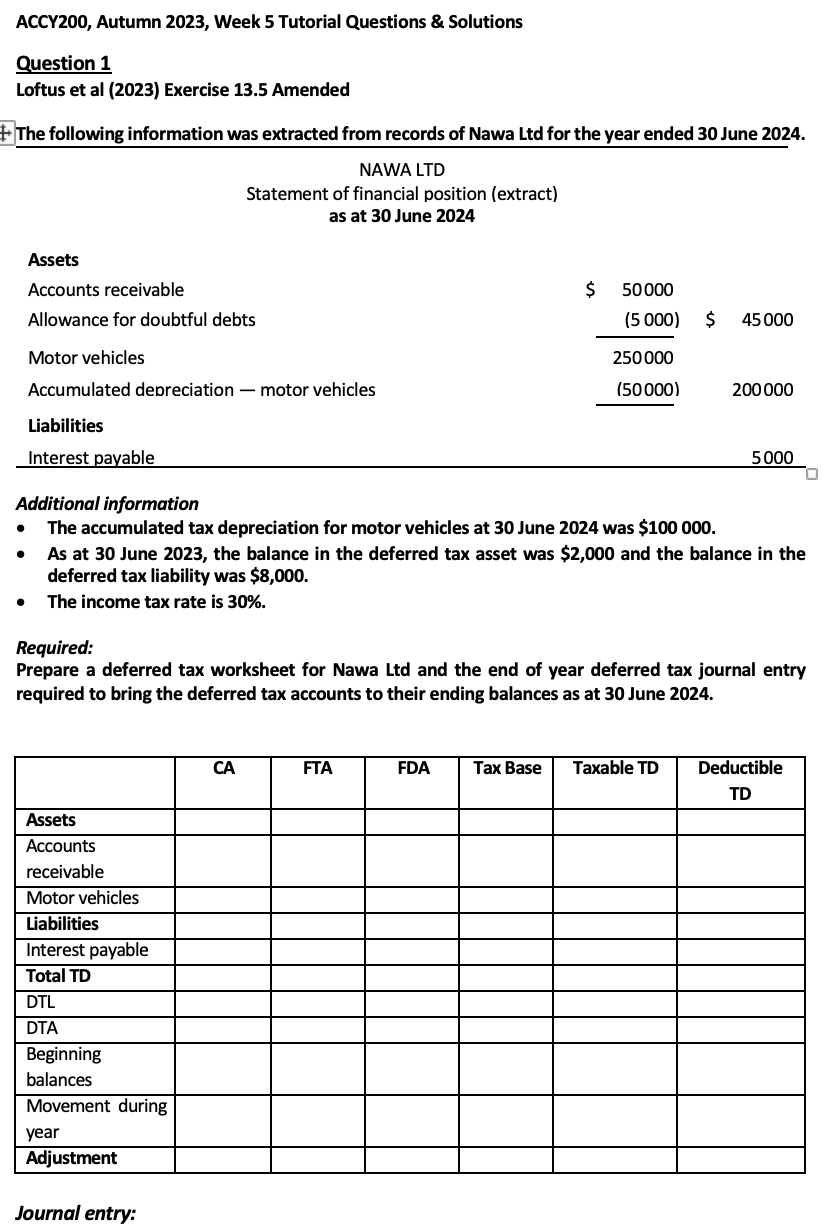

Question: ACCY200, Autumn 2023, Week 5 Tutorial Questions & Solutions Question 1 Loftus et al (2023) Exercise 13.5 Amended The following information was extracted from records

ACCY200, Autumn 2023, Week 5 Tutorial Questions & Solutions Question 1 Loftus et al (2023) Exercise 13.5 Amended The following information was extracted from records of Nawa Ltd for the year ended 30 June 2024. Additional information - The accumulated tax depreciation for motor vehicles at 30 June 2024 was $100000. - As at 30 June 2023, the balance in the deferred tax asset was $2,000 and the balance in the deferred tax liability was $88,000. - The income tax rate is 30%. Required: Prepare a deferred tax worksheet for Nawa Ltd and the end of year deferred tax journal entry required to bring the deferred tax accounts to their ending balances as at 30 June 2024. Journal entry

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts