Question: Activity 18 Capital Budgeting: Net Present Value (NPV) The purpose of this assignment is to practice capital budgeting via NPV calculation Class meeting: Morning /

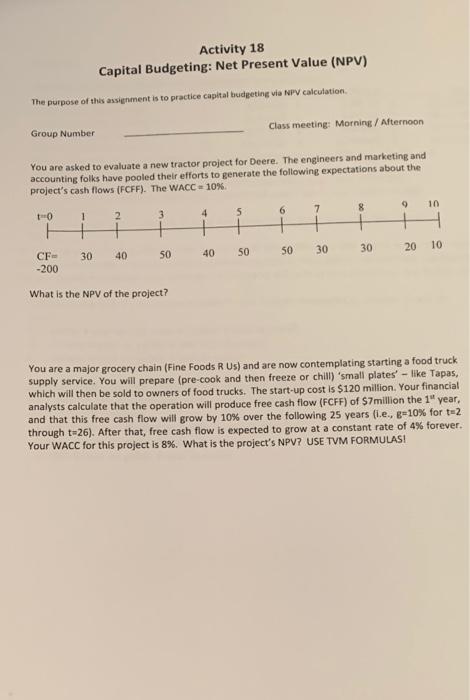

Activity 18 Capital Budgeting: Net Present Value (NPV) The purpose of this assignment is to practice capital budgeting via NPV calculation Class meeting: Morning / Afternoon Group Number You are asked to evaluate a new tractor project for Deere. The engineers and marketing and accounting folks have pooled their efforts to generate the following expectations about the project's cash flows (FCFF). The WACC - 10% 10 8 5 6 7 10 1 2 3 4 30 30 50 30 20 10 40 50 40 50 CF- -200 What is the NPV of the project? You are a major grocery chain (Fine Foods R Us) and are now contemplating starting a food truck supply service. You will prepare (pre-cook and then freeze or chill) 'small plates' - like Tapas, which will then be sold to owners of food trucks. The start-up cost is $120 million. Your financial analysts calculate that the operation will produce free cash flow (FCFF) of $7 million the 1" year, and that this free cash flow will grow by 10% over the following 25 years (.e., g=10% for t=2 through t=26). After that, free cash flow is expected to grow at a constant rate of 4% forever. Your WACC for this project is 8%. What is the project's NPV? USE TVM FORMULASI

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts