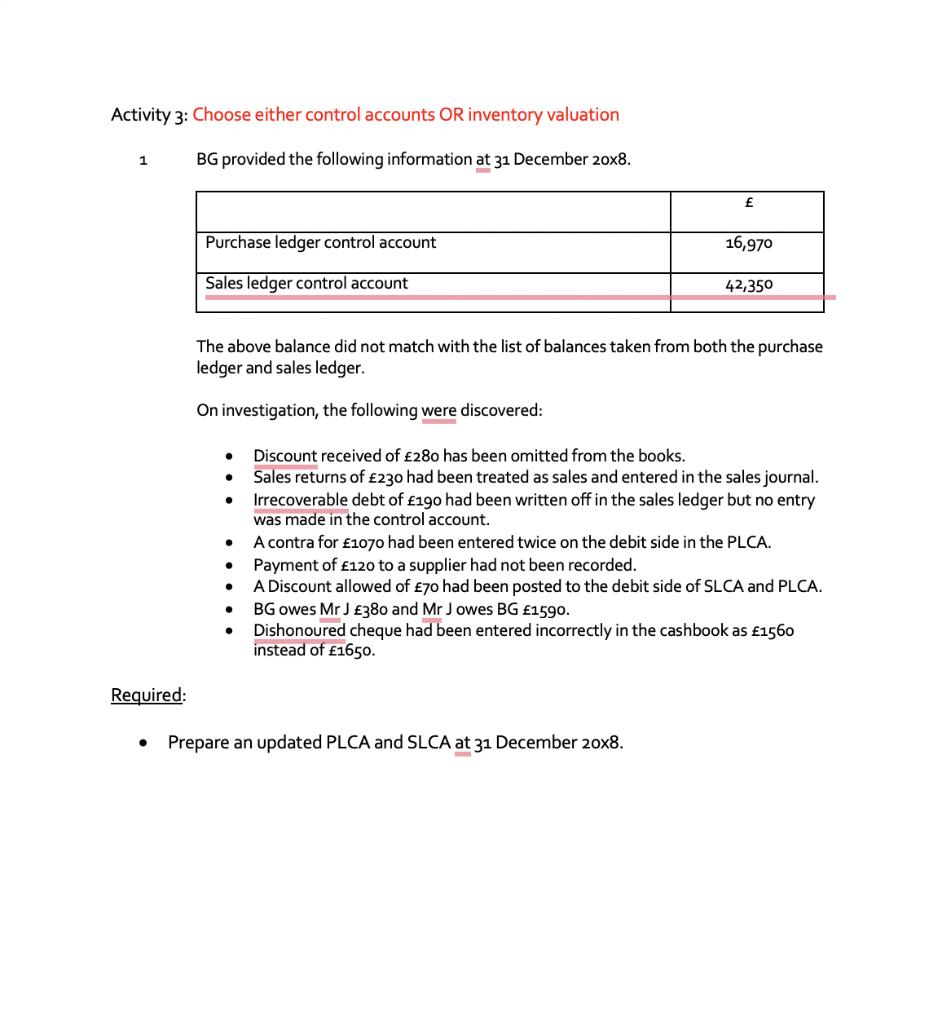

Question: Activity 3: Choose either control accounts OR inventory valuation BG provided the following information at 31 December 20x8. 1 Required: Purchase ledger control account

Activity 3: Choose either control accounts OR inventory valuation BG provided the following information at 31 December 20x8. 1 Required: Purchase ledger control account Sales ledger control account The above balance did not match with the list of balances taken from both the purchase ledger and sales ledger. On investigation, the following were discovered: 16,970 42,350 Prepare an updated PLCA and SLCA at 31 December 20x8. Discount received of 280 has been omitted from the books. Sales returns of 230 had been treated as sales and entered in the sales journal. Irrecoverable debt of 190 had been written off in the sales ledger but no entry was made in the control account. A contra for 1070 had been entered twice on the debit side in the PLCA. Payment of 120 to a supplier had not been recorded. A Discount allowed of 70 had been posted to the debit side of SLCA and PLCA. BG owes Mr J 380 and Mr J owes BG 1590. Dishonoured cheque had been entered incorrectly in the cashbook as 1560 instead of 1650.

Step by Step Solution

3.49 Rating (152 Votes )

There are 3 Steps involved in it

Answer Dr Updated sales ledger conhd account Defai... View full answer

Get step-by-step solutions from verified subject matter experts