Question: Activity Cost Pools, Activity Rates, and Product Costs using Activity-Based Costing Caldwell Home Appliances Inc. is estimating the activity cost associated with producing ovens and

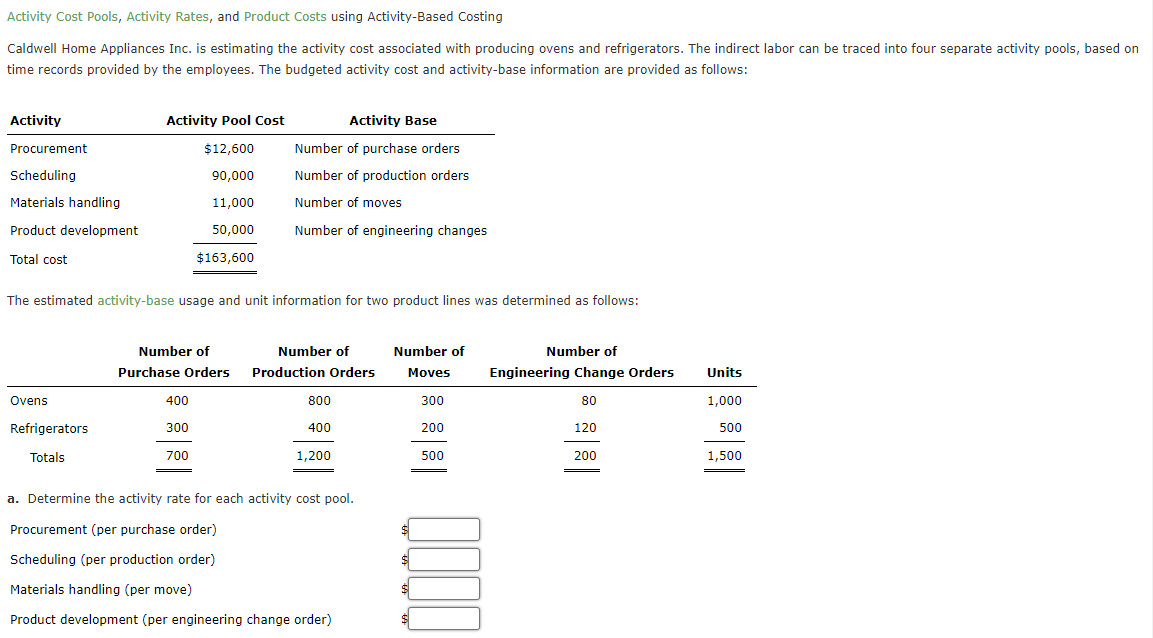

Activity Cost Pools, Activity Rates, and Product Costs using Activity-Based Costing Caldwell Home Appliances Inc. is estimating the activity cost associated with producing ovens and refrigerators. The indirect labor can be traced into four separate activity pools, based on time records provided by the employees. The budgeted activity cost and activity-base information are provided as follows: Activity Pool Cost Activity Base Activity Procurement Scheduling Number of purchase orders $12,600 90,000 Number of production orders Materials handling 11,000 Number of moves Product development 50,000 Number of engineering changes Total cost $ 163,600 The estimated activity-base usage and unit information for two product lines was determined as follows: Number of Number of Purchase Orders Production Orders 400 800 Number of Moves Number of Engineering Change Orders 80 Units Ovens 300 1,000 Refrigerators 300 400 200 120 500 Totals 700 1,200 500 200 1,500 a. Determine the activity rate for each activity cost pool. Procurement (per purchase order) Scheduling (per production order) III. Materials handling (per move) Product development (per engineering change order) $ b. Determine the activity-based cost per unit of each product. Round the per unit rates to the nearest cent. Ovens per unit Refrigerators per unit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts