Question: Using the information and Excel, provided for Jacks Maintenance Services to: 1. Record the journal entries for June transactions. Include narrations. 2. Record adjusting

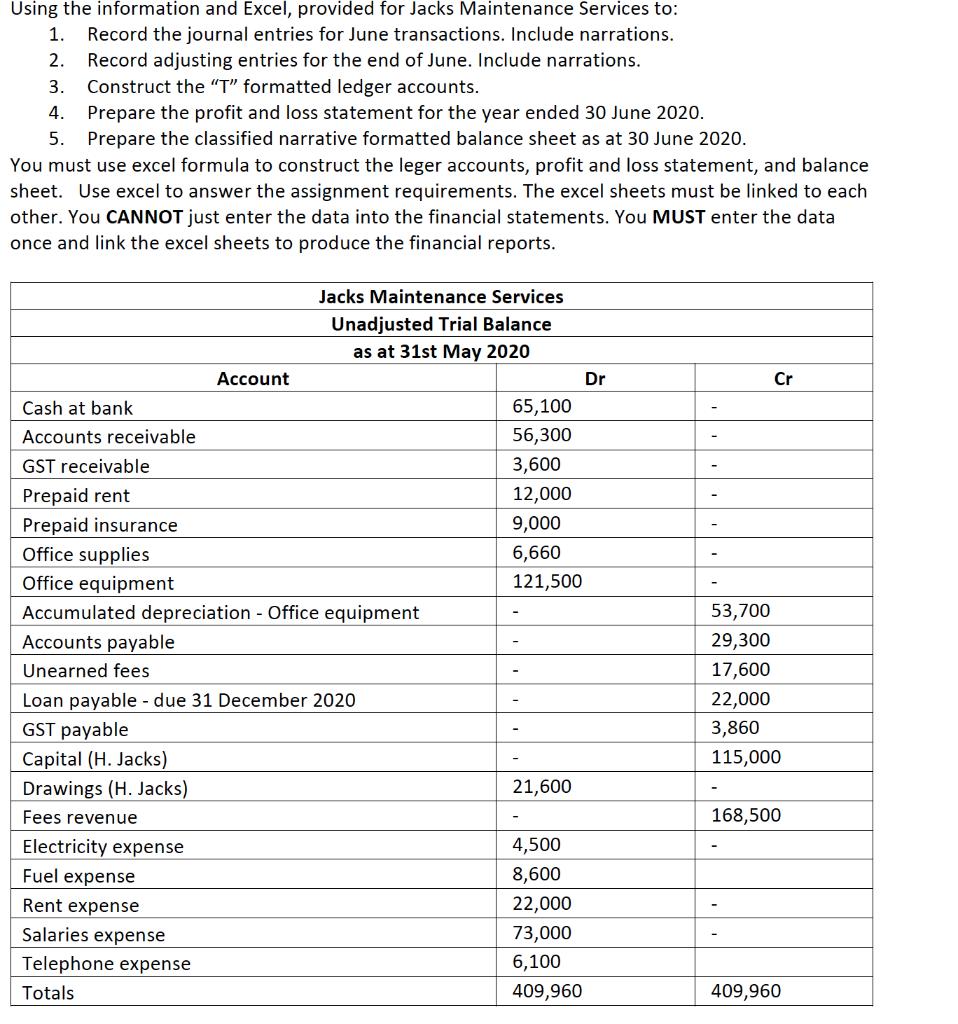

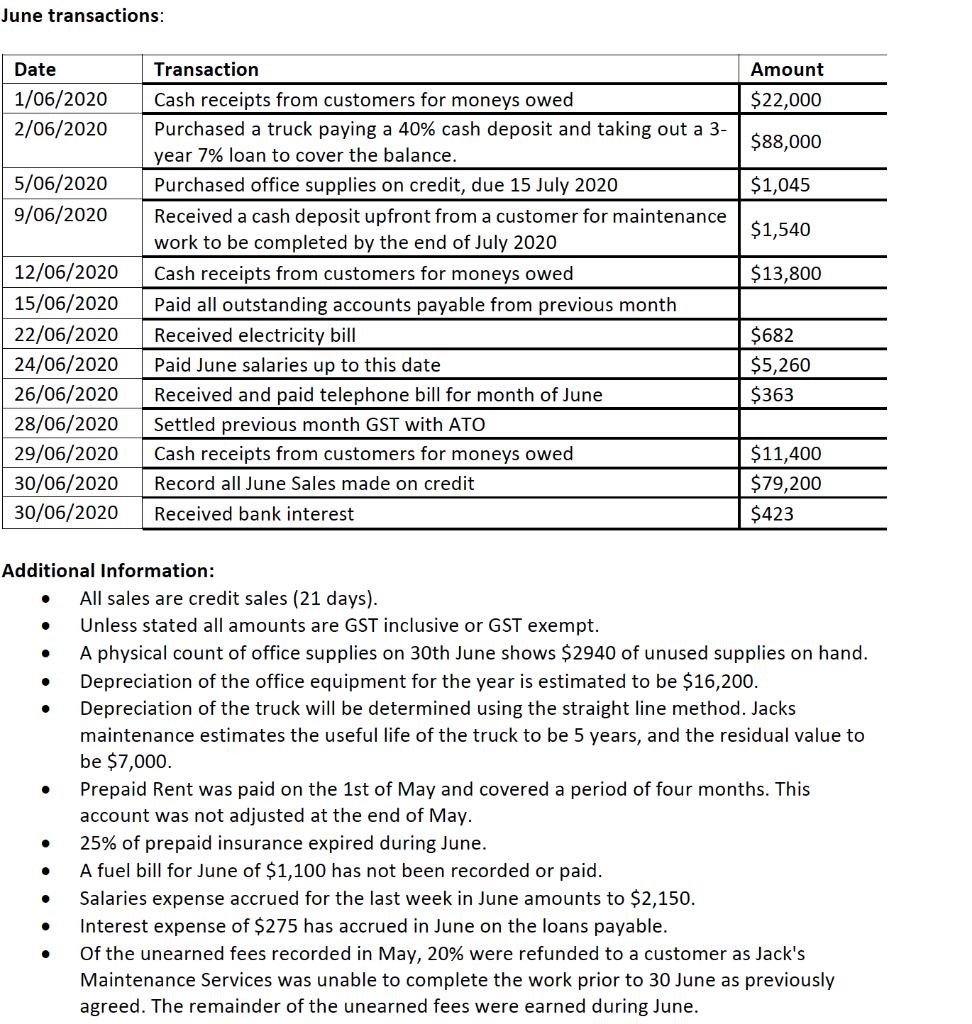

Using the information and Excel, provided for Jacks Maintenance Services to: 1. Record the journal entries for June transactions. Include narrations. 2. Record adjusting entries for the end of June. Include narrations. 3. Construct the "T" formatted ledger accounts. 4. Prepare the profit and loss statement for the year ended 30 June 2020. 5. Prepare the classified narrative formatted balance sheet as at 30 June 2020. You must use excel formula to construct the leger accounts, profit and loss statement, and balance sheet. Use excel to answer the assignment requirements. The excel sheets must be linked to each other. You CANNOT just enter the data into the financial statements. You MUST enter the data once and link the excel sheets to produce the financial reports. Cash at bank Accounts receivable GST receivable Prepaid rent Prepaid insurance Office supplies Office equipment Account Accumulated depreciation - Office equipment Accounts payable Unearned fees Capital (H. Jacks) Drawings (H. Jacks) Fees revenue Jacks Maintenance Services Unadjusted Trial Balance as at 31st May 2020 Loan payable - due 31 December 2020 GST payable Electricity expense Fuel expense Rent expense Salaries expense Telephone expense Totals 65,100 56,300 3,600 12,000 9,000 6,660 121,500 21,600 4,500 8,600 22,000 73,000 6,100 409,960 Dr Cr 53,700 29,300 17,600 22,000 3,860 115,000 168,500 409,960 June transactions: Date 1/06/2020 2/06/2020 5/06/2020 Purchased office supplies on credit, due 15 July 2020 9/06/2020 Received a cash deposit upfront from a customer for maintenance work to be completed by the end of July 2020 12/06/2020 Cash receipts from customers for moneys owed 15/06/2020 Paid all outstanding accounts payable from previous month 22/06/2020 Received electricity bill 24/06/2020 Paid June salaries up to this date 26/06/2020 Received and paid telephone bill for month of June 28/06/2020 Settled previous month GST with ATO 29/06/2020 Cash receipts from customers for moneys owed 30/06/2020 Record all June Sales made on credit 30/06/2020 Received bank interest Additional Information: Transaction Cash receipts from customers for moneys owed Purchased a truck paying a 40% cash deposit and taking out a 3- year 7% loan to cover the balance. Amount $22,000 $88,000 $1,045 $1,540 $13,800 $682 $5,260 $363 $11,400 $79,200 $423 All sales are credit sales (21 days). Unless stated all amounts are GST inclusive or GST exempt. A physical count of office supplies on 30th June shows $2940 of unused supplies on hand. Depreciation of the office equipment for the year is estimated to be $16,200. Depreciation of the truck will be determined using the straight line method. Jacks maintenance estimates the useful life of the truck to be 5 years, and the residual value to be $7,000. Prepaid Rent was paid on the 1st of May and covered a period of four months. This account was not adjusted at the end of May. 25% of prepaid insurance expired during June. A fuel bill for June of $1,100 has not been recorded or paid. Salaries expense accrued for the last week in June amounts to $2,150. Interest expense of $275 has accrued in June on the loans payable. Of the unearned fees recorded in May, 20% were refunded to a customer as Jack's Maintenance Services was unable to complete the work prior to 30 June as previously agreed. The remainder of the unearned fees were earned during June.

Step by Step Solution

3.44 Rating (170 Votes )

There are 3 Steps involved in it

Journal Entries Date Particulars Amt Dr Cr 01062020 Cash Ac Dr 22000 To Accounts receivable Ac 22000 ... View full answer

Get step-by-step solutions from verified subject matter experts