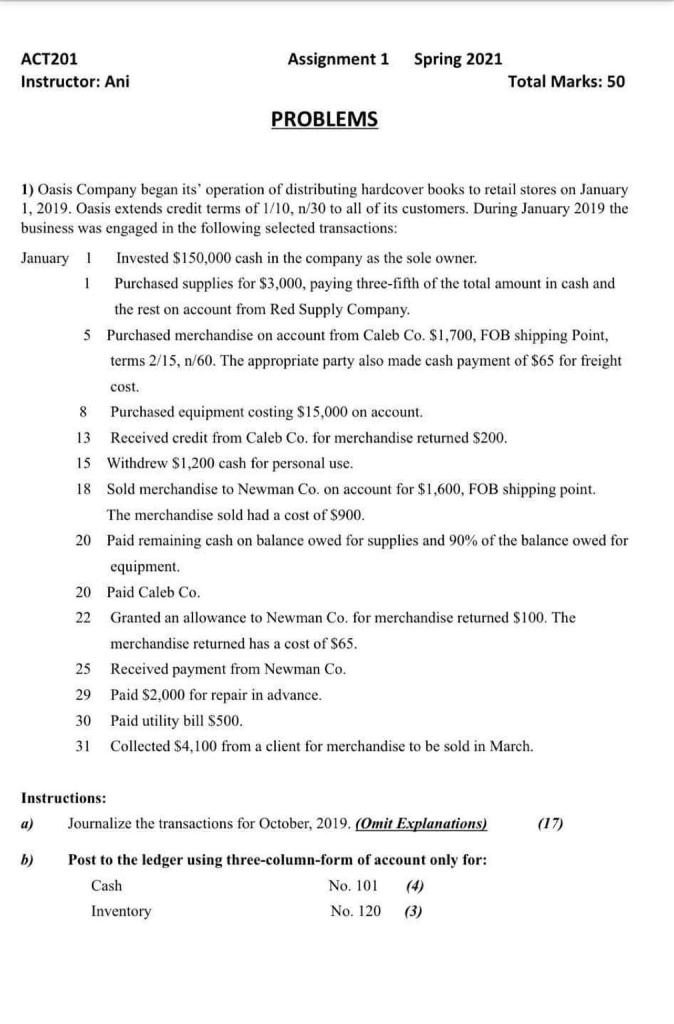

Question: Assignment 1 ACT201 Instructor: Ani Spring 2021 Total Marks: 50 PROBLEMS 1) Oasis Company began its operation of distributing hardcover books to retail stores on

Assignment 1 ACT201 Instructor: Ani Spring 2021 Total Marks: 50 PROBLEMS 1) Oasis Company began its operation of distributing hardcover books to retail stores on January 1, 2019. Oasis extends credit terms of 1/10, n/30 to all of its customers. During January 2019 the business was engaged in the following selected transactions: January 1 Invested $150,000 cash in the company as the sole owner. 1 Purchased supplies for $3,000, paying three-fifth of the total amount in cash and the rest on account from Red Supply Company 5 Purchased merchandise on account from Caleb Co. $1,700, FOB shipping Point, terms 2/15, n/60. The appropriate party also made cash payment of $65 for freight cost, 8 Purchased equipment costing $15,000 on account. 13 Received credit from Caleb Co. for merchandise returned $200. 15 Withdrew $1,200 cash for personal use. 18 Sold merchandise to Newman Co, on account for $1,600, FOB shipping point. The merchandise sold had a cost of $900. 20 Paid remaining cash on balance owed for supplies and 90% of the balance owed for equipment. 20 Paid Caleb Co. 22 Granted an allowance to Newman Co. for merchandise returned $100. The merchandise returned has a cost of $65. 25 Received payment from Newman Co. 29 Paid $2,000 for repair in advance. 30 Paid utility bill S500. 31 Collected $4,100 from a client for merchandise to be sold in March. Instructions: a) Journalize the transactions for October, 2019. (Omit Explanations) (17) b) Post to the ledger using three-column-form of account only for: Cash No. 101 Inventory No. 120 (3)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts