Question: Based on Case provided answer following question 1.Role of decentralized strategic leadership development 2.What are the deficiencies in the leadership development process 3.What is the

Based on Case provided answer following question

1.Role of decentralized strategic leadership development

2.What are the deficiencies in the leadership development process

3.What is the process of strategy creation at luck companies?

4.Role of founder leader, Role of strategic planning, visioning etc

5.Role of values

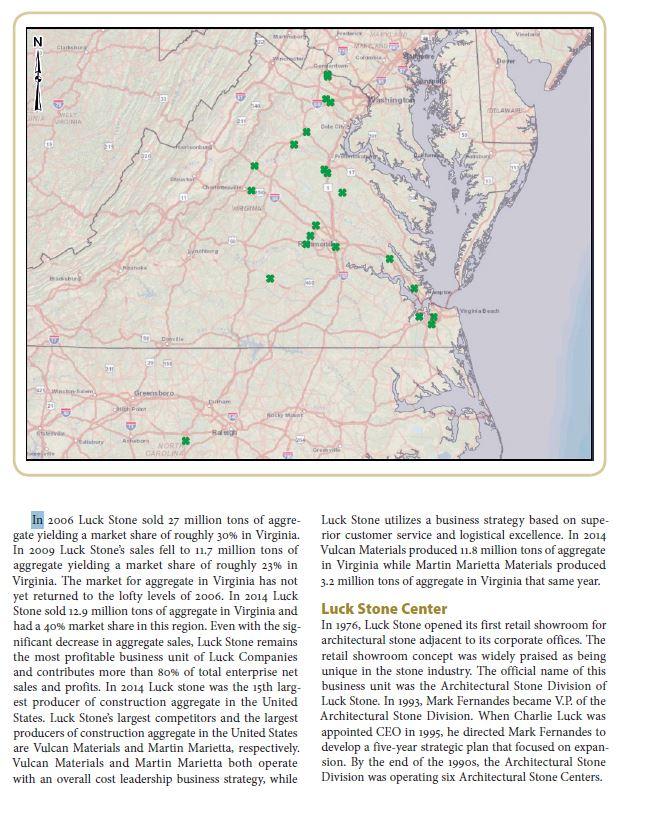

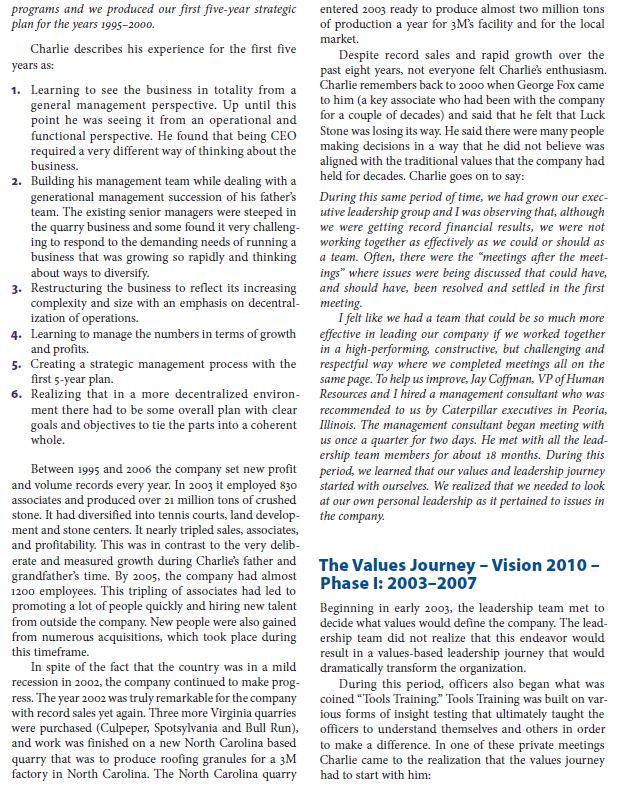

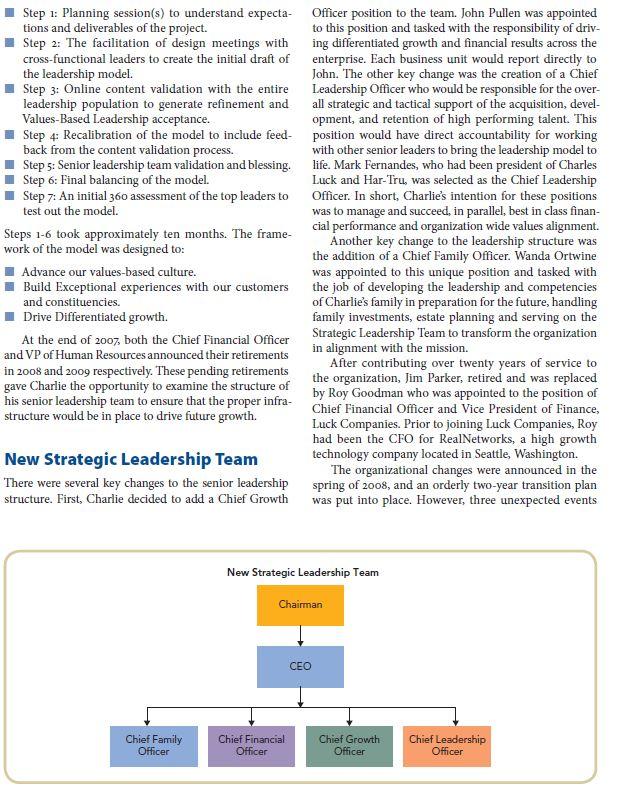

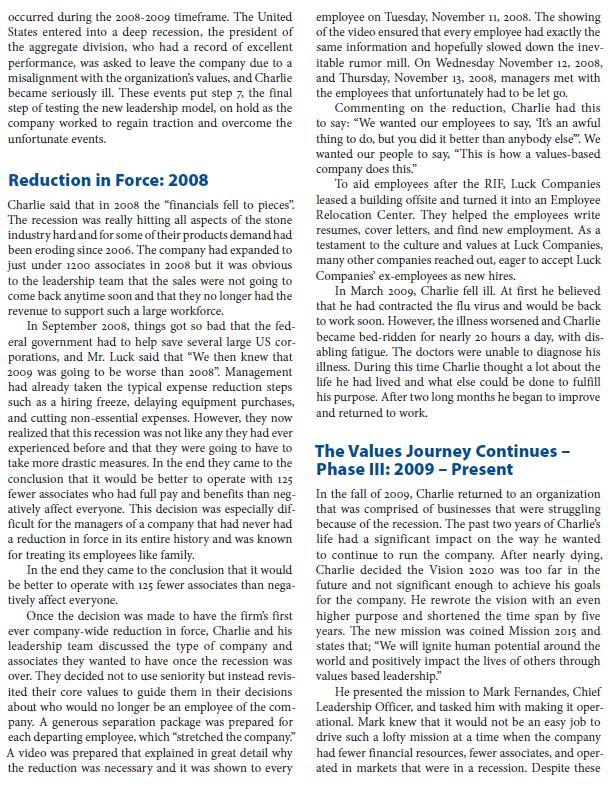

CASE 10 Luck Companies: Igniting Human Potential D. Robley Wood, Jr. NASCAR circuit. At the end of 1986, he put his racing Wallace Stettinius helmet aside and began work as a full-time employee for Robert S. Kelley Luck Companies. Thomas K. Quinton As a teenager, Charlie worked summers at the quar- ries doing various jobs such as repairing machinery and driving trucks. Growing up around the quarries gave Early in 2015 Mr. Charlie Luck, IV knew that his leader- Charlie a good sense of the business from the bottom ship skills were soon to be thoroughly tested by all of the up, but both he and his father thought it was necessary activities that needed his attention. In March 2015, he for him to have extensive experience in all aspects and was named Chairman of the National Stone, Sand and levels of the business if he was to succeed his father as Gravel Association where he was tasked with advanc- CEO. Charlie's father tested him by having him work his ing the association's agenda to ensure that the associa- way through the ranks to the position of CEO. His father tion continued to be the leading voice for the aggregate not only wanted him to earn the position, but also to industry. The agenda is aggressive and includes a new earn the respect of the company's associates. Had he not board structure and the execution of the association's proven capable, his father would not have appointed him Rocks Build America strategic plan. CEO. As third generation CEO of his family owned business, Thus, in early 1987, he began working full-time in the quarries and other departments; systematically moving Luck Companies, 2015 was off to a busy start as growth was returning to the aggregate industry in general and through supervisory and mid-management positions Luck Companies in particular. The firm's management for the next eight years. This kind of training had many had spent years building industry expertise on a foun- benefits - among them were learning the various aspects dation of Values Based Leadership. It was now time to of the business, developing managerial skills, and build- use their 800 talented employees to build an even higher ing relationships. Through this test, Charlie not only performing company. Working with his Chief Growth learned the importance of having a sound and innova- Officer, Mr. John Pullen, Mr. Charlie Luck had approved tive business strategy but also the role that values and culture played in executing them. The same values and a goal of almost doubling the company's size by the year 2020. This stretch goal forced his leaders to think out to the company's past success. culture that Charlie would later find out were the catalyst side-the-box" about their businesses and this was exactly what he wanted to accomplish. The next five years were After eight years of on-the-job training, Charlie's going to be fast paced and fun after years of retrench- father decided he was ready to run the company. In 1995, ment and slow growth in the construction aggregate he was promoted to President and subsequently became CEO in 1999. industry. When Charlie was appointed to CEO, the company Mr. Charlie Luck had become President and COO had a long history of success in the aggregate business in in 1995, and CEO in 1999, succeeding his father. A 1983 Virginia, driven by the business acumen and values of his graduate of the Virginia Military Institute, Charlie father and grandfather. The business had been operated earned a degree in Civil Engineering followed by a over the years in a very thoughtful, measured manner three-year career as a professional racecar driver on the with little or no debt and a solid but not rapid growth rate. The company's operations were all in Virginia and, like many small businesses, the management style was "top- down". The industry had experienced little consolidation and was primarily filled with family-owned businesses. Built on a "we care" attitude that emphasized integrity and treating people right, Luck Companies became a leader in customer service. By the late 1990s Luck Stone was known as a technology leader in its industry and was nationally ranked as one of the top 15 crushed-stone producers in the United States. A given was that the cul- ture that had proven so successful would not change, but most everything else was changing. The new millennium brought with it growing consolidation in the industry and fiercer competition. There was tremendous expansion in the markets, cre- ating faster growth rates, a much larger company, and increased debt to finance the growth. In the mid 'gos, Charlie and his leadership team realized that the top down" management style at Luck Companies was not ideal for meeting the needs of customers or employees. After much deliberation, they determined that there was a need for management decisions to be made closer to the customer. The organizational structure was decen- tralized and associate duties and responsibilities were changed to enable the company to better handle the growing complexity of sales opportunities. The company continued to grow under Charlie's leadership, but he understood that he was in a mature industry and therefore needed to diversify. Recognizing the increasing uniqueness of each of the business units, the leadership chose to separate the company into four businesses with distinct brand identities. There was an expectation through the strategic planning process for each to uniquely meet the needs of the marketplace, which resulted in specific strategies, brands and business plans for each business unit. Thinking back to his father and grandfather's suc- cess, Charlie wondered what the future held for Luck Companies. He challenged his management team to operate the company in a manner that not only excelled the company financially but also positively impacted the lives of its customers and associates. He was convinced that the company was well positioned to become even more successful in the future. century, the Luck family has turned a single quarry in the West End of Richmond, Virginia, into one of the top 20 largest producers of aggregate in the United States. Luck Companies operate under four separate business units or SBU's; Luck Stone, Luck Stone Center, Har-Tru, and Luck Development Partners. Although the Luck Companies business portfolio is divided into four SBUS, each business unit operates under Luck Companies values-based leadership system. A map of the Luck Stone business locations in 2015 is located below. Luck Stone Luck Stone, the largest business unit of Luck Companies, operates fifteen crushed stone plants, one sand and gravel plant, one specialty products operation and four distribution yards in the mid-Atlantic region. Luck Stone supplies a wide range of crushed stone, sand, gravel, and specialty stone; collectively called aggregate. The aggre- gate industry is further broken down into two main pro- duction segments: 1) Crushed Stone and 2) Sand and Gravel. Luck Stone primarily mines and sells crushed stone. Thirteen years ago Luck Stone started producing some sand and gravel. Defined geographically, due to the various sources, weights, sizes, and shipping costs associated with aggregates, the industry is significantly fragmented with about 1,550 companies operating 4,000 quarries in the United States.' Luck Stone's operations are located in the Mid-Atlantic Region of the United States, Virginia in particular. In 2014 the production of aggregates in the US totaled 2.17 billion metric tons that had a value of $20.3 billion dollars. Approximately 100,000 people were employed in the US aggregates industry in 2014. Aggregates are mined from various quarries and serve as inputs for the construction industry. The prosperity of the aggregate industry is directly correlated to the growth and economic stability of the construction industry, con- sisting of both private and public construction. These segments are further broken down into residential and nonresidential construction segments. Private residen- tial and nonresidential construction spending in the U.S. during 2014 was roughly $349 billion and $337 billion, respectively. Total public construction spending in the U.S. during 2014 was roughly $273 billion. While private construction accounts for the majority of construction spending, historically it has been highly volatile. This volatility has had a crippling impact on the aggregate industry during the recent recession. The public seg- ment, primarily funded by local, state, and federal gov- ernment organizations, is considerably more stable than the private segment. Luck Companies and Industry Overview Luck Stone, founded in 1923 by Charles Luck, Ir., is the largest family owned and operated construction aggregate company in the United States. Over the last V N CHE C De Dar DEWASA UN SWE GNIA 21 Delen * w *** 3 CH 101 Det 2 bir IM Grown boro E TE - A. NORTON CAROLINA In 2006 Luck Stone sold 27 million tons of aggre- Luck Stone utilizes a business strategy based on supe- gate yielding a market share of roughly 30% in Virginia. rior customer service and logistical excellence. In 2014 In 2009 Luck Stone's sales fell to 11.7 million tons of Vulcan Materials produced 11.8 million tons of aggregate aggregate yielding a market share of roughly 23% in in Virginia while Martin Marietta Materials produced Virginia. The market for aggregate in Virginia has not 3.2 million tons of aggregate in Virginia that same year. yet returned to the lofty levels of 2006. In 2014 Luck Stone sold 12.9 million tons of aggregate in Virginia and Luck Stone Center had a 40% market share in this region. Even with the sig- In 1976, Luck Stone opened its first retail showroom for nificant decrease in aggregate sales, Luck Stone remains architectural stone adjacent to its corporate offices. The the most profitable business unit of Luck Companies retail showroom concept was widely praised as being and contributes more than 80% of total enterprise net unique in the stone industry. The official name of this sales and profits. In 2014 Luck stone was the 15th larg- business unit was the Architectural Stone Division of est producer of construction aggregate in the United Luck Stone. In 1993, Mark Fernandes became V.P. of the States. Luck Stone's largest competitors and the largest Architectural Stone Division. When Charlie Luck was producers of construction aggregate in the United States appointed CEO in 1995, he directed Mark Fernandes to are Vulcan Materials and Martin Marietta, respectively. develop a five-year strategic plan that focused on expan- Vulcan Materials and Martin Marietta both operate sion. By the end of the 1990s, the Architectural Stone with an overall cost leadership business strategy, while Division was operating six Architectural Stone Centers. In 2000 a second five-year strategic plan was devel- held by Luck Companies. Each quarry owned by Luck oped with a strategic focus on product innovation. Companies needs nearly 5oo acres to operate efficiently. The Architectural Stone Division sought differentia- Location is also vital to the aggregate industry for the tion through new product offerings and began sourc- aforementioned reasons and serves as one of the largest ing stone internationally. During this time period the competitive advantages in this industry. Similarly, the Architectural Stone Division experienced increasing land development industry is highly dependent on loca- levels of competition from other contractor stone yards tion and centrality to population hubs. However, the life as well as big-box retailers such as Home Depot and of a quarry is limited to the amount of aggregate reserves Lowes. The management of the Architectural Stone in the ground. The long-range sustainable use of the Division knew that further differentiation was necessary land comes in the form of innovative real estate practices. to remain profitable. Developing these land assets allows Luck Companies to In 2007 the Architectural Stone Division went once again gain revenue from their land holdings. Luck through a significant rebranding and name change to Development Partners creates unique places by integrat- Charles Luck Stone Center. The strategic rebranding ing and highlighting natural, historical and environmen- shifted the brand from a contractor stone yard to an tal elements into the design of its projects. up-scale, design oriented architectural stone center. The new brand focused on a market of design savvy, afflu- Har-Tru ent homebuyers. Unfortunately, over the past ten years, Har-Tru is a global leader in tennis court surfacing the Charles Luck Stone Center sales were 82% correlated and accessories. Har-Tru was originally branded Lee with housing starts. The housing crisis in 2008 signifi- Tennis Court Products and was founded in the 1950s cantly reduced Charles Luck Stone Center sales. In 2014, by engineer Robert Lee. In 1997 Lee Tennis Court Charles Luck Stone Center shifted strategies to refocus Products was acquired by longtime partner and sup- on middle to higher-end consumers and added manufac- plier, Luck Companies. Two years after this acquisition, tured products to their product mix. With this new strat- Luck Companies acquired Lee Tennis Court Products egy, the business unit was rebranded "Luck Stone Center" largest competitor, ISP Tennis Products. Shortly after this acquisition Luck Companies acquired the manu- Side Note: facturing assets of the original Har-Tru material pro- vider and, finally, bought the Har-Tru brand name, a In the early 2000s the Architectural Stone Division sup- surface associated with some of the finest courts in the plied granite counter tops and interior surfaces to Home world. Depot. However, Home Depot became oversaturated with In 2013 Har-Tru acquired Century Sports, a retailer lower-end products and demanded lower prices from the for tennis court equipment based in Lakewood, New Architectural Stone Division. It was at this point that the Jersey. Century Sports has been in operation for over 30 division rebranded and shifted their strategy to concen- years and is the exclusive court equipment licensee of trate only on high-end stone sales and ceased to be one of Wilson sports. Home Depot's suppliers. Home Depot contracted a new Currently Har-Tru maintains between 85% and 90% supplier who was willing to meet their low price demands of the U.S. market share for clay tennis courts. The but unfortunately was unable to deliver on their order promises. Home Depot subsequently fired this new sup- from companies building non-traditional tennis courts main competition in the clay tennis court market comes plier and humbly asked the Architectural Stone Division with clay substitutes. While they are the leader in their to come back on as a supplier. The management of the industry, Har-Tru is the smallest business unit of Luck Architectural Stone Division was no longer interested in Companies and in 2014 contributed about 6% to the total supplying stone to big-box retailers. However, they agreed enterprise net sales. to supply Home Depot for 120 days so they had time to find a new supplier. This decision was driven by the values of Luck Companies to always treat each customer right History even if it did not fit with their long-term strategies. The Founders Years 1923 to 1964 Luck Stone acquired its first quarry, Sunnyside Granite Luck Development Partners Company, Inc. in Richmond, Virginia, in 1923. First year Luck Development Partners was founded in 1993 in order sales were $22,212 for chips" and "dust". These sales were to realize the development potential of the real estate fueled by the C. S. Luck and Son, which was owned by Charles Samuel Luck, the great grandfather of the current quarry became operational in 1985), Fauquier County, CEO. In 1925 the quarry employed 23 men and the first land purchased in 1987 and quarry became operational available production records show sales of 94,000 tons in 1988), Louisa County (land leased in 1989 and lim- of stone at an average price of $1.40/ton for the year 1928. ited production started the same year), Loudon County, During the 1930s Luck Stone acquired four more Leesburg (1993), and King William County (1996). quarries in Virginia. One of the quarries purchased was The oil crisis and recession of 1973 produced sky- the Boscobel quarry that is located about 20 miles from rocketing energy prices, high inflation, and a major lull the center of Richmond in Manakin-Sabot, Virginia; in the construction industry. Luck Stone's management where the company's headquarters are now located. The used this time to begin an initiative to bring energy sav- Boscobel quarry has been in operation since the 1880s ings, cost cutting and efficiency improvements to their and production records for 1931 show that it produced operations. Despite the depth of the recession and the 130,151 tons of stone with net sales of $138,065. In 1938 need to reduce hours, no employees were laid off. Luck Stone purchased Fairfax Quarries Inc. for $17,500. Following the recession of 1973, corporate manage- This quarry became one of their most successful quar- ment looked for areas into which to diversify in order ries because of the growth in Northern Virginia and its to lessen the impact of the cyclical nature of the con- proximity to Washington, D.C. struction industry. As a result, the Architectural Stone In the 1940s, the U.S. involvement in World War II Division was started in 1976 and their first stone center caused major production problems for Luck Stone. By opened the next year in Goochland, Virginia. 1942 there was a freeze on all state road contracts, a slow- Under the leadership of Charles, the company estab- down in the construction industry, and labor shortages lished itself as an industry leader in technology and for nearly all domestic companies. All of Luck Stone's innovation. In 1977 employees of Luck Stone designed quarries were forced to minimize operations with pro- and built the industry's first totally automated lime plant duction coming to a virtual halt in 1943 and 1944. The in Augusta County, Virginia. The plant was designed to Boscobel quarry was able to continue operations on a run unattended and had sensors that shutdown the plant reduced scale selling exclusively to the U.S. government if a problem arose. In 1987 Luck Stone's engineering team for military base construction in the greater Hampton designed and built segmentation and automation sys- Roads area. In 1949 the property for a new quarry near tems that allowed a plant to produce crushed stone 24 Charlottesville, Virginia, was purchased for $43,500 hours a day. Through his years as president and CEO from the Thomas Jefferson Memorial Commission and of Luck Companies, Charles grew the company signifi- is still operational cantly, created a culture focused on people, and brought the company to the forefront of innovation. Expansion, the Charles S. Luck, III, Years, 1965 to 1992 After spending summers working in the quarries, The Charles Luck IV Years Charles Luck, III, Charlie's father, joined the company in 1995. Charles Luck IV (Charlie) was named President in 1957 after his graduation from the Virginia Military of Luck Companies, and his father Charles became Institute and two years of active service in the United Chairman and CEO. At this point the company States Air Force. He became President of Luck Stone employed approximately 400 associates, produced over in 1965, succeeding his father, Charles S. Luck Jr., who 12 million tons of crushed stone, and was known for their became Chairman of the Board. When Charles took over in 1965, sales were approxi- Stone established a nationally recognized safety program, "WE CARE" about our people culture. In addition, Luck mately two million tons of crushed stone per year. When which became a model for the industry. he passed the baton to his son in 1995, annual tonnage of Charlie describes his early years as CEO as follows: crushed stone had grown to almost fifteen million tons per year. The company had expanded to 14 crushed stone I really did not fully understand the company at first. operations, including one in North Carolina. In Virginia, I knew that decision-making was centralized and we never quarries were purchased or developed and became shared our profit and loss data with our people in the field. operational under the Luck Stone name in Goochland I started sharing revenue, cost data, and profitability num- County (1965), Loudon County (1971), Green County bers with our field managers and I also decentralized our (land purchased in 1982 and quarry became operational management structure. To begin the development of our in 1984), Powhatan County (land purchased in 1984 and management team, I sent our officers to executive business programs and we produced our first five-year strategic entered 2003 ready to produce almost two million tons plan for the years 1995-2000. of production a year for 3M's facility and for the local market. Charlie describes his experience for the first five Despite record sales and rapid growth over the years as: past eight years, not everyone felt Charlie's enthusiasm. 1. Learning to see the business in totality from a Charlie remembers back to 2000 when George Fox came general management perspective. Up until this to him (a key associate who had been with the company point he was seeing it from an operational and for a couple of decades) and said that he felt that Luck functional perspective. He found that being CEO Stone was losing its way. He said there were many people required a very different way of thinking about the making decisions in a way that he did not believe was business. aligned with the traditional values that the company had 2. Building his management team while dealing with a held for decades. Charlie goes on to say: generational management succession of his father's During this same period of time, we had grown our exec- team. The existing senior managers were steeped in utive leadership group and I was observing that, although the quarry business and some found it very challeng- we were getting record financial results, we were not ing to respond to the demanding needs of running a working together as effectively as we could or should as business that was growing so rapidly and thinking a team. Often, there were the meetings after the meet- about ways to diversify. ings where issues were being discussed that could have, 3. Restructuring the business to reflect its increasing and should have been resolved and settled in the first complexity and size with an emphasis on decentral meeting. ization of operations. I felt like we had a team that could be so much more 4. Learning to manage the numbers in terms of growth effective in leading our company if we worked together and profits. in a high-performing, constructive, but challenging and 5. Creating a strategic management process with the respectful way where we completed meetings all on the first 5-year plan. same page. To help us improve, Jay Coffman, VP of Human 6. Realizing that in a more decentralized environ- Resources and I hired a management consultant who was ment there had to be some overall plan with clear recommended to us by Caterpillar executives in Peoria, goals and objectives to tie the parts into a coherent Illinois. The management consultant began meeting with whole. us once a quarter for two days. He met with all the lead- ership team members for about 18 months. During this Between 1995 and 2006 the company set new profit period, we learned that our values and leadership journey and volume records every year. In 2003 it employed 830 started with ourselves. We realized that we needed to look associates and produced over 21 million tons of crushed at our own personal leadership as it pertained to issues in stone. It had diversified into tennis courts, land develop the company ment and stone centers. It nearly tripled sales, associates, and profitability. This was in contrast to the very delib- erate and measured growth during Charlie's father and The Values Journey - Vision 2010 - grandfather's time. By 2005, the company had almost 1200 employees. This tripling of associates had led to Phase I: 2003-2007 promoting a lot of people quickly and hiring new talent Beginning in early 2003, the leadership team met to from outside the company. New people were also gained decide what values would define the company. The lead- from numerous acquisitions, which took place during ership team did not realize that this endeavor would this timeframe. result in a values-based leadership journey that would In spite of the fact that the country was in a mild dramatically transform the organization. recession in 2002, the company continued to make prog- During this period, officers also began what was ress. The year 2002 was truly remarkable for the company coined "Tools Training Tools Training was built on var- with record sales yet again. Three more Virginia quarries ious forms of insight testing that ultimately taught the were purchased (Culpeper, Spotsylvania and Bull Run), officers to understand themselves and others in order and work was finished on a new North Carolina based to make a difference. In one of these private meetings quarry that was to produce roofing granules for a 3M Charlie came to the realization that the values journey factory in North Carolina. The North Carolina quarry had to start with him: For two hours I sat in front of the group, while the team filled flip chart pages with comments about what they did and didn't like about my leadership. They then covered the walls with all the pages. At this particular time, I found the negative observations to be painful and I did not see them as gifts but rather as attacks on me. There was a side of me that was extremely upset and mad but I also knew that I had to do something different. Upon returning to Richmond, I talked with my father about this experience. He asked me about the feedback and I told him it was the same thing he had been telling me for the past nine years. He then asked me what I was going to do about it and I promised him that I was not going to quit and that I was going to work as hard as I possibly could to be a better leader for our company and for our people. This was clearly a pivotal point that forced me to look in the mirror and figure out how I could be a better leader at Luck Companies. After a year of these periodic meetings and Tools Training, other Associates began to notice a difference in the officers. At the end of this 18-month period the values that would lead the company were agreed upon: Commitment: "Take personal responsibility for the success of associates, customers, and communities Integrity: Earn the trust and respect of others Creativity: Have a passion for ideas and innovation that add value Leadership: Ignite Human Potential These values emphasize the importance of perfor- mance, and go beyond that to describe the behaviors required to do the right things. Charlie believed strongly that a values-driven culture was a way to achieve even better outcomes and performance. Examples of out- comes include: a. Improved customer loyalty and key account reten- tion through integrity and commitment toward any- one that the company came into contact with. b. Increased product innovation by focusing and embracing creativity throughout the company. c. Better efficiency and safety through an unwavering commitment to a best-in-class safety program. d. Acquisition advantages by gaining respect as an industry leader for operating with integrity as a core value in everyday operations. In 2004, after a year and a half of deciding what values would define Luck Companies, Charlie and the senior team decided it was time to unveil the Values Journey and Vision 2010 to the entire company. A series of departmental meetings were held where Charlie gave the speech that would change the company forever. In his speech, Charlie told the employees that he was no longer worried about just making money but instead how that money was being made. Many associates were shocked at Charlie's newfound Vision 2010, "To be the Model of a Values-Based Organization The next task was to embed this newfound vision throughout the company. It was important that these values did not become superficial posters merely hung on a wall to collect dust. Charlie and the senior team knew that in order to truly achieve the vision, the val- ues would have to reach the deepest depths of the com- pany and become ingrained in each and every associate. Every associate would be held accountable to these val- ues and through this accountability the vision would ignite potential in the associates to not only become better employees but better individuals holistically. To assure that the values were adhered to and lived out by every associate, a unique and intense process was developed to make Vision 2010 operational. To ensure the successful implementation of the vision, Luck Companies invested thousands of working hours and millions of dollars to embed it into the organization. Below is an overview of the steps taken to drive the vision: The Monthly Values Program: A year long program starting with top associates in groups of 40 to undergo the same tools training as the officers. Established the First Ritual: Any and every meeting would start with 10 - 15 minutes of values stories. Redid the annual associate performance reviews: The APR's were now built around values and behaviors, and encompassed two sections: 1) what section and 2) how section. Insights Study: Every employee down to the hourly level took an insights study to learn about themselves. New Values Curriculum: This new curriculum was built around values, insights, and supporting tools. Introduced Walking the Talk Awards: Associates sub- mitted people acting out the values (top five received a prize). Hired and embedded sight specific HR Personnel Their job was to work out in the fields and teach and train the new values. Quarterly Values Program: Also was attended by hourly associates. Implemented a Mentoring Program: Officers began to mentor 5 senior leaders at a time, and once senior lead- ers went through the program for a year, they turned around and mentored the associates beneath them. Employee Interview Process Overhaul: Managers him think about his own children. He traveled to a began to ask values-based behavior questions to Family Office consultant in Chicago to look into start- interviewees. ing a Family Office for the Luck Family. When he arrived, New Officer Incentive Plan: Now 33% of the officers the consultant asked Charlie about his company. He told bonuses were based on self-development (the mea- her about his values journey and his thoughts about sures of success were 360 assessments) a larger purpose in life. They began to talk about this In 2005, Mark Barth was appointed as the Director larger purpose and her curiosity grew. She asked about of Values. Others were also appointed as dedicated asso- that the Values Journey had made. He told her stories of the lives that the company had touched and the progress ciates in the Values Journey and Vision 2010. At this point, Luck Companies was allocating between one associates coming up and telling him how they have a and two million dollars of resources to Vision 2010 per better relationship with their children, with their parents, and with themselves. She stopped him and asked, "How year. However, institutionalizing the values model as the business grew was no easy feat. A number of managers often does a company get the chance to touch the lives could not or did not want to adapt to a more values ori of three generations? ented leadership style, preferring to strictly emphasize He realized that he and his company had the opportu- the importance of performance and/or other variables nity and ability to positively impact the lives of more people not aligned with the values. For example, some seasoned than he originally thought. Five years of the Values Journey Associates working in the Company were unable to see had made a positive impact on the company overall, but the benefit of incorporating values into their leadership there was still more to be done to create a company that style while some senior leaders' behaviors conflicted could touch the lives of everyone. He came to the realiza- with the values in which the Senior Leadership Team tion that the higher purpose he sought was for his company believed. Some left, while others were asked to leave. to enrich the lives of the people it touched - from employ- It took three years, but by 2006, the Values Journey ees to customers to suppliers and the community. He and was really gaining traction and people were truly acting his top associates began to research literature and others differently and adopting these values. Associates were experiences about doing good as the best path to doing approaching Charlie at company events to tell him how well. They realized that the model would be built based these values not only benefited their work life, but their on leadership. Values-Based Leadership would serve as the personal and family life as well. means to spread these values more effectively throughout the company and in turn the lives of the people the com- pany touches. From here Vision 2020 was created, "To be The Values Journey - Vision 2020 - recognized as one of the top five values based leadership Phase II: 2007-2008 organizations in the world." The values-based leadership model development At this point, Charlie was 46 years old and was thinking process began in the spring of 2007. Another consult- even more deeply at a personal level about what life is ing firm was brought in to help facilitate the design and about. He had been through 15 years of annual finan-assessment process. A small team of cross-functional cial records, and the Values Journey was working. But, leaders from the four business units was selected to somehow this didn't seem to be enough. He was begin- build the framework and behavioral components of the ning to think that there had to be a bigger purpose in model. This team was led internally by two senior lead- life. His wife's brother, Kyle Petty, does an annual charity ers, John Pullen, who at the time was VP of Strategy and ride across the country with a large group of friends and Real Estate, and Jay Coffman, VP of Human Resources. Charlie joined him. Out in the west, Charlie was riding The development team was given the assignment to due east directly into the sunrise. He had been riding align the mission, values, and Charlie's 2010 Vision into for about an hour at 100 miles per hour when he looked a practical inspiring model that would include the essen- over to the right at hundreds of migrant workers picking tial behaviors required for success as a leader at Luck strawberries. He questioned, "Why wasn't I born into a Companies. The model would also provide a framework family of migrant workers?" He thought back to what for ongoing selection and development of company his mom told him as a young child, "To whom much is leaders, content for leadership training, and behav- given, much is expected" ioral standards for performance management. The pro- Charlie returned from his cross-country trip and cess used to build the leadership model contained the began seeing his name on trusts and wills, which made following steps. Step 1: Planning session(s) to understand expecta- Officer position to the team. John Pullen was appointed tions and deliverables of the project. to this position and tasked with the responsibility of driv- Step 2: The facilitation of design meetings with ing differentiated growth and financial results across the cross-functional leaders to create the initial draft of enterprise. Each business unit would report directly to the leadership model. John. The other key change was the creation of a Chief Step 3: Online content validation with the entire Leadership Officer who would be responsible for the over- leadership population to generate refinement and all strategic and tactical support of the acquisition, devel- Values-Based Leadership acceptance. opment, and retention of high performing talent. This Step 4 Recalibration of the model to include feed-position would have direct accountability for working back from the content validation process. with other senior leaders to bring the leadership model to Step 5: Senior leadership team validation and blessing. life. Mark Fernandes, who had been president of Charles Step 6: Final balancing of the model. Luck and Har-Tru, was selected as the Chief Leadership Step 7: An initial 360 assessment of the top leaders to Officer. In short, Charlie's intention for these positions test out the model. was to manage and succeed, in parallel, best in class finan- Steps 1-6 took approximately ten months. The frame cial performance and organization wide values alignment. work of the model was designed to: Another key change to the leadership structure was the addition of a Chief Family Officer. Wanda Ortwine Advance our values-based culture. was appointed to this unique position and tasked with Build Exceptional experiences with our customers the job of developing the leadership and competencies and constituencies. of Charlie's family in preparation for the future, handling Drive Differentiated growth. family investments, estate planning and serving on the At the end of 2007, both the Chief Financial Officer Strategic Leadership Team to transform the organization and VP of Human Resources announced their retirements in alignment with the mission. in 2008 and 2009 respectively. These pending retirements After contributing over twenty years of service to gave Charlie the opportunity to examine the structure of the organization, Jim Parker, retired and was replaced his senior leadership team to ensure that the proper infra by Roy Goodman who was appointed to the position of Chief Financial Officer and Vice President of Finance, structure would be in place to drive future growth. Luck Companies. Prior to joining Luck Companies, Roy had been the CFO for RealNetworks, a high growth New Strategic Leadership Team technology company located in Seattle, Washington. The organizational changes were announced in the There were several key changes to the senior leadership spring of 2008, and an orderly two-year transition plan structure. First, Charlie decided to add a Chief Growth was put into place. However, three unexpected events New Strategic Leadership Team Chairman CEO Chief Family Officer Chief Financial Officer Chief Growth Officer Chief Leadership Officer occurred during the 2008-2009 timeframe. The United employee on Tuesday, November 11, 2008. The showing States entered into a deep recession, the president of of the video ensured that every employee had exactly the the aggregate division, who had a record of excellent same information and hopefully slowed down the inev- performance, was asked to leave the company due to a itable rumor mill. On Wednesday November 12, 2008, misalignment with the organization's values, and Charlie and Thursday, November 13, 2008, managers met with became seriously ill. These events put step 7, the final the employees that unfortunately had to be let go. step of testing the new leadership model, on hold as the Commenting on the reduction, Charlie had this company worked to regain traction and overcome the to say: "We wanted our employees to say, 'It's an awful unfortunate events. thing to do, but you did it better than anybody else". We wanted our people to say, "This is how a values-based company does this." Reduction in Force: 2008 To aid employees after the RIF, Luck Companies Charlie said that in 2008 the "financials fell to pieces" leased a building offsite and turned it into an Employee The recession was really hitting all aspects of the stone Relocation Center. They helped the employees write industry hard and for some of their products demand had resumes, cover letters, and find new employment. As a been eroding since 2006. The company had expanded to testament to the culture and values at Luck Companies, just under 1200 associates in 2008 but it was obvious many other companies reached out, eager to accept Luck to the leadership team that the sales were not going to Companies' ex-employees as new hires. come back anytime soon and that they no longer had the In March 2009, Charlie fell ill. At first he believed revenue to support such a large workforce. that he had contracted the flu virus and would be back In September 2008, things got so bad that the fed- to work soon. However, the illness worsened and Charlie eral government had to help save several large US cor- became bed-ridden for nearly 20 hours a day, with dis- porations, and Mr. Luck said that "We then knew that abling fatigue. The doctors were unable to diagnose his 2009 was going to be worse than 2008". Management illness. During this time Charlie thought a lot about the had already taken the typical expense reduction steps life he had lived and what else could be done to fulfill such as a hiring freeze, delaying equipment purchases, his purpose. After two long months he began to improve and cutting non-essential expenses. However, they now and returned to work. realized that this recession was not like any they had ever experienced before and that they were going to have to The Values Journey Continues - take more drastic measures. In the end they came to the Phase III: 2009 - Present conclusion that it would be better to operate with 125 fewer associates who had full pay and benefits than neg- In the fall of 2009, Charlie returned to an organization atively affect everyone. This decision was especially dif- that was comprised of businesses that were struggling ficult for the managers of a company that had never had because of the recession. The past two years of Charlie's a reduction in force in its entire history and was known life had a significant impact on the way he wanted for treating its employees like family. to continue to run the company. After nearly dying, In the end they came to the conclusion that it would Charlie decided the Vision 2020 was too far in the be better to operate with 125 fewer associates than nega- future and not significant enough to achieve his goals tively affect everyone. for the company. He rewrote the vision with an even Once the decision was made to have the firm's first higher purpose and shortened the time span by five ever company-wide reduction in force, Charlie and his years. The new mission was coined Mission 2015 and leadership team discussed the type of company and states that; "We will ignite human potential around the associates they wanted to have once the recession was world and positively impact the lives of others through over. They decided not to use seniority but instead revis- values based leadership." ited their core values to guide them in their decisions He presented the mission to Mark Fernandes, Chief about who would no longer be an employee of the com- Leadership Officer, and tasked him with making it oper- pany. A generous separation package was prepared for ational. Mark knew that it would not be an easy job to each departing employee, which "stretched the company." drive such a lofty mission at a time when the company A video was prepared that explained in great detail why had fewer financial resources, fewer associates, and oper- the reduction was necessary and it was shown to every ated in markets that were in a recession. Despite these negative circumstances, Mark and rest of the leadership opportunity areas that were identified. For example, a team believed in the mission and worked to develop a Vacation Donation Policy was created whereby employ- new values based leadership model that would make it ees could donate unused vacation time to other employ- happen. To guide them in this development, the seniorees in need. Annual Associate Engagement Surveys have team members relied on the Company's "Core Ideology become common practice at Luck Companies and the and Beliefs as well as the "Values Based Leadership management team continually challenges themselves to Value Proposition" presented below: achieve best in class performance year over year. Core Ideology and Beliefs: The Future of the Values Journey "We believe all people are born with the extraordinary potential to make a positive difference in the world. We The management team at Luck Companies used the 2012 believe making a difference is a choice, a conscious choice to 2014 time period to rationalize and reflect on all they that begins with our own self-awareness and alignment . all of their engagements and efforts to drive impact on had learned about Values Based Leadership. Through Values Based Leaders consistently make this choice then insure others do the same, positively impacting the lives of the subject locally and globally, they realized that they those around them." needed a platform that would better lend itself to pro- moting this model on a larger scale. Furthermore, the demand from companies and individuals for infor- Value Proposition: mation and coaching on VBL began to outpace Luck *At Luck Companies we believe doing good (making a dif. Companies' capacity. To this end, a decision was made ference) is the best path to doing well (business perfor- in 2014 to establish a Values Based Leadership Institute mance); and Values Based leadership is how we do good in 2015, called Inner Will. Furthermore, Charlie decided and why we do well." that this institute would be established as a 501-(c)(3) not-for-profit organization. Charlie stated that, "My In 2011, Charlie put step 7 into effect and had the belief from the beginning was to give this. (Values Based senior leadership team collectively go through a robust Leadership), to the world with nothing in return. The 360-Assessment process where each leader received institute will draw on internal leadership talent as well as feedback on how their behavior was aligned with the acclaimed professionals in the leadership field to advance model. After the 360-Assesment processes took place, the institute's mission. Luck Companies will ultimately the leaders went through an intense period of values become a "practitioner" of the institute's work. Through development and behavioral management training. Inner Will, management plans to accomplish the follow- The years 2012-2014 were very busy for Chief ing three goals that are part of "Vision 2015". First, to Leadership Officer Mark Fernandes. In an effort to share increase the "Number of lives Impacted" through Values the Luck Companies' story, mission, and beliefs about Based Leadership; second, to ensure that the Number of Values Based Leadership, Mark and his team traveled values based leaders developed" is increased; and third, locally, nationally and internationally leading speaking to increase "Our global reputation: Top 5" in the field of engagements on the subject of VBL. During this time Value Based Leadership. period, Mark and his team began to provide consulting services to a variety of organizations on the subject of Vision 2020 VEL. The HayGroup was hired to evaluate the Values Based Leadership effort at Luck Companies. Management Over the past ten years, there have been many changes at consultants from the HayGroup constructed a survey Luck Companies, from the rebranding of business units that aligned with the Values Based Leadership program to the restructuring of sales teams. However, one con- at Luck Companies and 98% of the firm's associates stant throughout this time period has been the mission completed the survey. The results of this survey were of Luck Companies to Ignite Human Potential through very favorable, placing Luck Companies among the top Values Based Leadership and positively impact lives companies in the world for employee engagement. The around the world. The dedication to fulfilling this mis- results were even more favorable than those from a sim- sion has been without question and Luck Companies ilar survey that had been conducted in 2011 and manage- continues to deepen their impact on people both ment immediately took action on the few problem and internally and externally. Internally, Luck Companies associates are challenged to think about their own pur- Har-Tru pose and vision and are encouraged and aided in their fulfillment . Externally Luck Companies dedicates a sig- Grow product basket nificant amount of effort and resources to initiatives such Other Sports: Identify and add surfaces, equipment as the founding of Inner Will, the non-profit founded and accessories for other sports that can be sold by Luck Companies to drive Values Based Leadership through our sales channels globally. While Igniting Human Potential has remained Other Tennis Products: Identify and add other unchanged, the "Vision" for 2020 will bring significant surfaces, equipment and accessories for tennis that change to the company. However, these changes are can be sold through our sales channels fueled by one constant, the belief in the mission to Ignite Innovation: Develop new products Human Potential. Three of the four Luck Companies' business units underwent or were in the process of undergoing an Broaden and deepen connection intense 5-year strategic planning process in 2014 and to the customer 2015. Each strategic plan was developed with a focus on supporting Vision 2020, the most aspirational five-year Develop new relationships in the markets we serve vision in the company's 93-year history. Vision 2020 is Develop relationships in new markets built on the following four strategic objectives and high- Deepen existing relationships and increase knowl- level definitions: edge and awareness to better meet customer needs Pilot windscreen measurement and installation ser- Financial Performance: Advance the Mission for vice through Century Sports future generations by insuring the long-term finan- cial health of the company. Leadership Development and Succession: Ensure Luck Development Partners we are developing the environment where each leader has the opportunity to optimize their purposes the many land holdings of Luck Companies besides Luck Development Partners is charged with managing passion, and competency in a way that prepares the company for the future. those being used for mining activities. Some of these Business Excellence: Optimize time, energy, and tal- properties include industrial parks and others are per- ent in order to build a healthy, profitable, and high mitted for mixed use including housing and retail. While performance company. Luck Development Partners currently manages these Growth: Challenge ourselves to intentionally rein- holdings, the future of this business unit will be revisited vent the growth process in a way that brings value to in late 2015. the company and grow sales from $240M to $450M. Luck Stone: The 2015-2020 2020 Objectives and Goals by Growth Engine Business Unit The 2015 mantra at Luck Stone was growth. The Chief The following objectives and goals were developed in Growth Officer and Corporate Development Team have 2014 and 2015 for each individual Luck Companies' busi- been supported with significant resources to deliver the ness unit: majority of the financial growth for Luck Companies. Management had considered getting into some of the businesses that utilized their aggregate but had concluded Luck Stone Center that the risks were not worth the rewards. For example, they had an opportunity to pursue business operations in Expand builder model to all target markets the asphalt industry, similar to the vertical integration of Reestablish account base with countertop strategy Vulcan Materials with concrete production, but decided Increase man-made product sales that doing so would put them in direct competition with Increase accessory sales some of their largest and most loyal customers. Therefore, Focus on operational efficiency and customer ser- in order to meet their growth goal and nearly double vice improvements revenue from $240M to $450M by 2020, management Continue culture and training initiatives decided that growth would be achieved by increasing the sales of aggregate while also expanding the offerings and Luck Companies devoted considerable effort to iden- breadth of the other business units. In establishing this tifying acquisition targets. Maps were constructed of all growth goal, Luck Companies will allocate 80% of avail- the growth areas from Virginia to Texas and over 600 able capital to growing the Luck Stone business unit, while independent aggregate producers in the targeted mar- the remaining 20% of capital will be focused on growing kets had been identified. In late 2014 and early 2015 Luck the Luck Stone Center and Har-Tru business units. Companies pursued and/or explored potential opportu- Luck Stone accounts for over 80% of the total rev-nities in Virginia, North Carolina, Tennessee, Alabama, enue of Luck Companies, and will continue to lead South Carolina and Maryland. These conversations were the firm's growth over the next five years. While Luck typically started with an introduction to Luck Companies Stone's growth plans do not include vertical integration, culture and Values Based Leadership model. Many of the there are opportunities for innovative new products to quarries that Luck Stone targeted as potential acquisi- help drive these growth efforts. For instance, manage- tion opportunities were small to medium sized family ment has identified a growing demand for engineered owned companies. These companies and their owners, soils and bio filtration media. Engineered soils and bio similar to Luck, view their employees as an extension filtration media are used in retention ponds to filter of their own family. If and when the various aggregate contaminates in water run-off before it is released into producers decide to put their companies up for sale, it streams or large bodies of water. Management believes is the belief of Luck's management team that some will that new regulations that focus on water quality and want to sell to Luck Companies because of their reputa- eco-friendly systems will make this a viable new oppor- tion of igniting the potential in their associates through tunity for their Luck Stone business unit. Some of the values based leadership, thus having a positive impact key inputs to these soils are taken from the top layer on all they touch. These owners truly care about their of material that covers the stone at quarries, known as people and therefore do not want to sell to one of the over burden. Over burden is typically removed to reach large industry conglomerates. Furthermore, by targeting the material below and is stockpiled on site, often tak- small to medium sized family owned companies with ing up valuable real estate. This market has been served similar values and beliefs to Luck Companies, it is the through a small division of Luck Stone called Luck belief of management that the integration of these com- Specialty Products. In 2015, Luck Specialty Products panies into Luck Companies will come with less hard- was rebranded into Luck EcoSystems and is now aggres- ship and burden. sively entering the engineered soils market and seeking Luck Companies was off to a fast start in 2015 with growth opportunities. many "irons in the fire". The largest plant expansion While some new product offerings and innovations in Luck Stone history was underway at Bull Run. Luck in the industry are possible, the almost doubling of reve- Stone Center was embarking on a new business strategy nue for Luck Companies is to be accomplished primarily under a new brand. Luck EcoSystems was developing through a strategy of acquisition and internal growth. new products in a relatively new market and growing Some internal growth is possible given Lucks investment rapidly. Har-Tru completed their first "turn-key" tennis in equipment, processes and people during the past five court installation supplying everything from court mate- years. In addition, the volume of aggregate sales in tons rial to netting and all other accessories. Inner Will had is still below peak levels, therefore some capacity in cur- put a board of directors and strategic development team rent operations is available. in place and had submitted an application for 501(c)(3) status. Luck Companies overall was poised for tremen- Side Note: dous growth over the next five years. As Charlie reflected back on his time as CEO and thought forward to 2020 In the northern region of Virginia, the Luck Stone Fairfax and beyond to future generations, he stated, The firm Plant has nearly reached the end of its reserve life. In antic-is in strong financial condition and has many associates ipation of this event, Luck Stone has invested nearly s40 who have untapped potential and we need to give them million into their Bull Run Plant, which is only ten min opportunities to realize their wildest dreams. I feel a utes from Fairfax, to back fill demand from Fairfax. By deep responsibility to handoff this company to the next 2016, the Bull Run Plant will have the capacity to produce generation of associates and family who will have signif- 5 million tons per year, making it the largest of any Luck icant opportunities for decades into our second century Stone plant. of running a family businessStep by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts