Question: ACG 5175 Please Help!!!! 1. 20ponis In this problem you are required to compute and interpret bankruptcy prediction ratios. The information presented below relates to

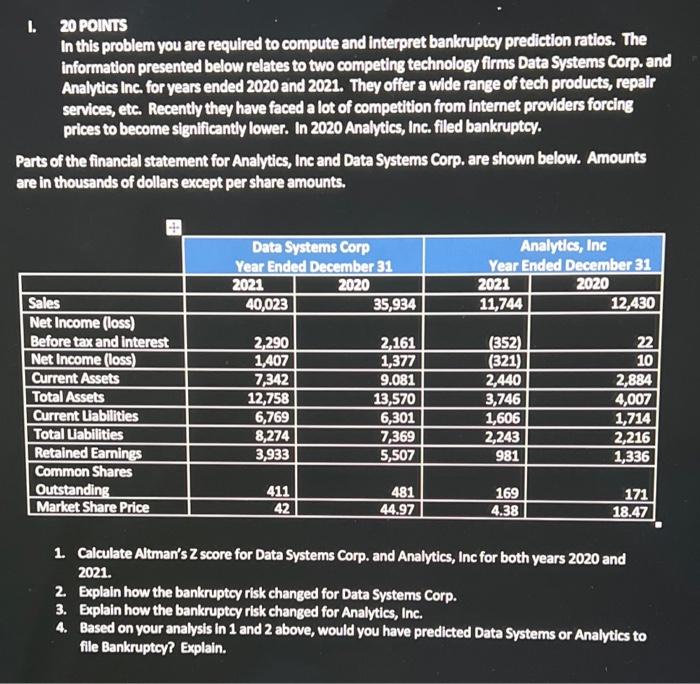

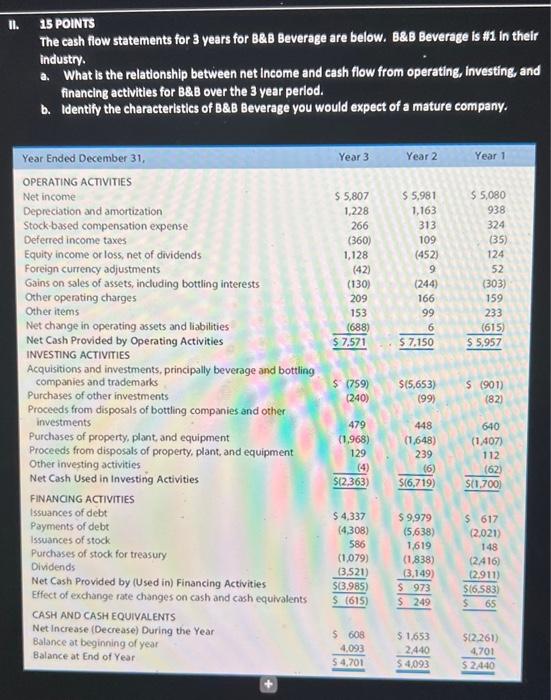

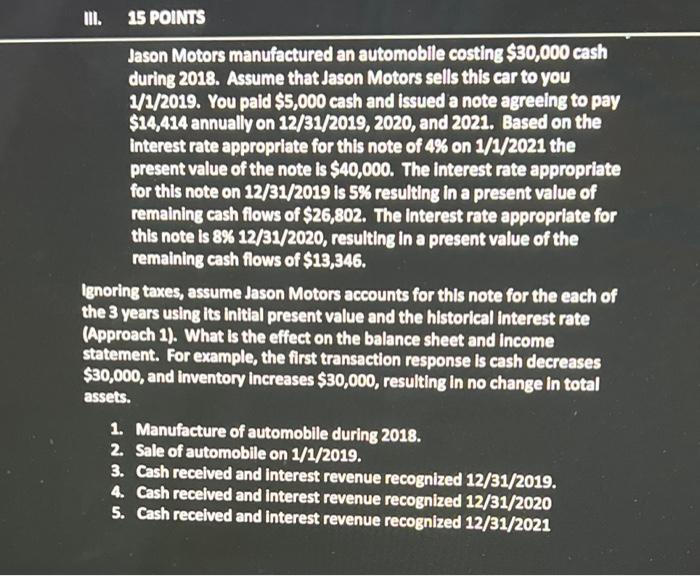

1. 20ponis In this problem you are required to compute and interpret bankruptcy prediction ratios. The information presented below relates to two competing technolosy firms Data Systems Corp, and Analytics inc. for years ended 2020 and 2021. They offer a wide range of tech products, repair services, etc. Recently they have faced a lot of competition from internet providers forcing prices to become significantly lower. In 2020 Analytics, Inc. filed bankruptc\%. arts of the financial statement for Analytics, Inc and Data Systems Corp, are shown below. Amounts ire in thousands of dollars except per share amounts. 1. Calculate Atman's Z score for Data Systems Corp. and Analytics, Inc for both years 2020 and 2021. 2. Explain how the bankruptcy risk changed for Data Systems Corp. 3. Explain how the bankruptcy risk changed for Analytics, Inc. 4. Based on your analysis in 1 and 2 above, would you have predicted Data Systems or Analytics to file Bankruptcy? Explain. u. 15 poINTS The cash flow statements for 3 years for BQB Beverage are below. B8B Beverage is $11 in their industry. a. What is the relationship between net income and cash flow from operating, investing, and financing activities for B\&B over the 3 year period. b. Identify the characteristics of B\&B Beverage you would expect of a mature company. Jason Motors manufactured an automoblle costing $30,000cash during 2018. Assume that Jason Motors sells this car to you $14,414 annually on 12/31/2019, 2020, and 2021. Based on the Interest rate appropriate for this note of 4% on 1/1/2021 the present value of the note is $40,000. The interest rate appropriate for this note on 12/31/2019 is 5% resulting in a present value of remaining cash flows of $26,802. The interest rate appropriate for this note is 8%12/31/2020, resulting in a present value of the remaining cash flows of $13,346. Ignoring taxes, assume Jason Motors accounts for this note for the each of the 3 years using its initial present value and the historical interest rate (Approach 1). What is the effect on the balance sheet and income statement. For example, the first transaction response is cash decreases $30,000, and inventory increases $30,000, resulting in no change in total assets. 1. Manufacture of automobile during 2018. 2. Sale of automobile on 1/1/2019. 3. Cash received and interest revenue recognized 12/31/2019. 4. Cash recelved and interest revenue recognized 12/31/2020 5. Cash recelved and interest revenue recognized 12/31/2021

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts