Question: EXAMPLEPREFERRED STOCK ( Section 9 - 8 ) A special case of the constant growth model is a stock with a zero growth rate. Such

EXAMPLEPREFERRED STOCK Section

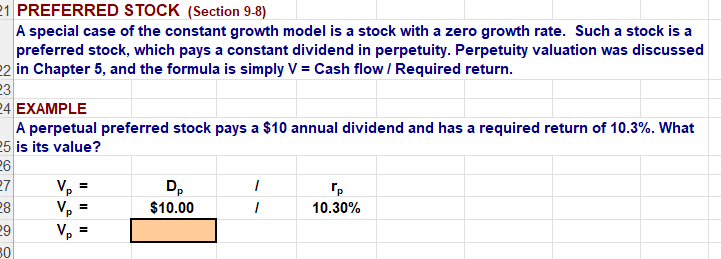

A special case of the constant growth model is a stock with a zero growth rate. Such a stock is a

preferred stock, which pays a constant dividend in perpetuity. Perpetuity valuation was discussed

in Chapter and the formula is simply Cash flow Required return.

EXAMPLE

A perpetual preferred stock pays a $ annual dividend and has a required return of What

is its value?

A company just paid a $ dividend, and it is expected to grow at for the next years. After

years the dividend is expected to grow at the rate of indefinitely. If the required return is

what is the stock's value today?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock