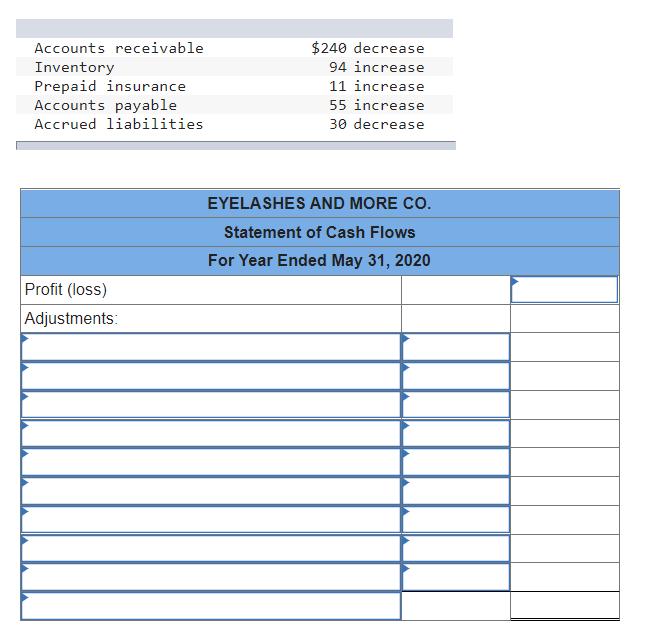

Question: Accounts receivable $240 decrease 94 increase Inventory Prepaid insurance Accounts payable 11 increase 55 increase Accrued liabilities 30 decrease EYELASHES AND MORE CO. Statement

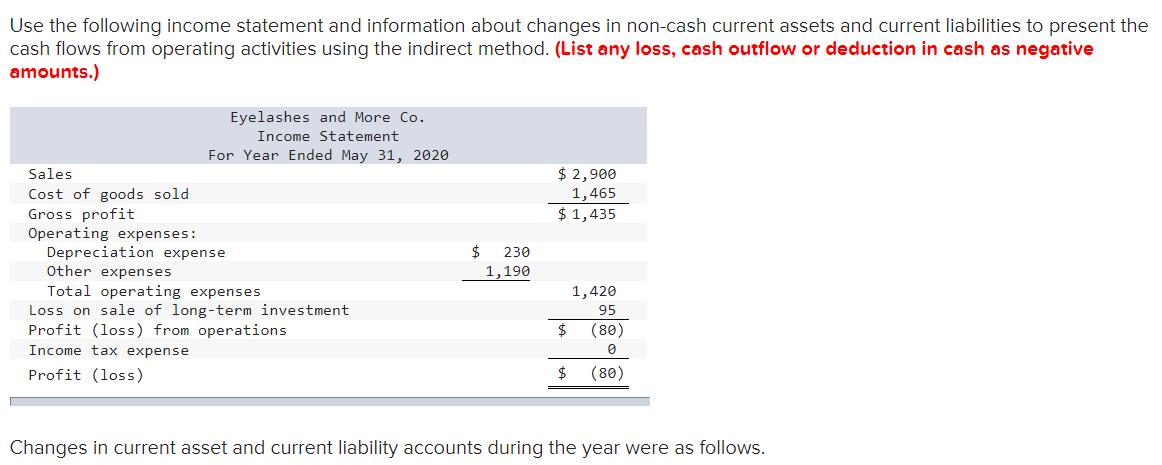

Accounts receivable $240 decrease 94 increase Inventory Prepaid insurance Accounts payable 11 increase 55 increase Accrued liabilities 30 decrease EYELASHES AND MORE CO. Statement of Cash Flows For Year Ended May 31, 2020 Profit (loss) Adjustments: Use the following income statement and information about changes in non-cash current assets and current liabilities to present the cash flows from operating activities using the indirect method. (List any loss, cash outflow or deduction in cash as negative amounts.) Eyelashes and More Co. Income Statement For Year Ended May 31, 2020 Sales $ 2,900 Cost of goods sold Gross profit Operating expenses: Depreciation expense 1,465 $ 1,435 $ 230 Other expenses 1,190 Total operating expenses Loss on sale of long-term investment Profit (loss) from operations Income tax expense 1,420 95 (80) Profit (loss) $4 (80) Changes in current asset and current liability accounts during the year were as follows. Accounts receivable $240 decrease 94 increase Inventory Prepaid insurance Accounts payable 11 increase 55 increase Accrued liabilities 30 decrease EYELASHES AND MORE CO. Statement of Cash Flows For Year Ended May 31, 2020 Profit (loss) Adjustments: Use the following income statement and information about changes in non-cash current assets and current liabilities to present the cash flows from operating activities using the indirect method. (List any loss, cash outflow or deduction in cash as negative amounts.) Eyelashes and More Co. Income Statement For Year Ended May 31, 2020 Sales $ 2,900 Cost of goods sold Gross profit Operating expenses: Depreciation expense 1,465 $ 1,435 $ 230 Other expenses 1,190 Total operating expenses Loss on sale of long-term investment Profit (loss) from operations Income tax expense 1,420 95 (80) Profit (loss) $4 (80) Changes in current asset and current liability accounts during the year were as follows. Accounts receivable $240 decrease 94 increase Inventory Prepaid insurance Accounts payable 11 increase 55 increase Accrued liabilities 30 decrease EYELASHES AND MORE CO. Statement of Cash Flows For Year Ended May 31, 2020 Profit (loss) Adjustments: Use the following income statement and information about changes in non-cash current assets and current liabilities to present the cash flows from operating activities using the indirect method. (List any loss, cash outflow or deduction in cash as negative amounts.) Eyelashes and More Co. Income Statement For Year Ended May 31, 2020 Sales $ 2,900 Cost of goods sold Gross profit Operating expenses: Depreciation expense 1,465 $ 1,435 $ 230 Other expenses 1,190 Total operating expenses Loss on sale of long-term investment Profit (loss) from operations Income tax expense 1,420 95 (80) Profit (loss) $4 (80) Changes in current asset and current liability accounts during the year were as follows. Accounts receivable $240 decrease 94 increase Inventory Prepaid insurance Accounts payable 11 increase 55 increase Accrued liabilities 30 decrease EYELASHES AND MORE CO. Statement of Cash Flows For Year Ended May 31, 2020 Profit (loss) Adjustments: Use the following income statement and information about changes in non-cash current assets and current liabilities to present the cash flows from operating activities using the indirect method. (List any loss, cash outflow or deduction in cash as negative amounts.) Eyelashes and More Co. Income Statement For Year Ended May 31, 2020 Sales $ 2,900 Cost of goods sold Gross profit Operating expenses: Depreciation expense 1,465 $ 1,435 $ 230 Other expenses 1,190 Total operating expenses Loss on sale of long-term investment Profit (loss) from operations Income tax expense 1,420 95 (80) Profit (loss) $4 (80) Changes in current asset and current liability accounts during the year were as follows.

Step by Step Solution

3.52 Rating (152 Votes )

There are 3 Steps involved in it

cashflows from operating activities EYELASHES AND MORE CO STATEMENT OF CASHFLOW FOR YEAR ENDED MAY 3... View full answer

Get step-by-step solutions from verified subject matter experts