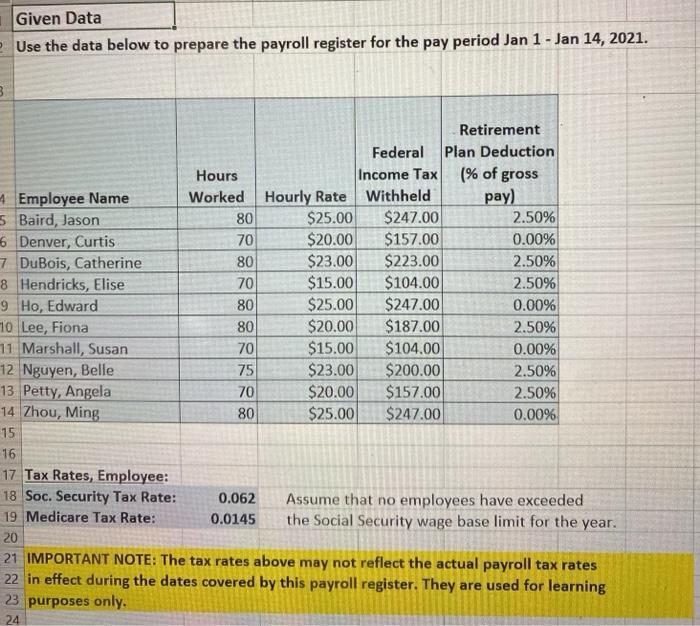

Question: Given Data e Use the data below to prepare the payroll register for the pay period Jan 1 - Jan 14, 2021. Retirement Plan

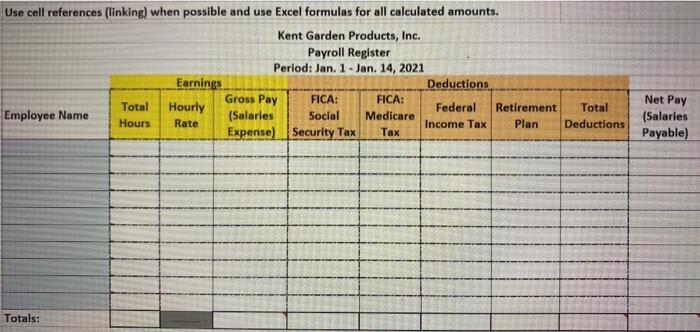

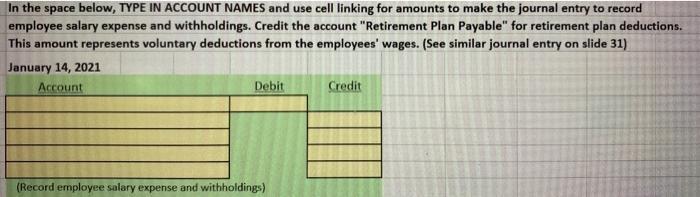

Given Data e Use the data below to prepare the payroll register for the pay period Jan 1 - Jan 14, 2021. Retirement Plan Deduction (% of gross pay) 2.50% 0.00% 2.50% 2.50% 0.00% 2.50% 0.00% Federal Hours Income Tax Worked Hourly Rate Withheld $247.00 1 Employee Name 5 Baird, Jason 6 Denver, Curtis 7 DuBois, Catherine 8 Hendricks, Elise 9 Ho, Edward 10 Lee, Fiona 11 Marshall, Susan 12 Nguyen, Belle 13 Petty, Angela 14 Zhou, Ming $25.00 $20.00 $23.00 $15.00 $25.00 $20.00 $15.00 $23.00 $20.00 $25.00 80 70 $157.00 $223.00 $104.00 $247.00 $187.00 $104.00 $200.00 $157.00 $247.00 80 70 80 80 70 75 2.50% 70 2.50% 0.00% 80 15 16 17 Tax Rates, Employee: 18 Soc. Security Tax Rate: 19 Medicare Tax Rate: 0.062 Assume that no employees have exceeded the Social Security wage base limit for the year. 0.0145 20 21 IMPORTANT NOTE: The tax rates above may not reflect the actual payroll tax rates 22 in effect during the dates covered by this payroll register. They are used for learning 23 purposes only. 24 Use cell references (linking) when possible and use Excel formulas for all calculated amounts. Kent Garden Products, Inc. Payroll Register Period: Jan. 1- Jan. 14, 2021 Earnings Deductions Gross Pay FICA: FICA: Net Pay Total Hourly Federal Total Employee Name Retirement Plan (Salaries Social Medicare (Salaries Payable) Hours Rate Income Tax Deductions Expense) Security Tax Totals: In the space below, TYPE IN ACCOUNT NAMES and use cell linking for amounts to make the journal entry to record employee salary expense and withholdings. Credit the account "Retirement Plan Payable" for retirement plan deductions. This amount represents voluntary deductions from the employees' wages. (See similar journal entry on slide 31) January 14, 2021 Account Debit Credit (Record employee salary expense and withholdings)

Step by Step Solution

3.44 Rating (151 Votes )

There are 3 Steps involved in it

Solution table 1 according to the given information we can calculate the figure and mention in the t... View full answer

Get step-by-step solutions from verified subject matter experts