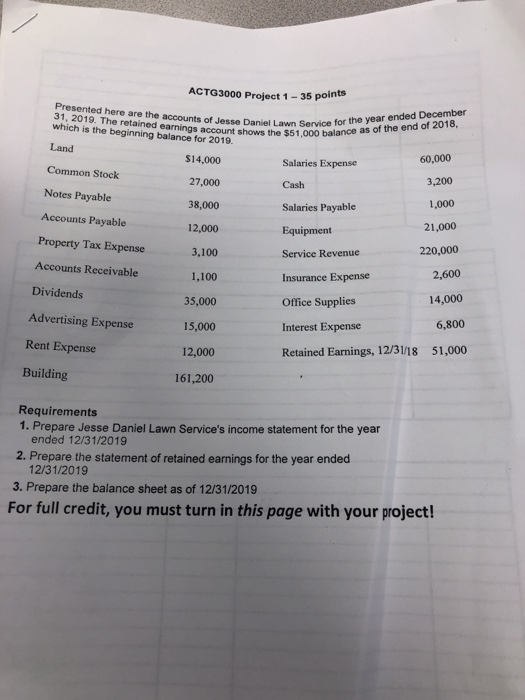

Question: ACTG3000 Project 1 - 35 points 31, 2019. The retained earnings account shows the $51.000 balance as of the end of 2018, Presented here are

ACTG3000 Project 1 - 35 points 31, 2019. The retained earnings account shows the $51.000 balance as of the end of 2018, Presented here are the accounts of Jesse Daniel Lawn Service for the year ended December which is the beginning balance for 2019. Land $14,000 Salaries Expense 60,000 Common Stock 27,000 Cash 3,200 Notes Payable 38,000 1,000 Accounts Payable Salaries Payable Equipment 12,000 21.000 Property Tax Expense Accounts Receivable 3,100 Service Revenue 220,000 1,100 Insurance Expense 2,600 Dividends 35,000 Office Supplies 14,000 Advertising Expense Rent Expense 15,000 Interest Expense 6,800 12,000 Retained Earnings, 12/31/18 51,000 Building 161,200 Requirements 1. Prepare Jesse Daniel Lawn Service's income statement for the year ended 12/31/2019 2. Prepare the statement of retained earnings for the year ended 12/31/2019 3. Prepare the balance sheet as of 12/31/2019 For full credit, you must turn in this page with your project

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts