on equipment, 10% per year. Residual value is insignificant. Straight-line depreciation method is adopted. 4. Interest at 5% is receivable on the note for one full year. 5. Rent expense for the year. (Two-year rental was prepaid on 1 January 2020 for S12,800.) 6. Accrued salaries and wages at 31 December 2020 is $5,800. Required: (a) Prepare the necessary adjusting entries. (12 marks) (b) Compute Medici's income: (i) before recording the adjusting entries; and (ii) after recording the adjusting entries. Explain why Medici's banker would prefer to wait for Medici to complete its year-end adjustment process before making a decision on the loan renewal. (5 marks) (c) Prepare the necessary closing entries after adjustments. (12 marks) The net realizable values presented below were estimated on 31 December 2019 and re-estimated on 31 January 2020. Cost S520,000 Net Realizable Value $485,000 31 December 2019 31 January 2020 520,000 585,000 Required: Al. Prepare the journal entries required at 31 December 2019, and 31 January 2020, assuming that the inventory is recorded at LCNRVV, using a perpetual inventory system and an allowance account under the cost-of-goods-sold method. (4 marks) A2. If the inventory is recorded at LCNRV, using a perpetual system and an allowance account under the loss method instead, will the method provide a higher or lower gross profit and net income in the year? (4 marks) Part B (5 marks) On 1 January 2020, Arch lent to a borrower in exchange for a 3-year promissory note. The note has a principal value of S600,000 and a maturity date of 31 December 2022. The note has a stated annual interest rate of 8% (coupon rate), with interest payable at the end of each year starting 31 December 2020. The market rate of interest for a note of similar risk is 10%. Requirement: B1. Calculate the present value of the promissory note on 1 January 2020 (rounded to the nearest dollars). (3 marks) B2. Prepare the journal entry to recognize the note on 1 January 2020. (2 marks) The following transactions related to Arch took place in 2020. 1. On 15 February 2020, Arch sold some electronic products at a price of $50,000. The customer was given a cash discount of 3/20, n/60 (ignore cost of goods sold). Gross method is used to account for cash discount. 2. On 1 March 2020, the customer settled 20% of the price by paying $9,700 cash within the discount period. Requirement: C1. Prepare Arch's journal entry for each of the above transactions 1 - 2. (5 marks) C2. Arch currently prepares a set of monthly financial statements for the managers' operating decision-making. However, due to the amount of time required to check for the accuraey of the calculations and journal entries prepared, it takes more than 1 week's time before the monthly reports could be available for managers' use in the following month. To shorten the preparation time, Arch is considering if these checking procedures shall be skipped. What trade-offs, in terms of qualitative characteristics of useful information, are inherent in this case? (Note: Your answer shall cover two qualitative characteristics from fundamental and/or enhancing qualities) (3 marks) The net realizable values presentod below were esimatod on 31 Decomber 2019 and re-estimaned en 31 Janary 200. Cont SS20,000 520.000 NaRealicate Yal 31 December 2019 31 January 2000 SRS Required: AL. Prepane the jourmal entries required at 31 ecember 2019, and 31 Jamuary 2000, auming that the imentury is reconded at LCNRV, aing a perpetual imemtory ytem and a allowance secunt under the cot of goodeld method (4 marka A2. Irhe inventery is recorded at LCNRV, using a perpetual syston and an alaneu under the loss method instead, will the metd proides higher or lower gs podit and net income in the year? (4 mark Part s markal On i Jamury 2020. Arch lent to a bomower in exchange for a yer promisory note The note has a principal value of S00,000 and a maturiny date of 31 December 2022 The note han a stated annal interest ate of tonpon ate, with innorest payahle at the end of each yew stanting I December 220 The market rate of interest for a note of similar rik is 10 Requirement BI, Cakulanr the present value of the peomissory ate on 1 lumary 2030 inunded t the nearest dellar Omak 82. Propure the joumal entry tu recognire the nute on 1 January 20 2marka) Part Cmarka The folrwing tranactions related Aach teok place in 2020 1. On 15 Februry 2000, Anch wold ame elecmic producta ta price of S50.000. The custemer was given a canh discot of 320, n0 rignane cost of grod sldi. Cin method is sed to acconunt for cah disount 2. On 1 March 2020, the customer setled 20 of the price by paying 00 cadh within the dincount period Reguirement: CI. Propane Anch's jounal entry Soe cach of the ahove tranaction 1-2 (5 muka C2. Anch curenty propare atof mondhly financial statemes for the maagn operating docision-making However, due to the amount of time mpuired to check for the aracy of the calculatioms and jountal entries prepeed it takes mre than I wedk's time belane the monthly reports could be available for manage" use in the following month. Te heten the preparation time, Arch is omsidering if these checking procedres sall be skipped What rade-off, in terms of qualitutive characteristies of useful indonation inherent in this cae (Note: Your anet shall cover two qualitative characeritics fm findumental andior cnhancing qualitien) () marka (Tetal for Questien 2l marka Question 2 (29 marks) Medici Corporation ("Medici") is preparing a meeting with its banker to discuss the renewal of a long-term debt. The following trial balance was taken from the books of Medici Corporation on 31 December 2020. Debit S 12.000 40,000 Account Credit Cash Accounts Receivable Note Receivable 7,000 Allowance for Doubtful Accounts S 1,800 44,000 4,800 Inventory Prepaid Insurance Equipment Accumulated Depreciation-Equipment Accounts Payable Dividends Payable Share Capital-Ordinary Retained Earnings 105,000 15,000 10,800 10,000 44,000 55,000 Sales Revenue 260,000 Cost of Goods Sold Salaries and Wages Expense Prepaid Rent 111,000 50,000 12,800 Dividends 10,000 $396,600 Total $396,600 The trial balance above has not yet reflected below: 1. Insurance expired during the year, S2,000. 2. Estimated doubtful debts at the year-end, 11% of the accounts receivable (gross). No doubtful debt is expected regarding the note receivable. 3. Depreciation on equipment, 10% per year. Residual value is insignificant. Straight-line depreciation method is adopted. 4. Interest at 5% is receivable on the note for one full year. 5. Rent expense for the year. (Two-year rental was prepaid on 1 January 2020 for S12,800.) 6. Accrued salaries and wages at 31 December 2020 is $5,800. Required: (a) Prepare the necessary adjusting entries. (12 marks) (b) Compute Medici's income: (i) before recording the adjusting entries; and (ii) after recording the adjusting entries. Explain why Medici's banker would prefer to wait for Medici to complete its year-end adjustment process before making a decision on the loan renewal. (5 marks) (c) Prepare the necessary closing entries after adjustments. (12 marks) The net realizable values presented below were estimated on 31 December 2019 and re-estimated on 31 January 2020. Cost S520,000 Net Realizable Value $485,000 31 December 2019 31 January 2020 520,000 585,000 Required: Al. Prepare the journal entries required at 31 December 2019, and 31 January 2020, assuming that the inventory is recorded at LCNRVV, using a perpetual inventory system and an allowance account under the cost-of-goods-sold method. (4 marks) A2. If the inventory is recorded at LCNRV, using a perpetual system and an allowance account under the loss method instead, will the method provide a higher or lower gross profit and net income in the year? (4 marks) Part B (5 marks) On 1 January 2020, Arch lent to a borrower in exchange for a 3-year promissory note. The note has a principal value of S600,000 and a maturity date of 31 December 2022. The note has a stated annual interest rate of 8% (coupon rate), with interest payable at the end of each year starting 31 December 2020. The market rate of interest for a note of similar risk is 10%. Requirement: B1. Calculate the present value of the promissory note on 1 January 2020 (rounded to the nearest dollars). (3 marks) B2. Prepare the journal entry to recognize the note on 1 January 2020. (2 marks) The following transactions related to Arch took place in 2020. 1. On 15 February 2020, Arch sold some electronic products at a price of $50,000. The customer was given a cash discount of 3/20, n/60 (ignore cost of goods sold). Gross method is used to account for cash discount. 2. On 1 March 2020, the customer settled 20% of the price by paying $9,700 cash within the discount period. Requirement: C1. Prepare Arch's journal entry for each of the above transactions 1 - 2. (5 marks) C2. Arch currently prepares a set of monthly financial statements for the managers' operating decision-making. However, due to the amount of time required to check for the accuraey of the calculations and journal entries prepared, it takes more than 1 week's time before the monthly reports could be available for managers' use in the following month. To shorten the preparation time, Arch is considering if these checking procedures shall be skipped. What trade-offs, in terms of qualitative characteristics of useful information, are inherent in this case? (Note: Your answer shall cover two qualitative characteristics from fundamental and/or enhancing qualities) (3 marks)

Step by Step Solution

3.46 Rating (153 Votes )

There are 3 Steps involved in it

MULTIPLE QUESTIONSONLY QUESTION NO2 AND ITS THREE SUB PARTS ARE ANSWERE... View full answer

Get step-by-step solutions from verified subject matter experts