Question: In this simulation, you are asked to address various requirements regarding the accounting for receivables. Prepare responses to allparts. KWW Professlonal Simulation E Accounting for

In this simulation, you are asked to address various requirements regarding the accounting for receivables. Prepare responses to allparts.

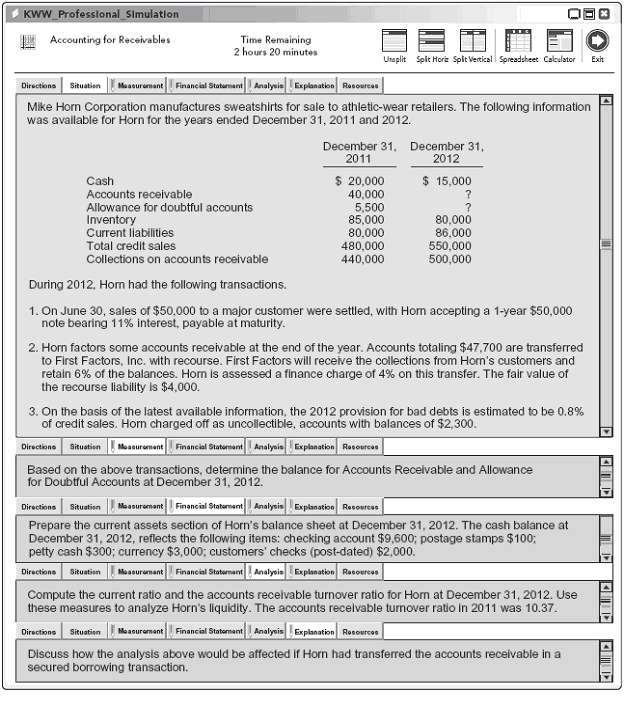

KWW Professlonal Simulation E Accounting for Receivables Time Remaining 2 hours 20 minutes Unaplit Spit Horie Splt Vertical Spreadsheet Calculator Exit Ma souremant Financial StatarnanAnalyuie Explanation Rosources Directions Situatien Mike Horn Corporation manufactures sweatshirts for sale to athletic-wear retailers. The following information was avallable for Horn for the years ended December 31, 2011 and 2012. December 31, 2011 December 31, 2012 $ 20,000 40,000 5,500 85,000 80.000 $ 15,000 Cash Accounts receivable Allowance for doubtful accounts Inventory Current llabilities 80,000 86.000 Total credit sales 480,000 440,000 550,000 500,000 Collections on accounts receivable During 2012, Hom had the following transactions. 1. On June 30, sales of $50,000 to a major customer were settled, with Hom accepting a 1-year $50,000 note bearing 11% interest, payable at maturity. 2. Horn factors some accounts receivable at the end of the year. Accounts totaling $47,700 are transferred to First Factors, Inc. with recourse. First Factors will receive the collections from Horn's customers and retain 6% of the balances. Hom is assessed a finance charge of 4% on this transfer. The fair value of the recourse lability is $4,000. 3. On the basis of the latest available information, the 2012 provision for bad debts is estimated to be 0.8% of credit sales. Horn charged off as uncollectible, accounts with balances of $2,300. Moaaurament Financial Staternant Analyois Explanation Rosourcas Directione Situation Based on the above transactions, determine the balance for Accounts Recelvable and Allowance for Doubtful Accounts at December 31, 2012. Meauromant Financial Staterment Analysia Explanation Recourcas Directions Situation Prepare the current assets section of Horn's balance sheet at December 31, 2012. The cash balance at December 31, 2012, reflects the following items: checking account $9,600; postage stamps $100; petty cash $300; currency $3,000; customers' checks (post-dated) $2,000. Mo saurumant Financial Statwrnant Analyein Explanation Rosourcos Directions Situstion Compute the current ratio and the accounts recelvable turnover ratio for Hom at December 31, 2012. Use these measures to analyze Horn's liquidity. The accounts recelvable turnover ratio In 2011 was 10.37. Moaourement Financial Staternent Analysin Explanation Rocourcos Directione Situatien Discuss how the analysis above would be affected If Horn had transferred the accounts receivable in a secured borrowing transaction.

Step by Step Solution

3.42 Rating (158 Votes )

There are 3 Steps involved in it

Measurement Trade Accounts Receivable Allowance for Doubtful Accounts Beginning balance 40000 Beginn... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

51-B-A-C-R (317).docx

120 KBs Word File