Question: Acrobat Reader File Edit View Window Help Wed Jan 19 4:18 PM . Screen Shot 2022-01-19 at 4.15.13 PM.pdf N Home - Netflix Home Tools

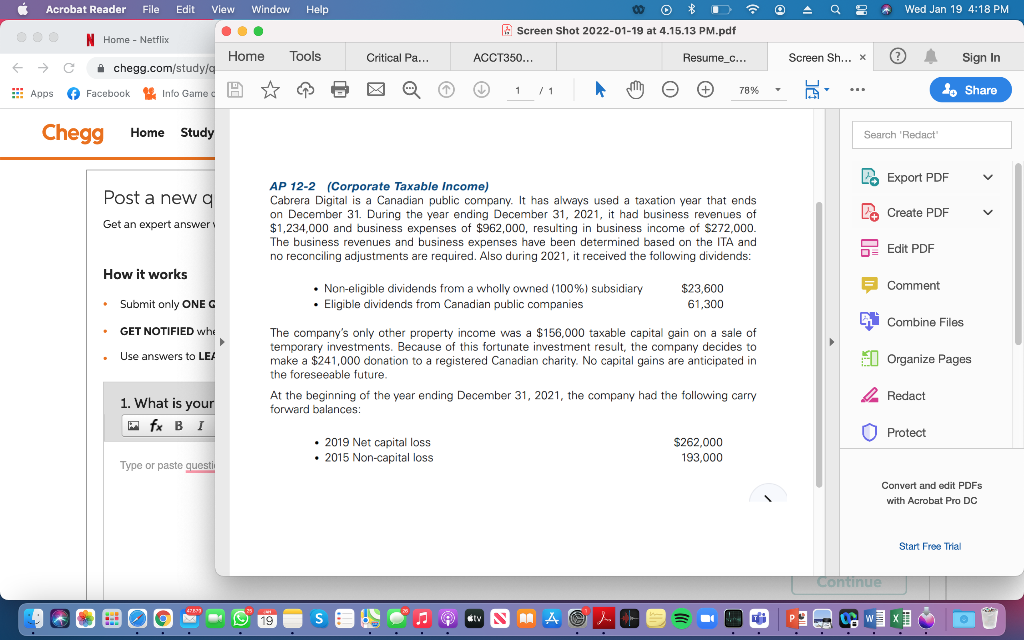

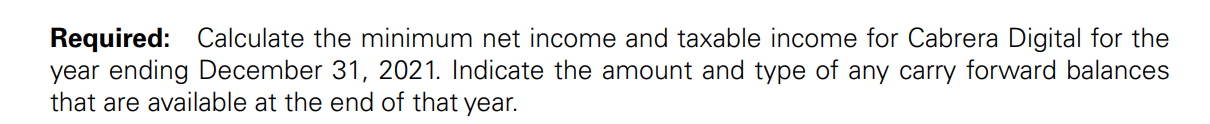

Acrobat Reader File Edit View Window Help Wed Jan 19 4:18 PM . Screen Shot 2022-01-19 at 4.15.13 PM.pdf N Home - Netflix Home Tools Critical Pa... ACCT350... Resume_c... Screen Sh... X Sign In G chegg.com/study/q s! Apps 1 Facebook ... Info Games / 1 78% 4. Share Chegg Home Study Search Redact L. Export PDF Post a new a Lo Create PDF Get an expert answer AP 12-2 (Corporate Taxable income) Cabrera Digital is a Canadian public company. It has always used a taxation year that ends on December 31. During the year ending December 31, 2021, it had business revenues of $1,234,000 and business expenses of $962,000, resulting in business income of $272,000. The business revenues and business expenses have been determined based on the ITA and no reconciling adjustments are required. Also during 2021, it received the following dividends: Edit PDF How it works Comment Non-eligible dividends from a wholly owned (100%) subsidiary Eligible dividends from Canadian public companies $23,600 61,300 . Submit only ONE G Combine Files GET NOTIFIED whe Use answers to LEA Organize Pages The company's only other property income was a $156,000 taxable capital gain on a sale of temporary investments. Because of this fortunate investment result, the company decides to make a $241,000 donation to a registered Canadian charity. No capital gains are anticipated in the foreseeable future. At the beginning of the year ending December 31, 2021, the company had the following carry forward balances: Redact 1. What is your fx B 1 Protect . 2019 Net capital loss 2015 Non-capital loss $262,000 193,000 . Type or paste questi Convert and edit PDFs with Acrobat Pro DC Start Free Trial Continue 19 S S NA T WTX O Required: Calculate the minimum net income and taxable income for Cabrera Digital for the year ending December 31, 2021. Indicate the amount and type of any carry forward balances that are available at the end of that year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts