Question: ACNT Post Homework 2303 QUESTION 1 0.4 points Save Answer During the year, the following activity occurred: If the company uses the last-in, rst out

ACNT Post Homework 2303

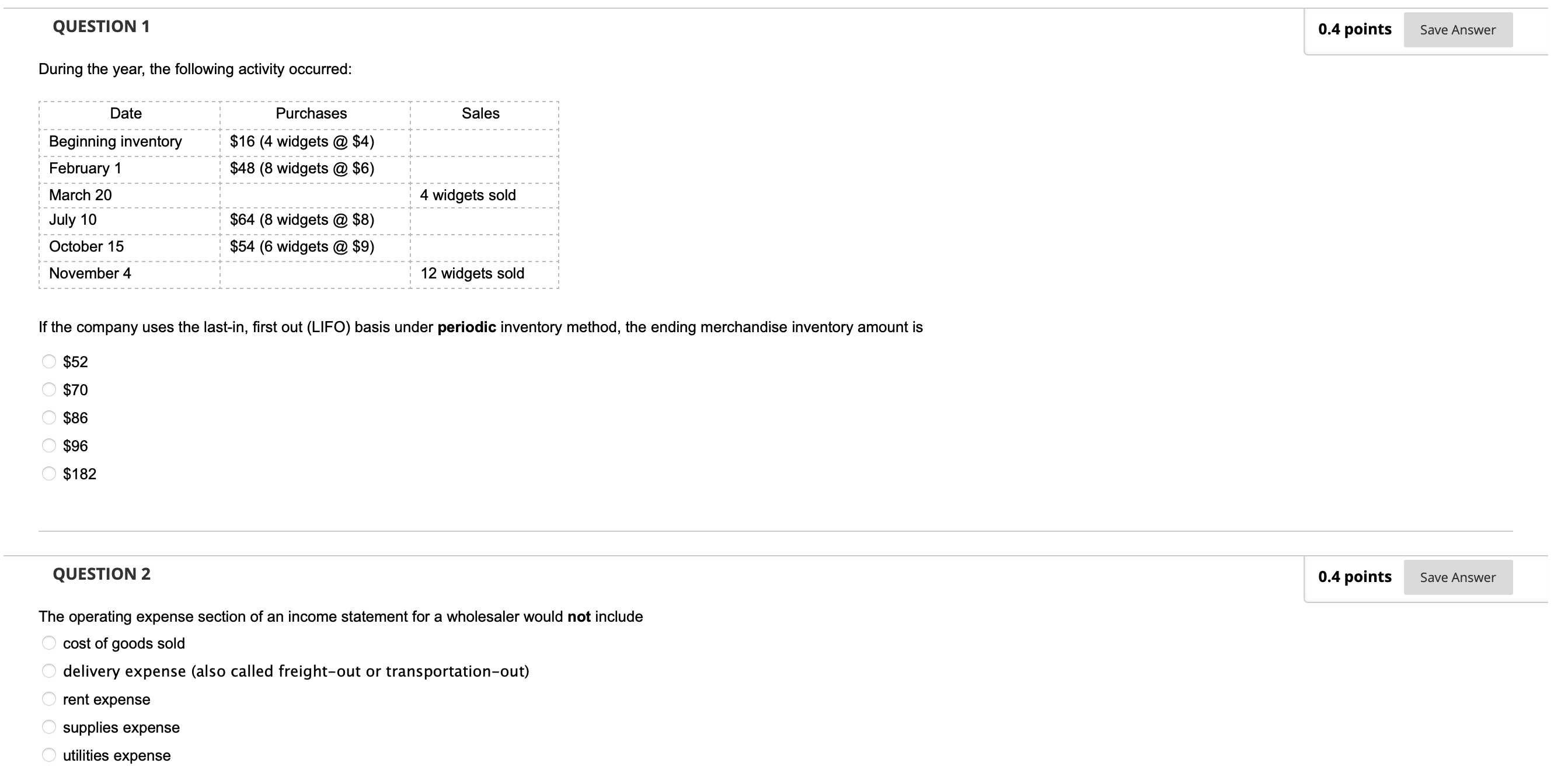

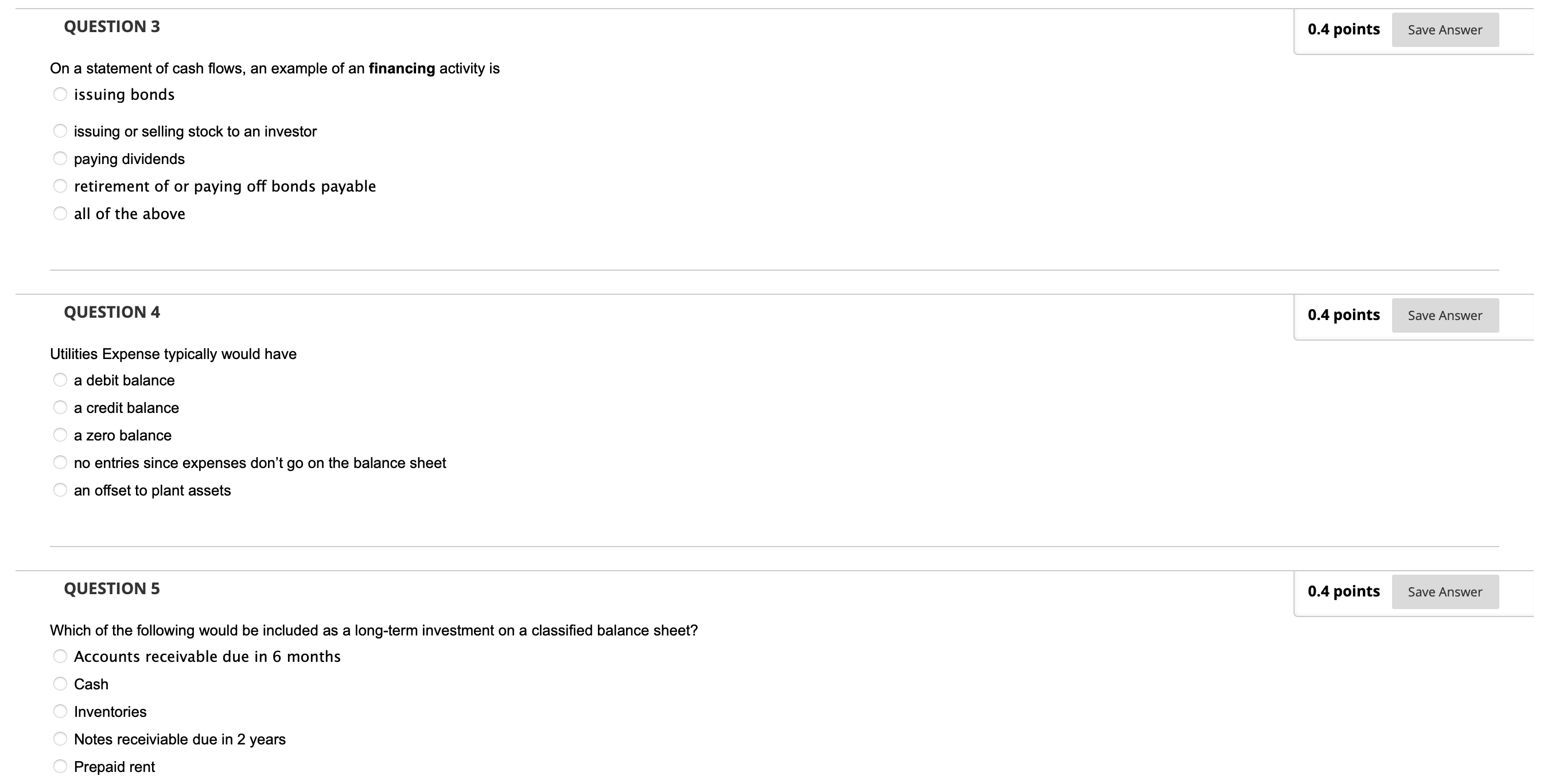

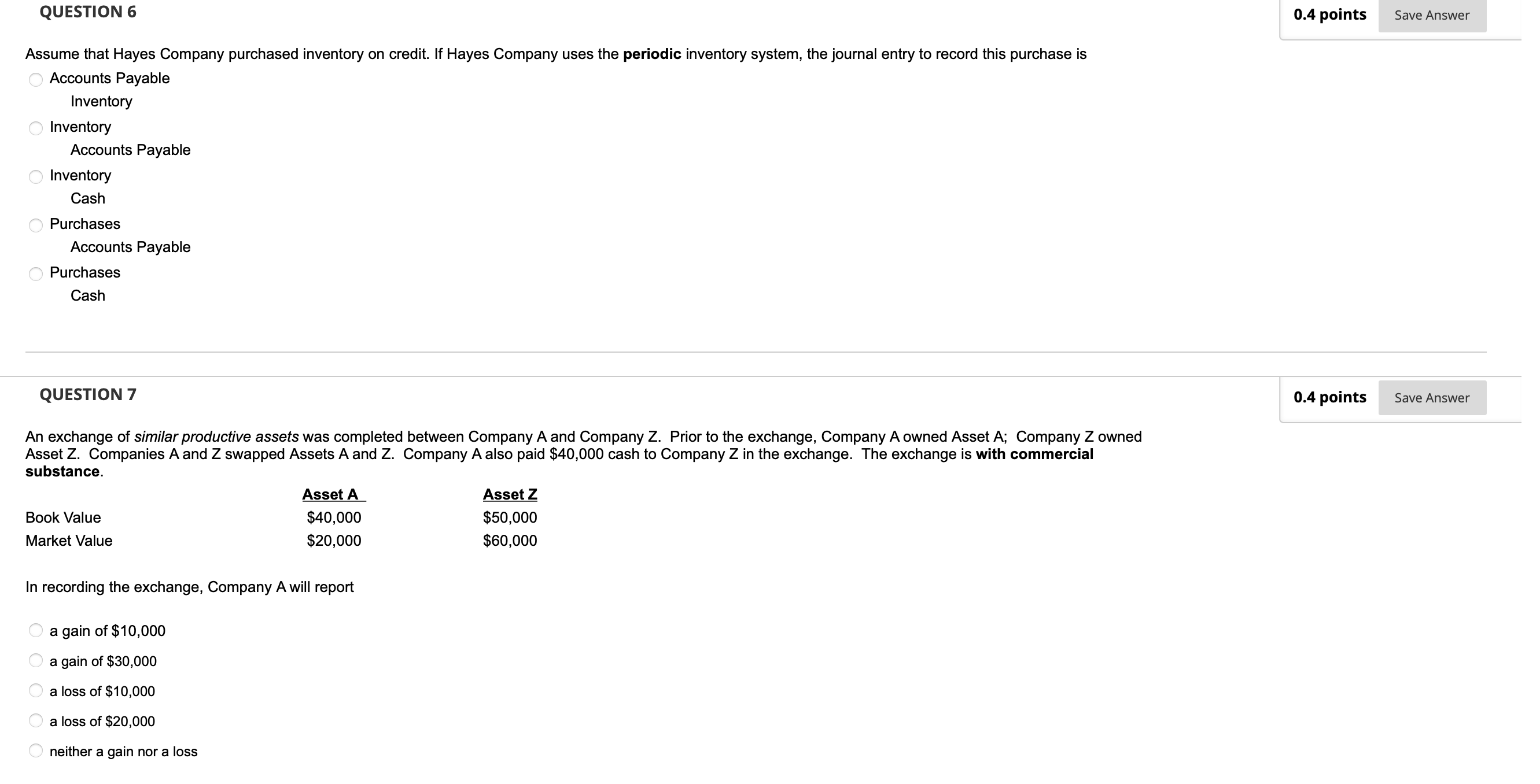

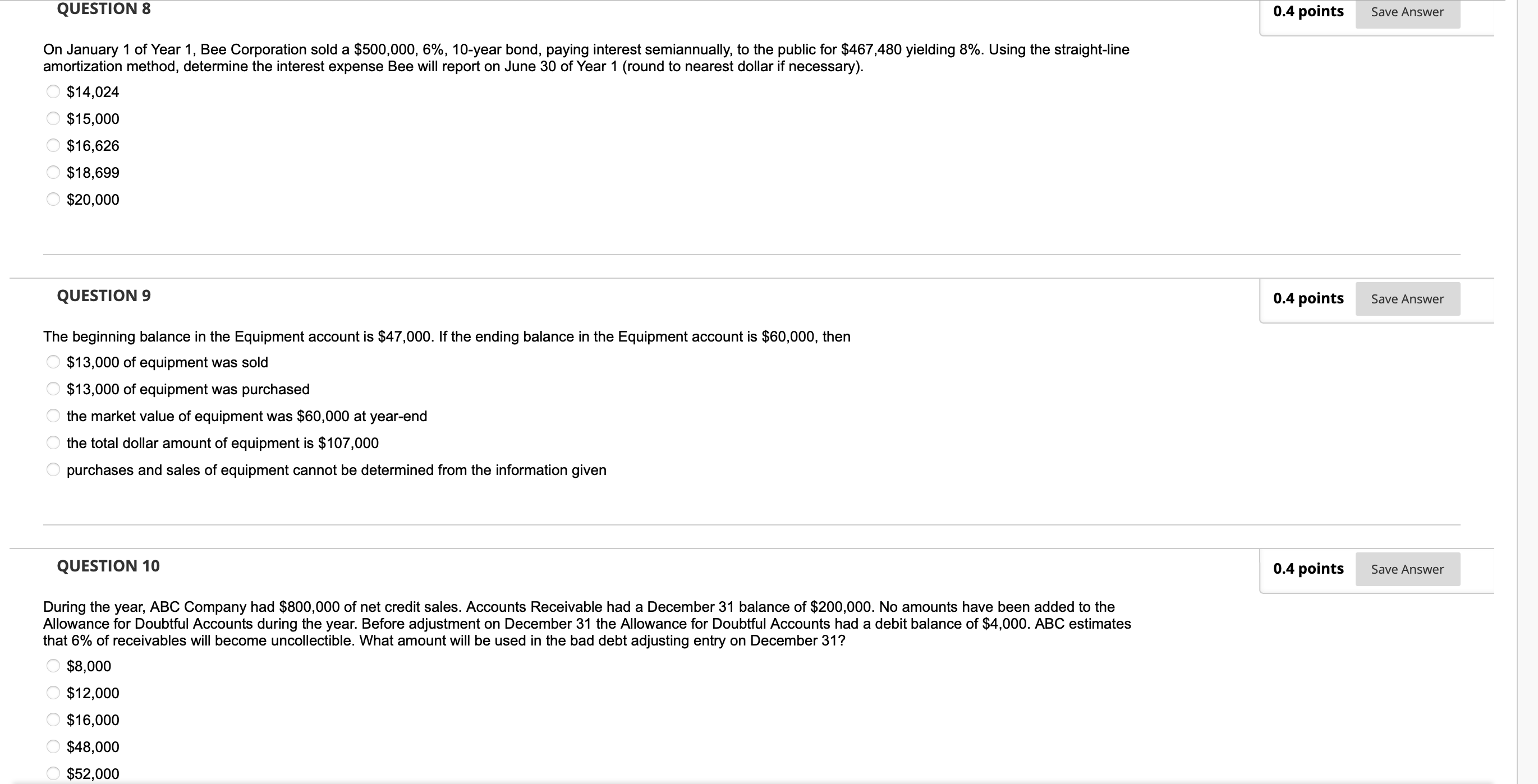

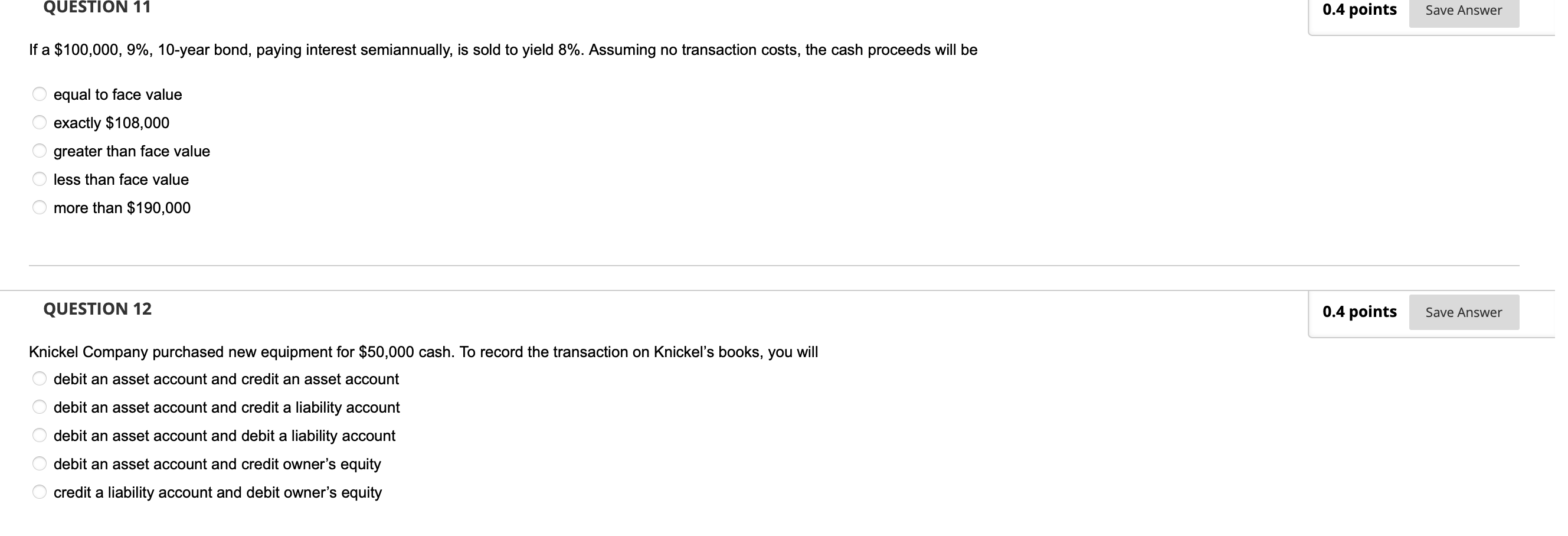

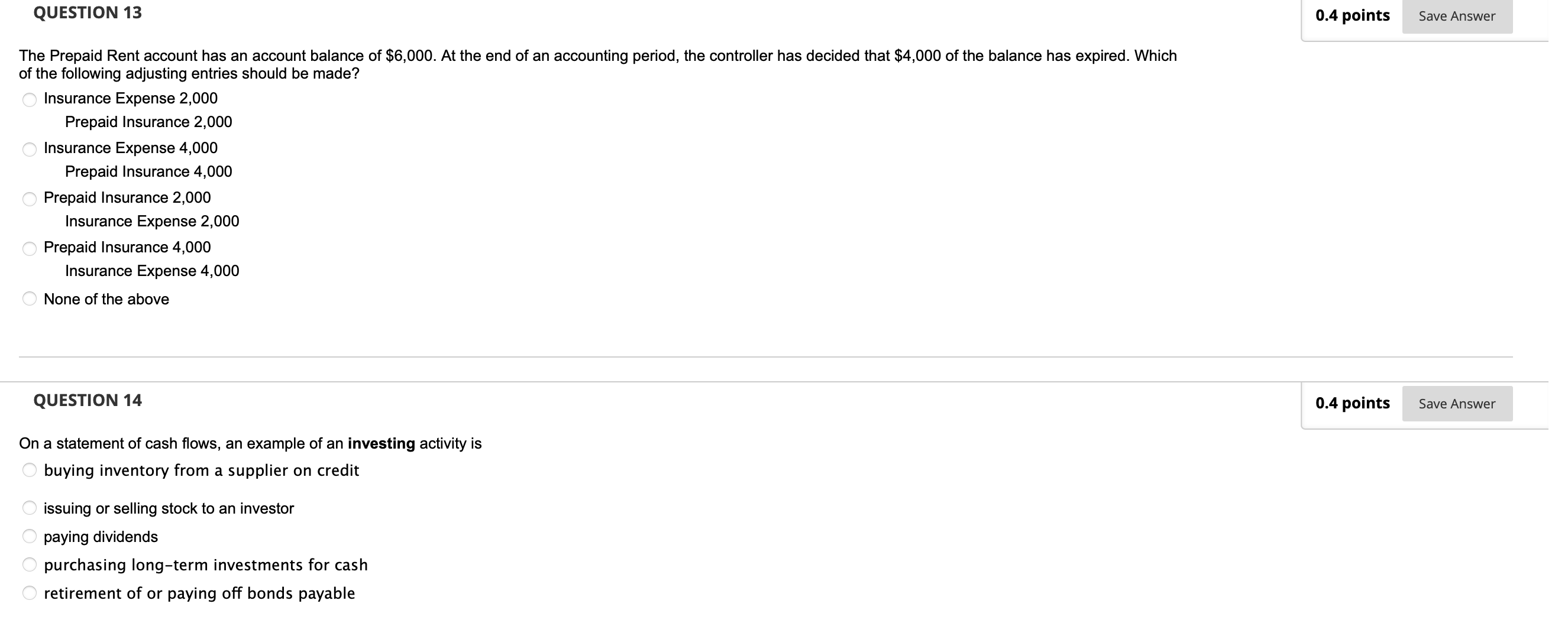

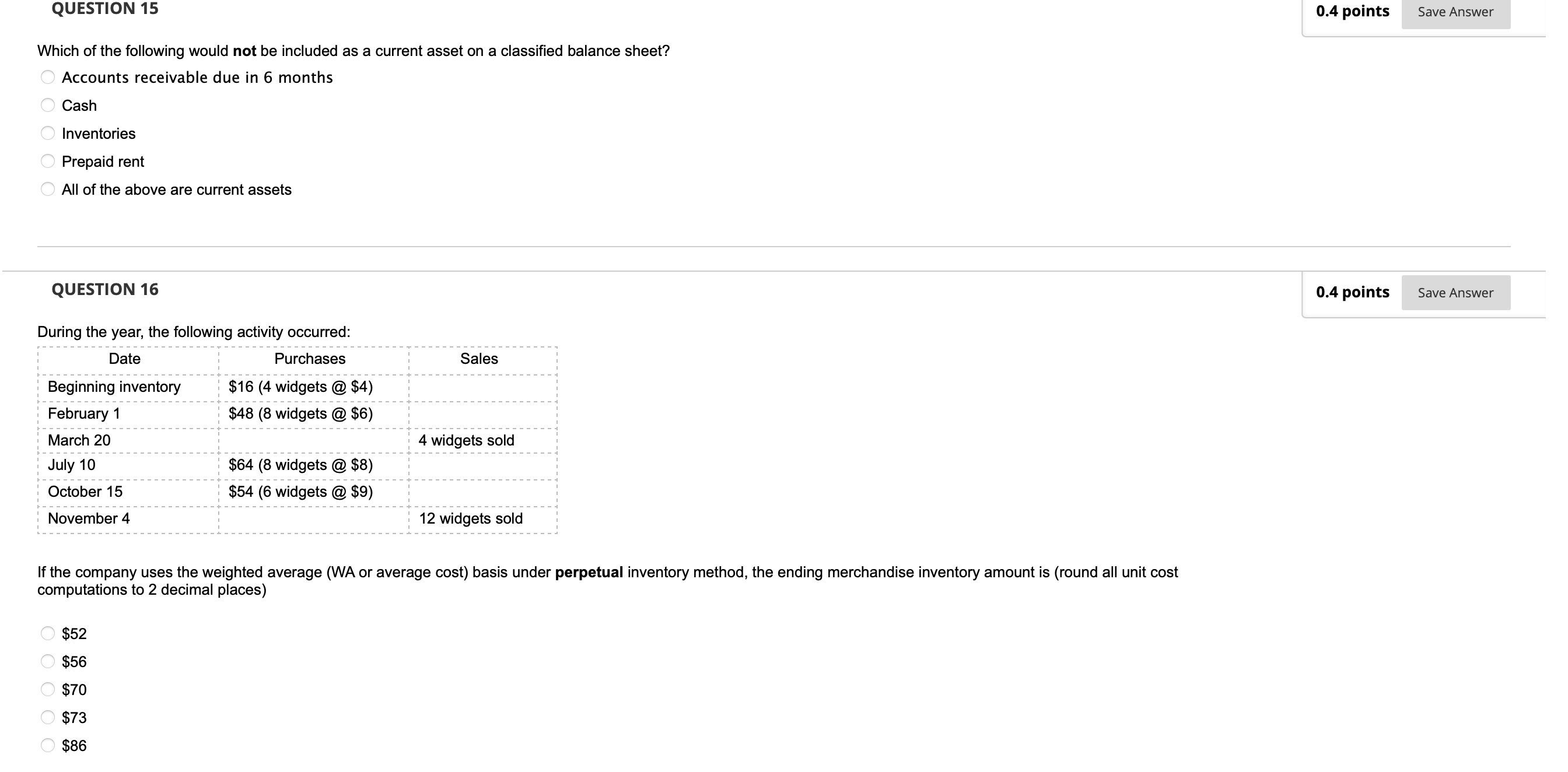

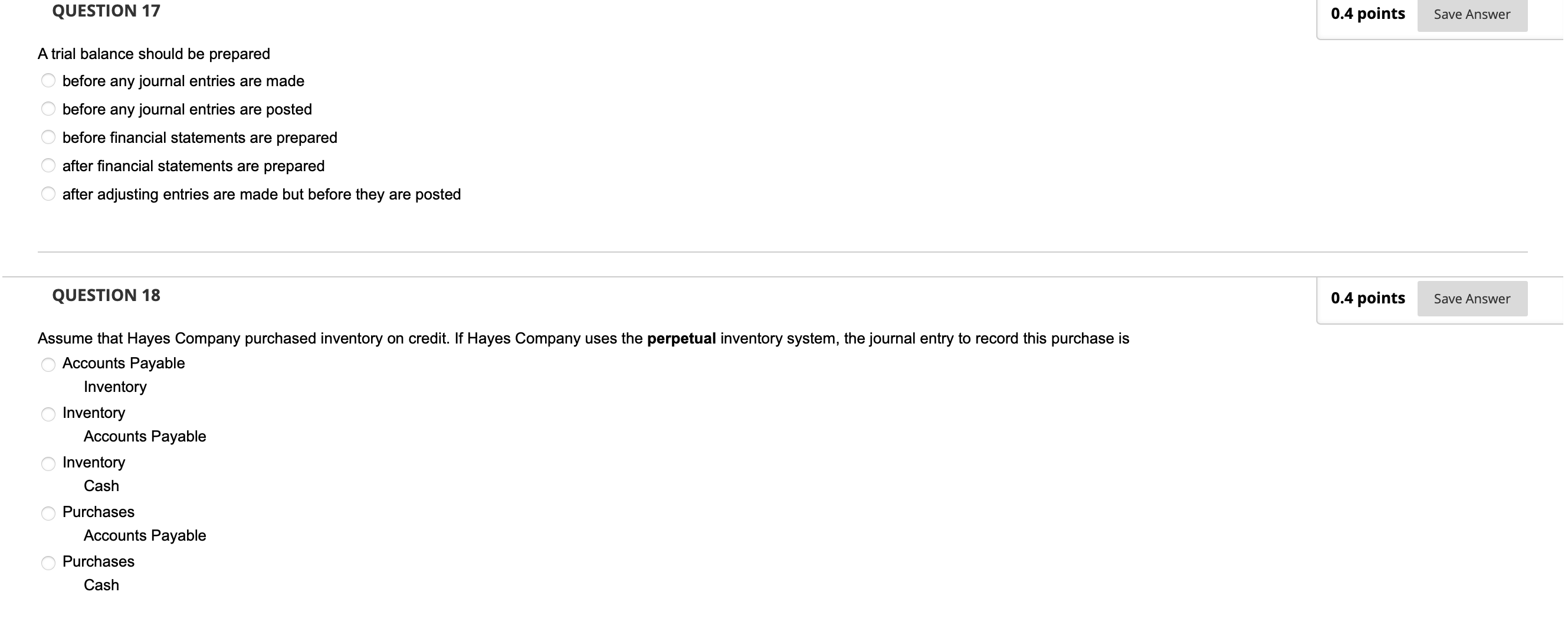

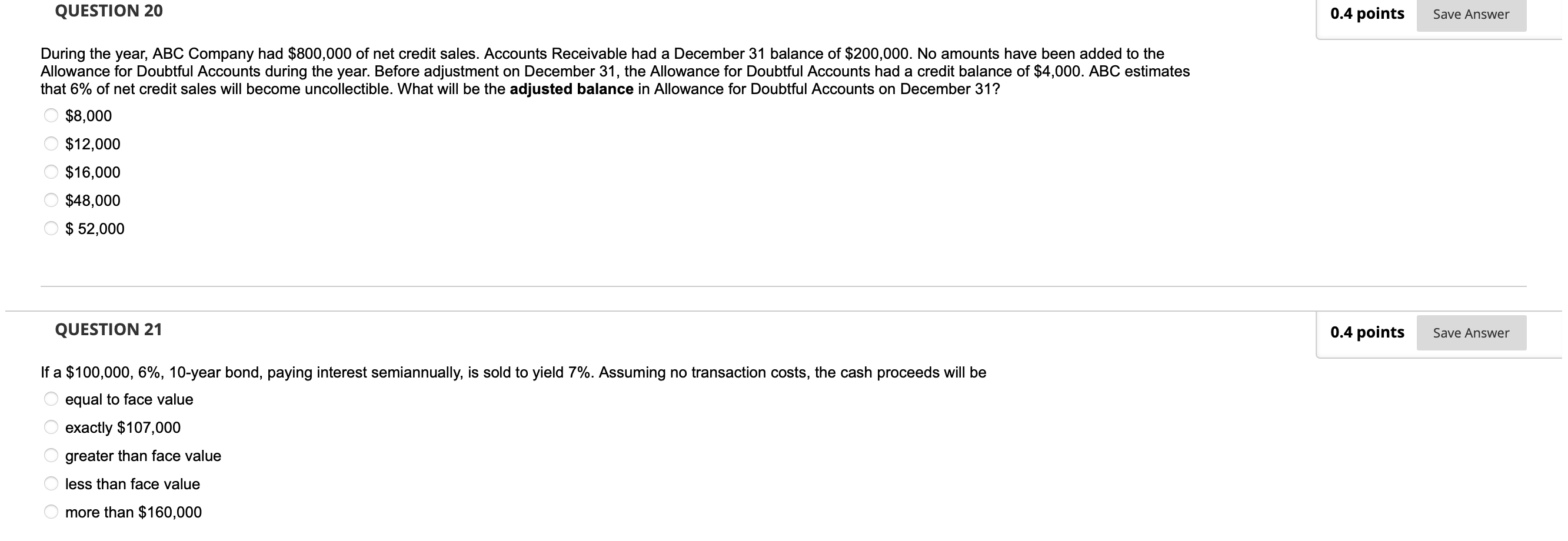

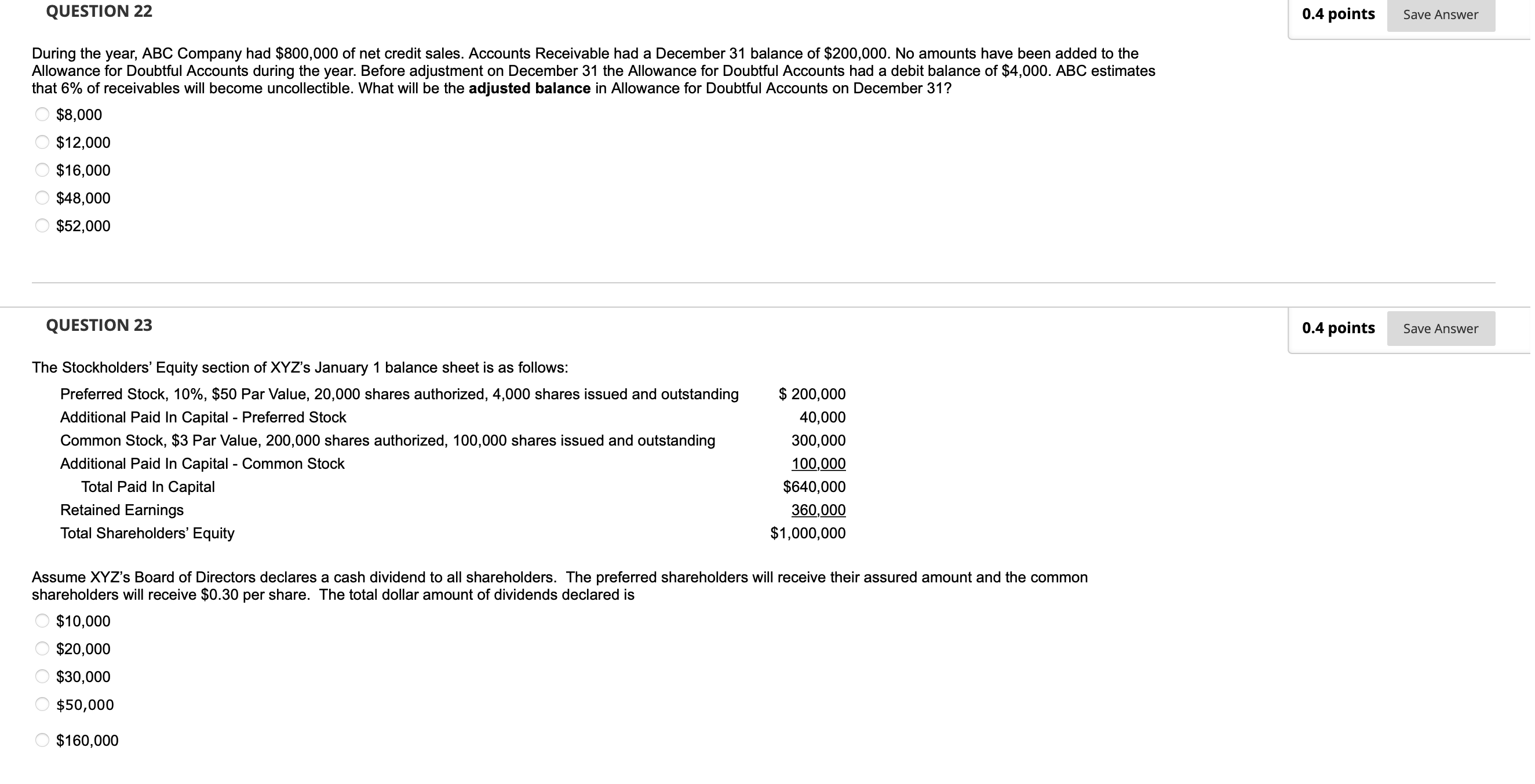

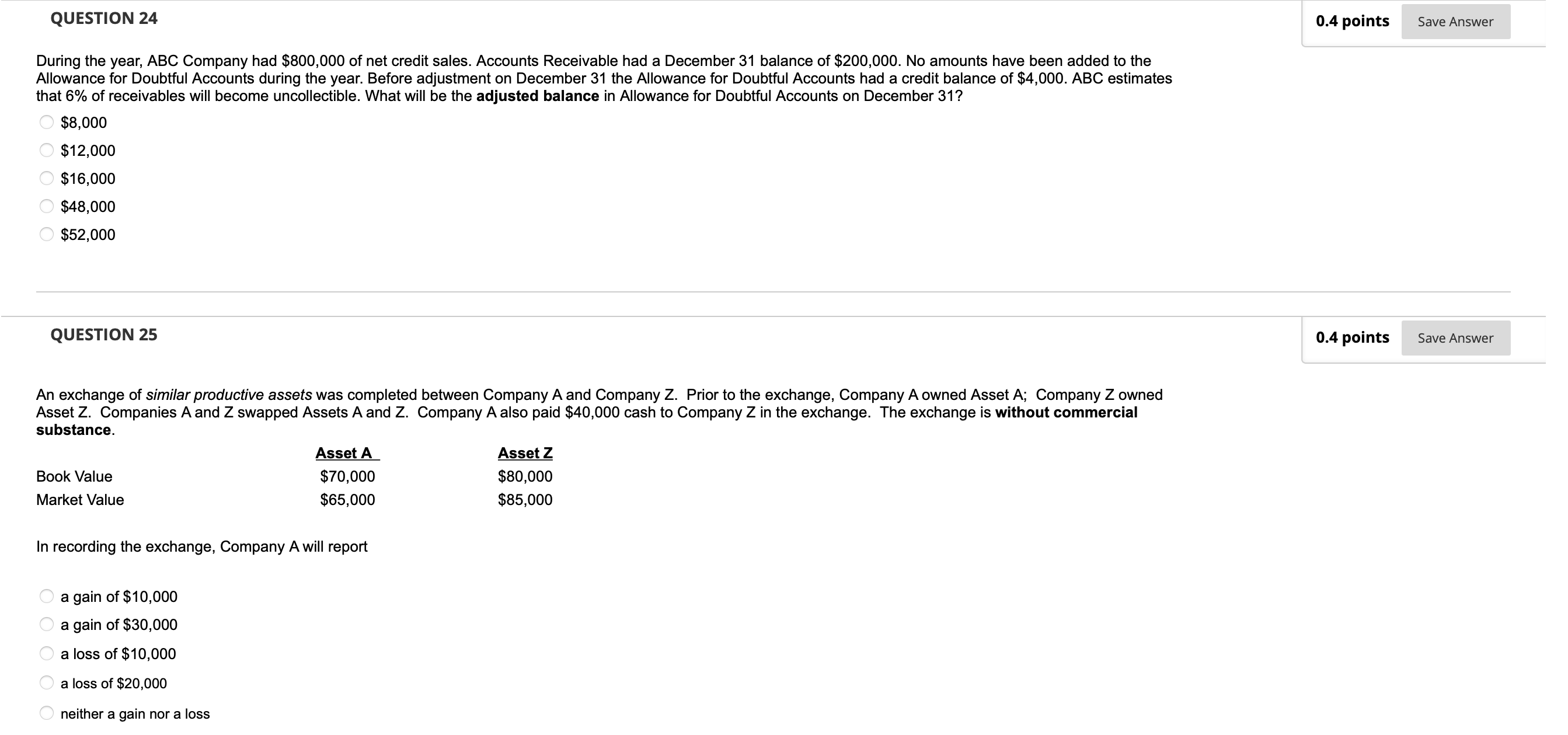

QUESTION 1 0.4 points Save Answer During the year, the following activity occurred: If the company uses the last-in, rst out (LIFO) basis under periodic inventory method, the ending merchandise inventory amount is \" $52 $70 ' $86 \\ $96 $182 QUESTION 2 0.4 points Save Answer The operating expense section of an income statement for a wholesaler would not include cost of goods sold delivery expense (also called freight-out or transportation-out) " \\ rent expense supplies expense utilities expense QUESTION 3 0.4 points Save Answer On a statement of cash ows, an example of an flnanclng activity is issuing bonds " issuing or selling stock to an investor " paying dividends " retirement of or paying off bonds payable " all of the above QUESTION 4 0.4 points Save Answer Utilities Expense typically would have " a debit balance a credit balance a zero balance ' ' no entries since expenses don't go on the balance sheet ' an offset to plant assets QUESTION 5 0.4 points Save Answer Which of the following would be included as a long-term investment on a classied balance sheet? ' ' Accounts receivable due in 6 months ' Cash ' Inventories ' Notes rece'wiable due in 2 years ' Prepaid rent QUESTION 6 0.4 points Save Answer Assume that Hayes Company purchased inventory on credit. If Hayes Company uses the periodic inventory system, the journal entry to record this purchase is ' ' Accounts Payable Inventory ' ' Inventory Accounts Payable ' ' Inventory Cash ' ' Purchases Accounts Payable ' ' Purchases Cash QUESTION 7 0.4 points Save Answer An exchange of similar productive assets was completed between Company A and Company 2. Prior to the exchange, Company A owned Asset A; Company Z owned Asset Z. Companies A and Z swapped Assets A and Z. Company A also paid $40,000 cash to Company Z in the exchange. The exchange is with commercial substance. Asset A Asset 2 Book Value $40,000 $50,000 Market Value $20,000 $60,000 In recording the exchange, Company A will report ' ' a gain of$10,000 '7 a gain of $30,000 7' a loss of $10,000 ' a loss of $20,000 ' neither a gain nor a loss QUESTION 3 0.4 points Save Answer On January 1 of Year 1, Bee Corporation sold a $500,000, 6%, 10-year bond, paying interest semiannually, to the public for $467,480 yielding 8%. Using the straight-line amortization method, determine the interest expense Bee will report on June 30 of Year 1 (round to nearest dollar if necessary). ' $14,024 " $15,000 ' $16,626 " $18,699 ' $20,000 QUESTION 9 0.4 points Save Answer The beginning balance in the Equipment account is $47,000. if the ending balance in the Equipment account is $60,000, then $13,000 of equipment was sold ' $13,000 of equipment was purchased " the market value of equipment was $60,000 at year-end ' the total dollar amount of equipment is $107,000 " purchases and sales of equipment cannot be determined from the information given QUESTION 10 ' 0.4 points Save Answer During the year, ABC Company had $800,000 of net credit sales. Accounts Receivable had a December 31 balance of $200,000. No amounts have been added to the Allowance for Doubtful Accounts during the year. Before adjustment on December 31 the Allowance for Doubtful Accounts had a debit balance of $4,000. ABC estimates that 6% of receivables will become uncollectible. What amount will be used in the bad debt adjusting entry on December 31'? $8,000 ' $12,000 7 $16,000 \\ $48,000 7 $52,000 QU ESTION 11 0.4 points Save Answer If a $100,000, 9%, 10-year bond, paying interest semiannually, is sold to yield 8%. Assuming no transaction costs, the cash proceeds will be equal to face value " exactly $108,000 \\ greater than face value ' less than face value more than $190,000 QUESTION 1 2 0.4 points Save Answer Knickel Company purchased new equipment for $50,000 cash. To record the transaction on Knickel's books, you will ' debit an asset account and credit an asset account ' debit an asset account and credit a liability account debit an asset account and debit a liability account \\ debit an asset account and credit owner's equity credit a liability account and debit owner's equity QUESTION 1 3 0.4 points Save Answer The Prepaid Rent account has an account balance of $6,000. At the end of an accounting period, the controller has decided that $4,000 of the balance has expired. Which of the following adjusting entries should be made? " Insurance Expense 2,000 Prepaid Insurance 2,000 ' Insurance Expense 4,000 Prepaid Insurance 4,000 Prepaid Insurance 2,000 Insurance Expense 2,000 " Prepaid Insurance 4,000 Insurance Expense 4,000 ' None of the above QUESTION 14 0.4 points Save Answer On a statement of cash ows, an example of an investing activity is " buying inventory from a supplier on credit 7' issuing or selling stock to an investor ' paying dividends purchasing longterm investments for cash retirement of or paying off bonds payable QUESTION 1 5 0.4 polnts Save Answer Which of the following would not be included as a current asset on a classied balance sheet? ' Accounts receivable due in 6 months Cash " Inventories ' Prepaid rent All of the above are current assets QUESTION 1 6 0.4 points Save Answer During the year. the following activity occurred: If the company uses the weighted average (WA or average cost) basis under perpetual inventory method, the ending merchandise inventory amount is (round all unit cost computations to 2 decimal places) $52 $56 $70 " $73 ' $86 QUESTION 17 0.4 points Save Answer A trial balance should be prepared before any journal entries are made before any journal entries are posted before financial statements are prepared after financial statements are prepared after adjusting entries are made but before they are posted QUESTION 18 0.4 points Save Answer Assume that Hayes Company purchased inventory on credit. If Hayes Company uses the perpetual inventory system, the journal entry to record this purchase is Accounts Payable Inventory Inventory Accounts Payable Inventory Cash Purchases Accounts Payable Purchases CashQUESTION 19 0.4 points Save Answer What is the generic journal entry for issuing bonds at a discount? " Bond Interest Expense Cas h Discount on Bonds Payable Bonds Payable Cash Cash Discount on Bonds Payable Bonds Payable Cash Premium on Bonds Payable Bonds Payable ' Investment in Bonds Cash Discount on Bond Investment QUESTION 20 0.4 points Save Answer During the year, ABC Company had $800,000 of net credit sales. Accounts Receivable had a December 31 balance of $200,000. No amounts have been added to the Allowance for Doubtful Accounts during the year. Before adjustment on December 31, the Allowance for Doubtful Accounts had a credit balance of $4,000. ABC estimates that 6% of net credit sales will become uncollectible. What will be the adjusted balance in Allowance for Doubtful Accounts on December 31? 7 $8,000 $12,000 7' $16,000 $48,000 \\ $ 52,000 QUESTION 21 0.4 points Save Answer If a $100,000, 6%, 10-year bond, paying interest semiannually, is sold to yield 7%. Assuming no transaction costs, the cash proceeds will be " equal to face value exactly $107,000 " greater than face value less than face value more than $160,000 QUESTION 22 0.4 points Save Answer During the year, ABC Company had $800,000 of net credit sales. Accounts Receivable had a December 31 balance of $200,000. No amounts have been added to the Allowance for Doubtful Accounts during the year. Before adjustment on December 31 the Allowance for Doubtful Accounts had a debit balance of $4,000. ABC estimates that 6% of receivables will become uncollectible. What will be the adjusted balance in Allowance for Doubtful Accounts on December 31? L $8,000 L $12,000 \\ $16,000 \\ $48,000 \\ $52,000 QUESTION 23 0.4 points Save Answer The Stockholders' Equity section of XYZ's January 1 balance sheet is as follows: Preferred Stock, 10%, $50 Par Value, 20,000 shares authorized, 4,000 shares issued and outstanding $ 200,000 Additional Paid In Capital - Preferred Stock 40,000 Common Stock, $3 Par Value, 200,000 shares authorized, 100,000 shares issued and outstanding 300,000 Additional Paid In Capital - Common Stock M,M Total Paid In Capital $640,000 Retained Earnings ,m Total Shareholders' Equity $1,000,000 Assume XYZ's Board of Directors declares a cash dividend to all shareholders. The preferred shareholders will receive their assured amount and the common shareholders will receive $0.30 per share. The total dollar amount of dividends declared is 0 $10,000 \\ $20,000 \\ $30,000 \\ $50,000 \\ $160,000 QUESTION 24 0.4 points SaveAnswer During the year, ABC Company had $800,000 of net credit sales. Accounts Receivable had a December 31 balance of $200,000. No amounts have been added to the Allowance for Doubtful Accounts during the year. Before adjustment on December 31 the Allowance for Doubtful Accounts had a credit balance of $4,000. ABC estimates that 6% of receivables will become uncollectible. What will be the adjusted balance in Allowance for Doubtful Accounts on December 31? $8,000 $12,000 / \\ $16,000 $48,000 $52,000 QUESTION 25 0.4 points Save Answer An exchange of similar productive assets was completed between Company A and Company Z. Prior to the exchange, Company A owned Asset A; Company Z owned Asset Z. Companies A and Z swapped Assets A and Z. Company A also paid $40,000 cash to Company 2 in the exchange. The exchange is without commercial substance. Asset A Asset 2 Book Value $70,000 $80,000 Market Value $65,000 $85,000 In recording the exchange, Company Awill report ' a gain of$10,000 ' a gain of $30,000 ' a loss of $10,000 ' a loss of $20,000 neither a gain nor a loss

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts