Question: ACCT 2 0 6 0 - Chapter 5 , 6 , and 7 Bonus Point - In class Required: a . Assuming that the company

ACCT Chapter and Bonus Point In class

Required:

a Assuming that the company uses absorption costing, compute the unit product cost and prepare an income statement.

b Assuming that the company uses variable costing, compute the unit product cost and prepare an income statement.

c Reconcile the variable costing and absorption costing net operating incomes for the month.

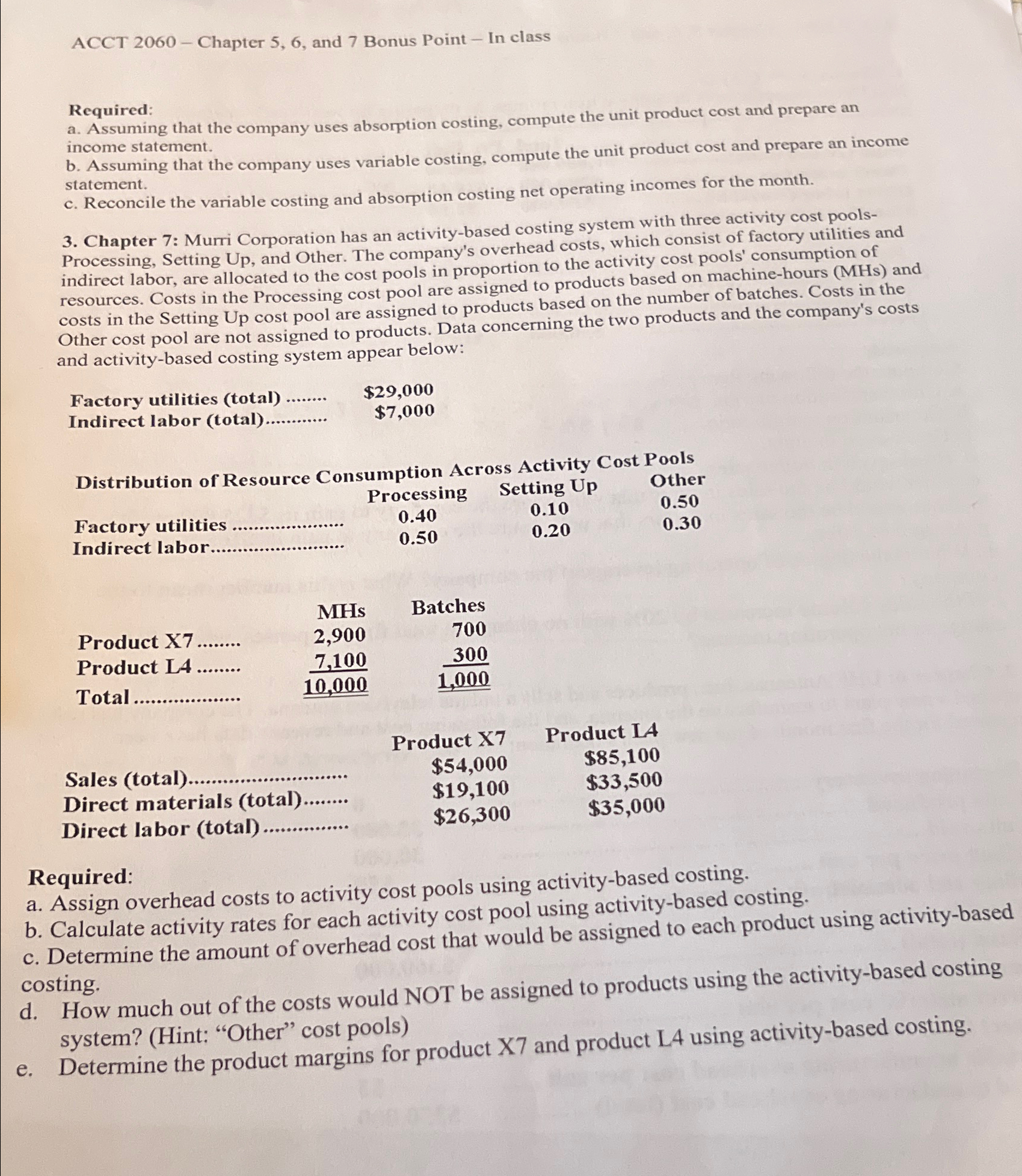

Chapter : Murri Corporation has an activitybased costing system with three activity cost poolsProcessing, Setting Up and Other. The company's overhead costs, which consist of factory utilities and indirect labor, are allocated to the cost pools in proportion to the activity cost pools' consumption of resources. Costs in the Processing cost pool are assigned to products based on machinehours MHs and costs in the Setting Up cost pool are assigned to products based on the number of batches. Costs in the Other cost pool are not assigned to products. Data concerning the two products and the company's costs and activitybased costing system appear below:

Factory utilities total $$

Indirect labor total $

Distribution of Resource Consumption Across Activity Cost Pools

Factory utilities

tableProcessingSetting UpOther

Product

Product L

Total

tableMHsBatches

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock