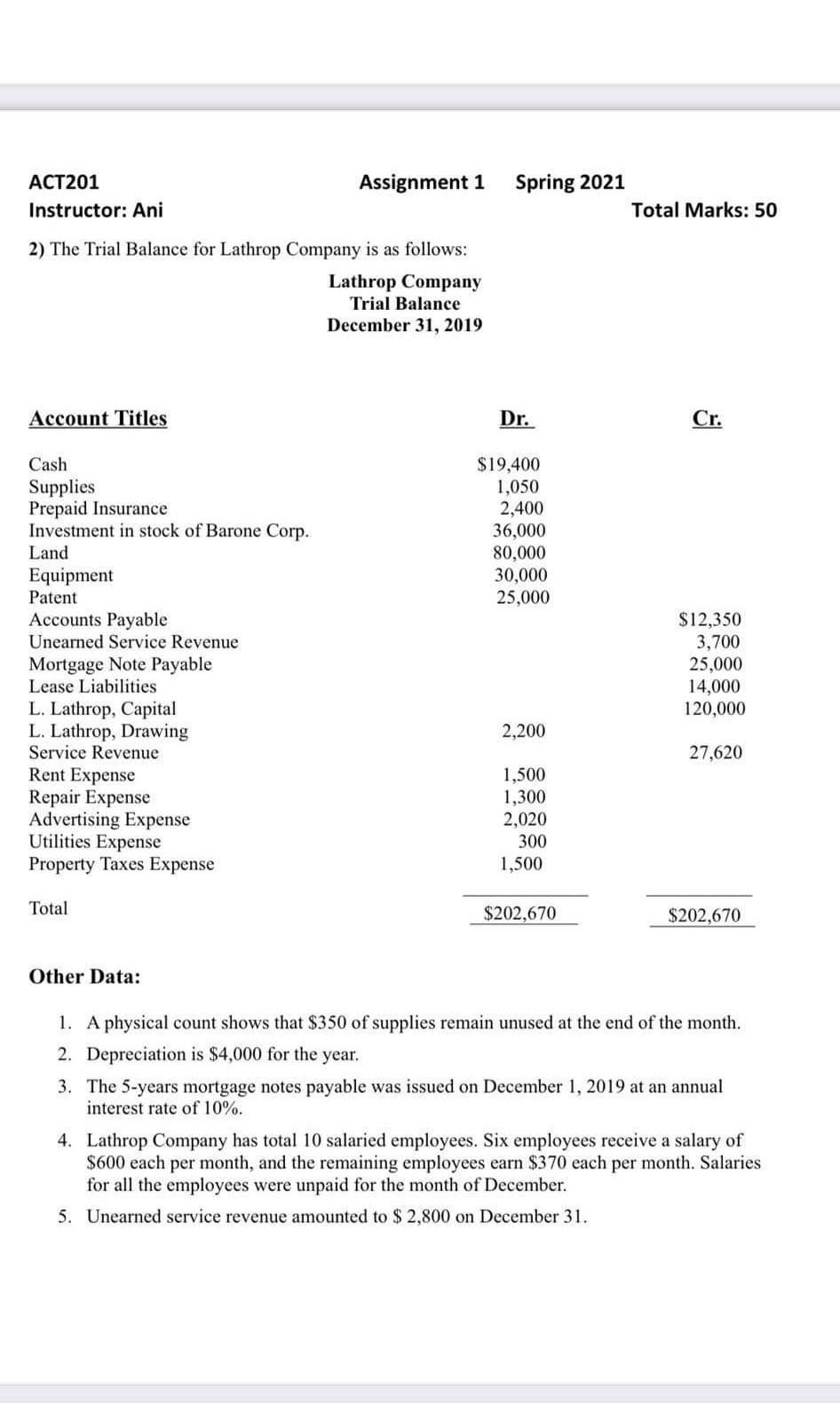

Question: ACT201 Instructor: Ani Assignment 1 Spring 2021 Total Marks: 50 2) The Trial Balance for Lathrop Company is as follows: Lathrop Company Trial Balance December

ACT201 Instructor: Ani Assignment 1 Spring 2021 Total Marks: 50 2) The Trial Balance for Lathrop Company is as follows: Lathrop Company Trial Balance December 31, 2019 Account Titles Dr. Cr. $19,400 1,050 2,400 36,000 80,000 30,000 25,000 Cash Supplies Prepaid Insurance Investment in stock of Barone Corp. Land Equipment Patent Accounts Payable Unearned Service Revenue Mortgage Note Payable Lease Liabilities L. Lathrop, Capital L. Lathrop, Drawing Service Revenue Rent Expense Repair Expense Advertising Expense Utilities Expense Property Taxes Expense $12,350 3,700 25,000 14,000 120,000 2,200 27,620 1,500 1,300 2,020 300 1,500 Total $202,670 $202,670 Other Data: 1. A physical count shows that $350 of supplies remain unused at the end of the month. 2. Depreciation is $4,000 for the year. 3. The 5-years mortgage notes payable was issued on December 1, 2019 at an annual interest rate of 10%. 4. Lathrop Company has total 10 salaried employees. Six employees receive a salary of $600 each per month, and the remaining employees earn $370 each per month. Salaries for all the employees were unpaid for the month of December. 5. Unearned service revenue amounted to $ 2,800 on December 31. ACT201 Instructor: Ani Assignment 1 Spring 2021 Total Marks: 50 2) The Trial Balance for Lathrop Company is as follows: Lathrop Company Trial Balance December 31, 2019 Account Titles Dr. Cr. $19,400 1,050 2,400 36,000 80,000 30,000 25,000 Cash Supplies Prepaid Insurance Investment in stock of Barone Corp. Land Equipment Patent Accounts Payable Unearned Service Revenue Mortgage Note Payable Lease Liabilities L. Lathrop, Capital L. Lathrop, Drawing Service Revenue Rent Expense Repair Expense Advertising Expense Utilities Expense Property Taxes Expense $12,350 3,700 25,000 14,000 120,000 2,200 27,620 1,500 1,300 2,020 300 1,500 Total $202,670 $202,670 Other Data: 1. A physical count shows that $350 of supplies remain unused at the end of the month. 2. Depreciation is $4,000 for the year. 3. The 5-years mortgage notes payable was issued on December 1, 2019 at an annual interest rate of 10%. 4. Lathrop Company has total 10 salaried employees. Six employees receive a salary of $600 each per month, and the remaining employees earn $370 each per month. Salaries for all the employees were unpaid for the month of December. 5. Unearned service revenue amounted to $ 2,800 on December 31

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts