Question: Acme Corporation has created a deferred compensation plan (Plan) for 50 key executives (participants), all of whom are highly compensated employees. Acme contributes each year

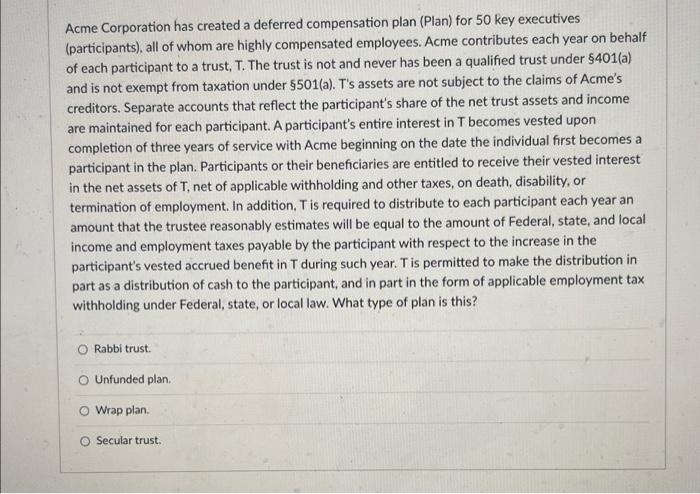

Acme Corporation has created a deferred compensation plan (Plan) for 50 key executives (participants), all of whom are highly compensated employees. Acme contributes each year on behalf of each participant to a trust, T. The trust is not and never has been a qualified trust under $401(a) and is not exempt from taxation under $501(a). T's assets are not subject to the claims of Acme's creditors. Separate accounts that reflect the participant's share of the net trust assets and income are maintained for each participant. A participant's entire interest in T becomes vested upon completion of three years of service with Acme beginning on the date the individual first becomes a participant in the plan. Participants or their beneficiaries are entitled to receive their vested interest in the net assets of T, net of applicable withholding and other taxes, on death, disability, or termination of employment. In addition, Tis required to distribute to each participant each year an amount that the trustee reasonably estimates will be equal to the amount of Federal, state, and local income and employment taxes payable by the participant with respect to the increase in the participant's vested accrued benefit in T during such year. Tis permitted to make the distribution in part as a distribution of cash to the participant, and in part in the form of applicable employment tax withholding under Federal, state, or local law. What type of plan is this? O Rabbi trust O Unfunded plan O Wrap plan. Secular trust

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts