Question: Acompany is considering a 2 year project that requires paying $5,000,000 for a cutting edge production equipment. This equipment falls into the year MACRS class

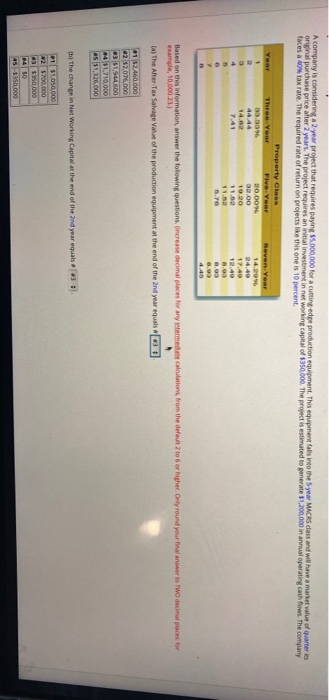

Acompany is considering a 2 year project that requires paying $5,000,000 for a cutting edge production equipment. This equipment falls into the year MACRS class and will have a market value of quarters original purchase price after 2 years. The project requires an initial investment in networking capital of $350.000. The project is estimated to generate $1,200,000 in annual operating cash flows. The company faces a 10% tax rate. The required rate of return on projects like this one is 10 percent. Year 1 Seven-Year 14.00 Property Class Three Year Five Year 13.05. 0.00% 44.44 39.00 14.02 19.30 7.41 1. 6.70 4 12.40 . 0.03 4.45 Based on this information, answer the following questions. Oncrease decimal places for any intermediate calculations, from the default 2 to 6 or higher. Only round your first answer to TWO decimal places for example, 10.000-23) ta) The Alter Tax Salvage Value of the production equipment at the end of the 2nd year equalse 3 112.460.000 62 52,076,000 351944,600 4 11,710,000 as 51,326,000 thi The change in Net Working Capital at the end of the 2nd year equals! 01 $1,050,000 22 $700.000 a $150.000 0450 45-1350.000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts