Question: . using PR 15-5B pp. 780-781 part 1 only with the following changes: January 1 WIP is $102000 NOT $109200, Dec 31 WIP is $85000

.

.

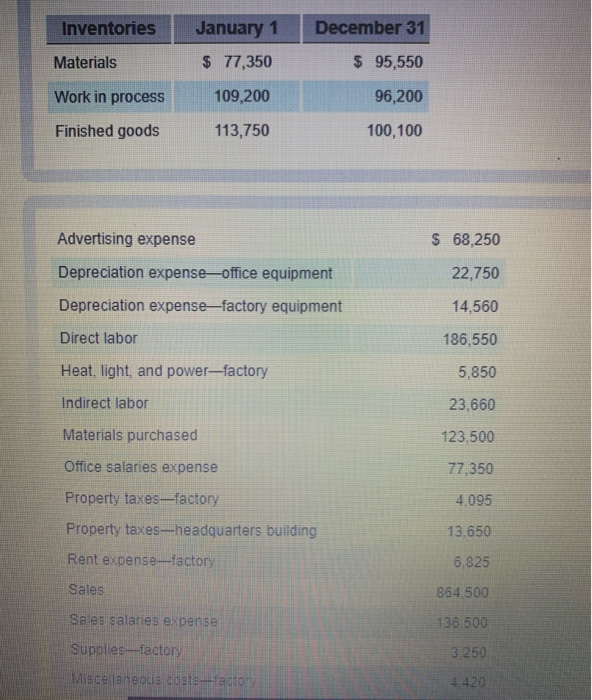

using PR 15-5B pp. 780-781 part 1 only with the following changes: January 1 WIP is $102000 NOT $109200, Dec 31 WIP is $85000 NOT $96200, materials purchased is $128000 NOT $123500, and miscellaneous cost- factory is $5500 NOT $4420 the cost of FOH used in production is 65740 62660 63740 64740 Inventories Materials Work in process Finished goods January 1 $ 77,350 109,200 113,750 December 31 $ 95,550 96,200 100,100 Advertising expense Depreciation expense-office equipment Depreciation expense-factory equipment Direct labor Heat, light, and power-factory Indirect labor Materials purchased Office salaries expense Property taxes-factory Property taxes-headquarters building Rent expense-factory Sales Sales salaries expense Supplies-factory Miscellaneous costs-factory $ 68,250 22,750 14,560 186,550 5,850 23,660 123,500 77,350 4,095 13,650 6,825 864,500 136.500 3,250 4.420

Step by Step Solution

3.49 Rating (156 Votes )

There are 3 Steps involved in it

FOH is factory overhead which is also known as manufacturing overhead which comprises of all INDIRECT COSTS associated with the operations of the manu... View full answer

Get step-by-step solutions from verified subject matter experts