Question: ACCT 302 - Team Problem 1: Chapter 10 Spring 2020 During 2017, Grow-a-Lot, Inc underwent a major expansion. In order to expand, they entered into

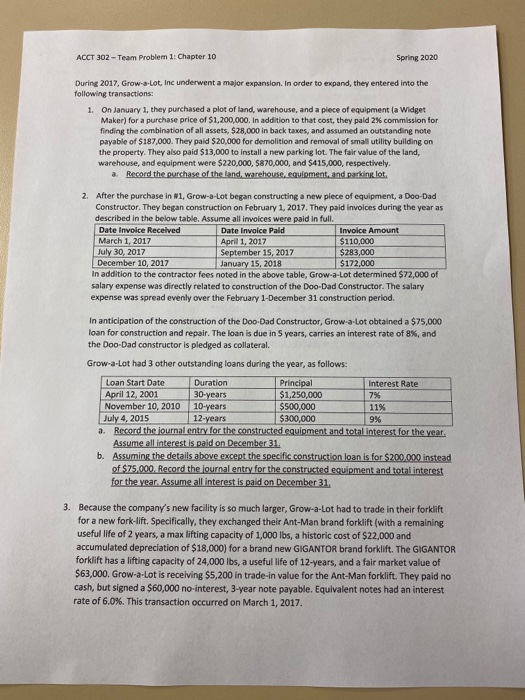

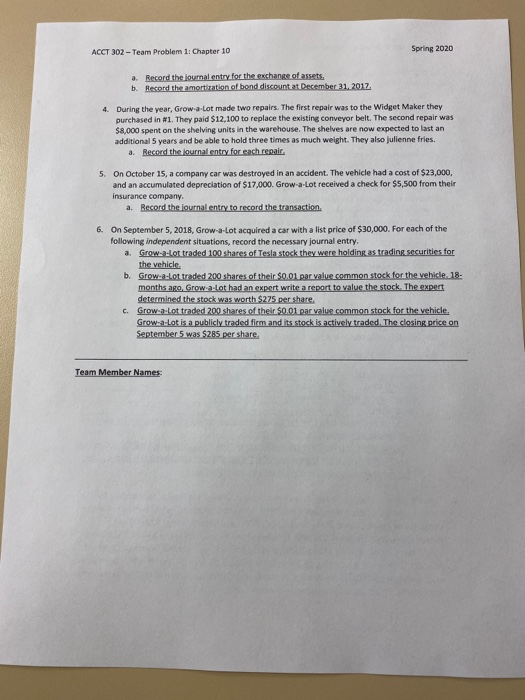

ACCT 302 - Team Problem 1: Chapter 10 Spring 2020 During 2017, Grow-a-Lot, Inc underwent a major expansion. In order to expand, they entered into the following transactions 1 On January 1, they purchased a plot of land, warehouse, and a piece of equipment la Widget Maker) for a purchase price of $1,200,000. In addition to that cost, they paid 2% commission for finding the combination of all assets, $28.000 in back taxes, and assumed an outstanding note payable of $187.000. They paid $20,000 for demolition and removal of small utility building on the property. They also paid $13,000 to install a new parking lot. The fair value of the land, warehouse, and equipment were $220,000, 5870,000, and 5415,000, respectively. a Record the chase of the land warehouse equipment and parking lot 2. After the purchase in 1, Grow-a-Lot began constructing a new piece of equipment, a Doo-Dad Constructor. They began construction on February 1, 2017. They paid invoices during the year as described in the below table. Assume all invoices were paid in full, Date Invoice Received Date Invoice Paid Involce Amount March 1, 2017 April 1, 2017 $110,000 July 30, 2017 September 15, 2017 $283,000 December 10, 2017 January 15, 2018 $172.000 In addition to the contractor fees noted in the above table, Grow-a-Lot determined $72,000 of salary expense was directly related to construction of the Doo-Dad Constructor. The salary expense was spread evenly over the February 1-December 31 construction period. in anticipation of the construction of the Doo-Dad Constructor, Grow-a-Lot obtained a $75,000 loan for construction and repair. The loan is due in 5 years, carries an interest rate of 8%, and the Doo-Dad constructor is pledged as collateral. Grow-a-Lot had 3 other outstanding loans during the year, as follows: 7% 11% Loan Start Date Duration Principal Interest Rate April 12, 2001 30 years $1,250,000 November 10, 2010 10-years $500,000 July 4, 2015 12-years $300.000 a. Record the journal entry for the constructed equipment and total interest for the year Assume all interest is paid on December 31. b. Assuming the details above except the specific construction loan is for $200.000 instead of $75.000. Record the journal entry for the constructed equipment and total interest for the year. Assume all interest is paid on December 31 3. Because the company's new facility is so much larger, Grow-a-Lot had to trade in their forklift for a new fork-lift. Specifically, they exchanged their Ant-Man brand forklift (with a remaining useful life of 2 years, a max lifting capacity of 1,000 lbs, a historic cost of $22,000 and accumulated depreciation of $18,000) for a brand new GIGANTOR brand forklift. The GIGANTOR forklift has a lifting capacity of 24,000 lbs, a useful life of 12-years, and a fair market value of $63,000. Grow-a-Lot is receiving 55,200 in trade-in value for the Ant-Man forklift. They paid no cash, but signed a $60,000 no interest, 3-year note payable. Equivalent notes had an interest rate of 6.0%. This transaction occurred on March 1, 2017. ACCT 302 - Team Problem 1: Chapter 10 Spring 2020 a Record the journal entry for the exchange of assets. b. Record the amortization of bond discount at December 31, 2017 4. During the year, Grow-a-Lot made two repairs. The first repair was to the Widget Maker they purchased in 01. They paid $12,100 to replace the existing conveyor belt. The second repair was 58.000 spent on the shelving units in the warehouse. The shelves are now expected to last an additional 5 years and be able to hold three times as much weight. They also julienne fries. a. Record the journal entry for each repair. 5. On October 15, a company car was destroyed in an accident. The vehicle had a cost of $23,000, and an accumulated depreciation of $17,000. Grow-a-Lot received a check for $5,500 from their insurance company. a. Record the journal entry to record the transaction 6. On September 5, 2018, Grow-a-Lot acquired a car with a list price of $30,000. For each of the following independent situations, record the necessary journal entry. a. Grow -Lot traded 100 shares of Tesla stock they were holdintas trading securities for the vehicle. b. Grow-a-Lot traded 200 shares of their $0.01 par value common stock for the vehicle, 18- months ago Growlot had an expert write a report to value the stock. The expert determined the stock was worth $275 per share, c. Grow-a-Lot traded 200 shares of their $0.01 par value common stock for the vehicle Grow a lot is a publicly traded firm and its stock is actively traded. The closing price on September 5 was $285 per share Team Member Names

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts