Question: If Acme company (HW_04.xlsx) makes the following changes from our demonstrated example in its bid: 1) change the fixed cost to $8000; 2) change probabilities

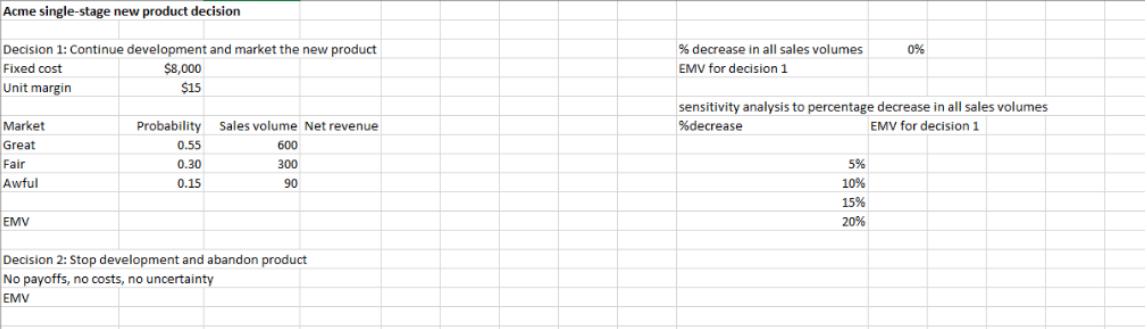

If Acme company (HW_04.xlsx) makes the following changes from our demonstrated example in its bid:

1) change the fixed cost to $8000;

2) change probabilities of Great, Fair and Awful to 0.55, 0.30, and 0.15 respectively;

3) the unit margin is $15.

Please reconsider that 1) whether Acme company should market the new product or abandon it, and 2) perform the sensitivity analysis if all sales volumes are decreased by 5%, 10%, 15%, and 20%.

Acme single-stage new product decision Decision 1: Continue development and market the new product Fixed cost % decrease in all sales volumes 0% $8,000 EMV for decision 1 Unit margin $15 sensitivity analysis to percentage decrease in all sales volumes %decrease Probability Sales volume Net revenue EMV for decision 1 Market 0.55 600 Great 5% 0.30 300 Fair 10% Awful 0.15 90 15% EMV 20% Decision 2: Stop development and abandon product No payoffs, no costs, no uncertainty EMV

Step by Step Solution

3.50 Rating (163 Votes )

There are 3 Steps involved in it

Lets analyze the given situation step by step Step 1 Calculate the Expected Monetary Value EMV The EMV for each market condition is calculated as foll... View full answer

Get step-by-step solutions from verified subject matter experts