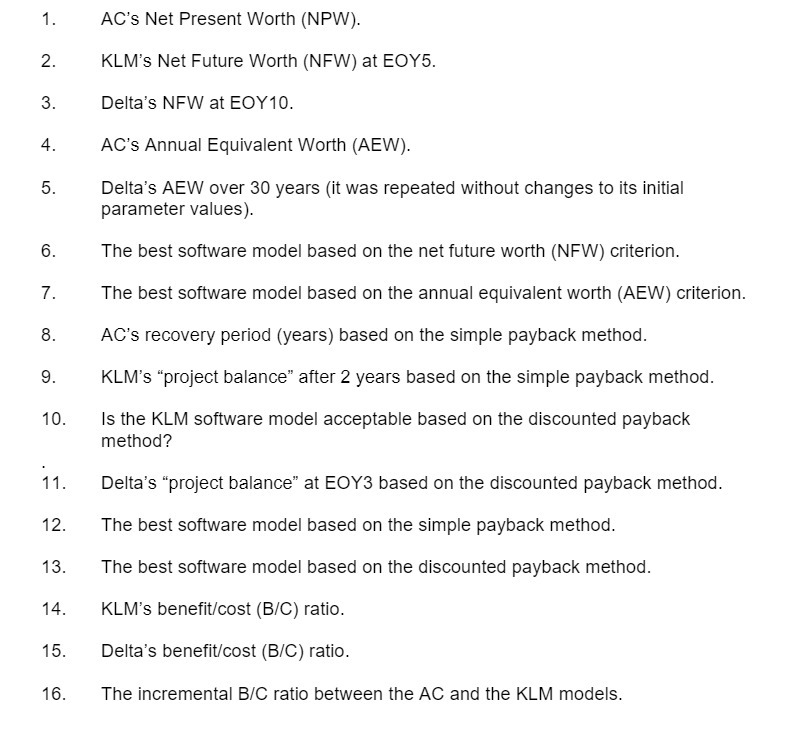

Question: AC's Net Present Worth (NPW). 2. KLM's Net Future Worth (NFW) at EOY5. 3. Delta's NFW at EOY10. 4 . AC's Annual Equivalent Worth (AEW).

AC's Net Present Worth (NPW). 2. KLM's Net Future Worth (NFW) at EOY5. 3. Delta's NFW at EOY10. 4 . AC's Annual Equivalent Worth (AEW). 5. Delta's AEW over 30 years (it was repeated without changes to its initial parameter values). 6. The best software model based on the net future worth (NFW) criterion. 7. The best software model based on the annual equivalent worth (AEW) criterion. 8. AC's recovery period (years) based on the simple payback method. 9. KLM's "project balance" after 2 years based on the simple payback method. 10. Is the KLM software model acceptable based on the discounted payback method? 11 . Delta's "project balance" at EOY3 based on the discounted payback method. 12. The best software model based on the simple payback method. 13. The best software model based on the discounted payback method. 14. KLM's benefit/cost (B/C) ratio. 15. Delta's benefit/cost (B/C) ratio. 16. The incremental B/C ratio between the AC and the KLM models

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts