Question: Accounts Payable Sleek Ride, a company providing limo services, has a December 31 year-end date. For Sleek Ride, the following transactions occurred during the first

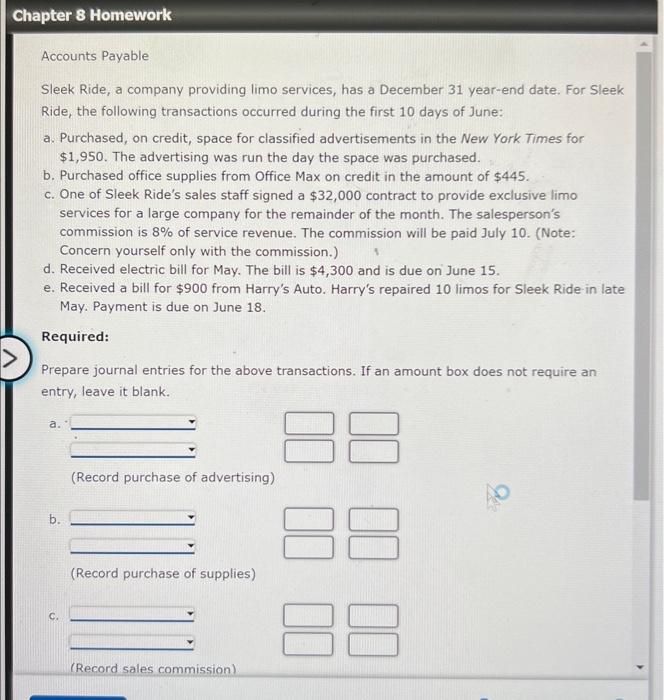

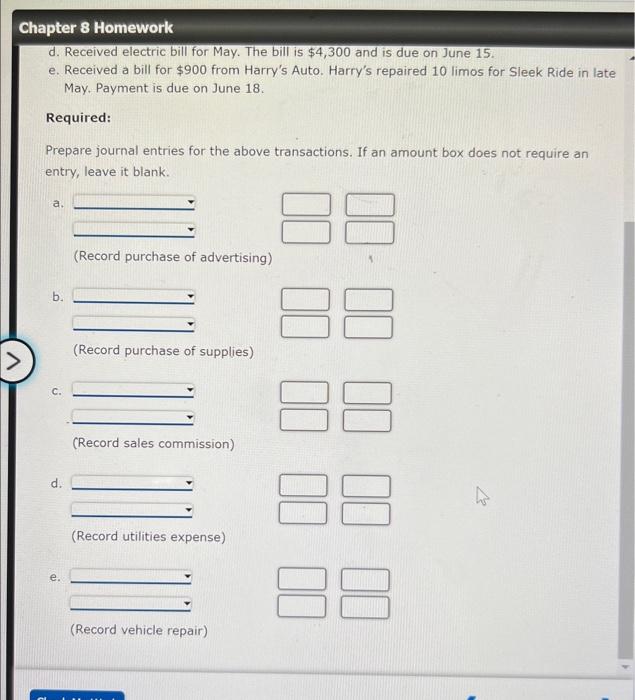

Accounts Payable Sleek Ride, a company providing limo services, has a December 31 year-end date. For Sleek Ride, the following transactions occurred during the first 10 days of June: a. Purchased, on credit, space for classified advertisements in the New York Times for $1,950. The advertising was run the day the space was purchased. b. Purchased office supplies from Office Max on credit in the amount of $445. c. One of Sleek Ride's sales staff signed a $32,000 contract to provide exclusive limo services for a large company for the remainder of the month. The salesperson's commission is 8% of service revenue. The commission will be paid July 10 . (Note: Concern yourself only with the commission.) d. Received electric bill for May. The bill is $4,300 and is due on June 15 . e. Received a bill for $900 from Harry's Auto. Harry's repaired 10 limos for Sleek Ride in late May. Payment is due on June 18. Required: Prepare journal entries for the above transactions. If an amount box does not require an entry, leave it blank. (Record sales commission) d. Received electric bill for May. The bill is $4,300 and is due on June 15 . e. Received a bill for $900 from Harry's Auto. Harry's repaired 10 limos for Sleek Ride in late May, Payment is due on June 18. Required: box does not require an

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts