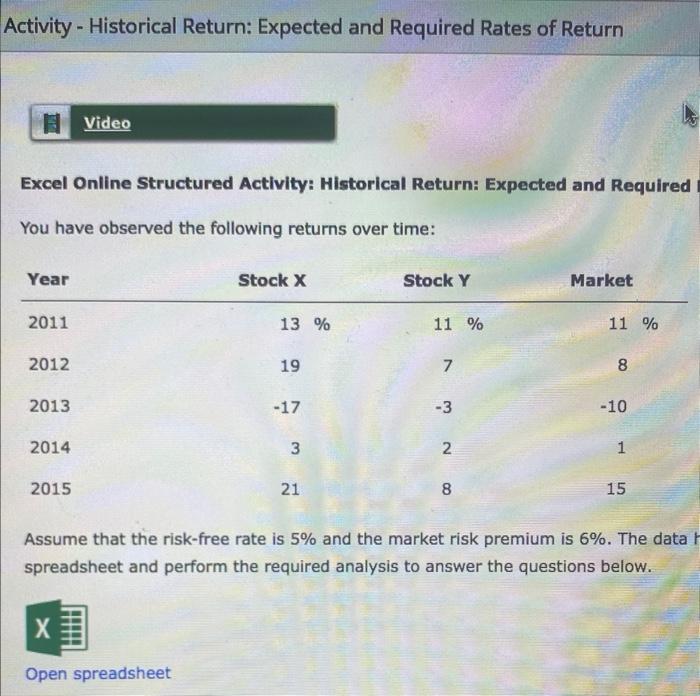

Question: Activity - Historical Return: Expected and Required Rates of Return Excel Online Structured Activity: Historical Return: Expected and Required You have observed the following returns

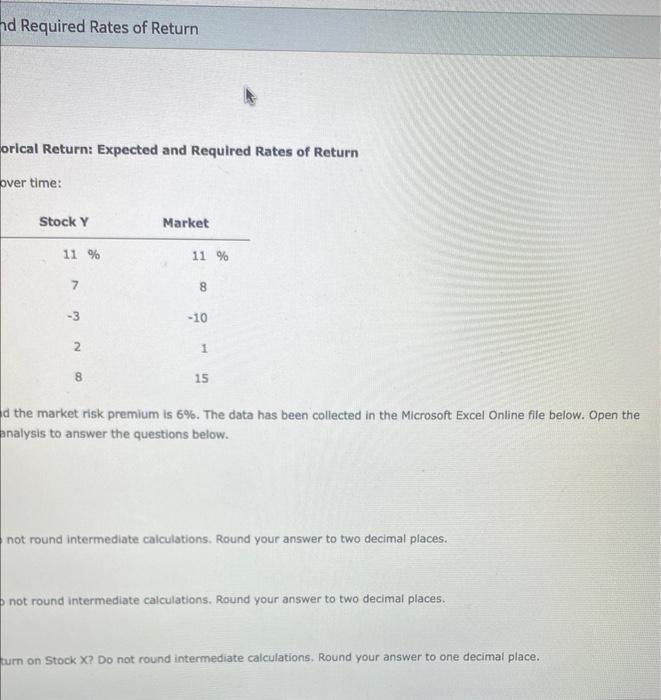

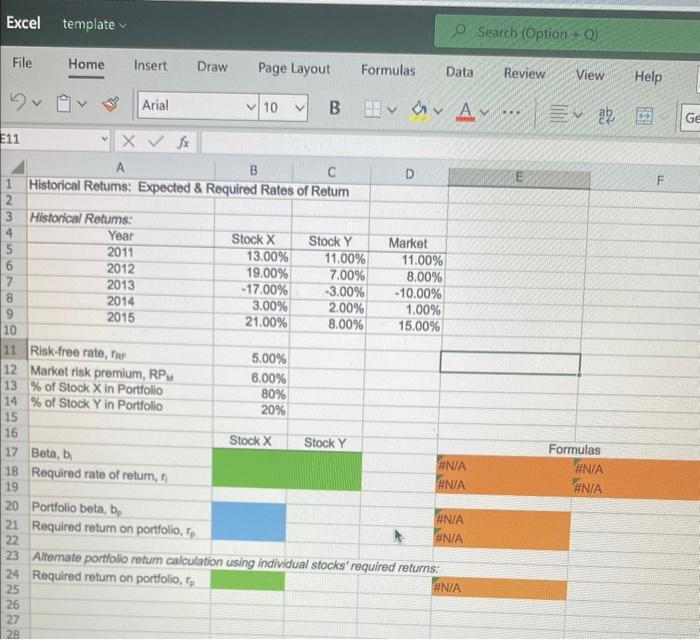

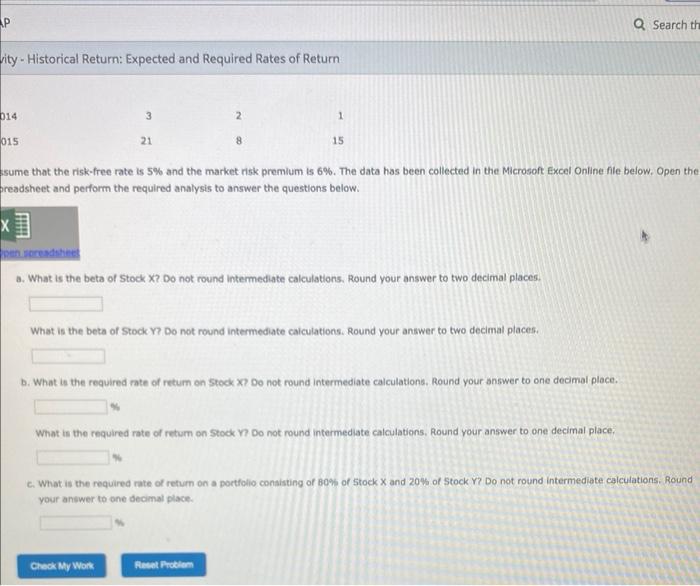

Activity - Historical Return: Expected and Required Rates of Return Excel Online Structured Activity: Historical Return: Expected and Required You have observed the following returns over time: Assume that the risk-free rate is 5% and the market risk premium is 6%. The data spreadsheet and perform the required analysis to answer the questions below. ad Required Rates of Return orical Return: Expected and Required Rates of Return over time: d the market risk premium is 6%. The data has been collected in the Microsoft Excel Online file below. Open the analysis to answer the questions below. not round intermediate calculations. Round your answer to two decimal places. not round intermediate calculations. Round your answer to two decimal places. turn on Stock X? Do not round intermediate calculations, Round your answer to one decimal place. Excel template \begin{tabular}{l} File Home Insert Draw Page Layout Formulas Data Review View Help \\ \hline \end{tabular} 23 Aftemate portfolio retum calculation using individual stocks' required returns: 24 Required return on portfolio, rp HN/A vity - Historical Return: Expected and Required Rates of Return ssume that the risk-free rate is 5% and the market risk premium is 6%. The data has been collected in the Microsoft Excel Online file below, Open the ireadsheet and perform the required analysis to answer the questions below. a. What is the beta of Stock X ? Do not round intermediate calculations. Round your answer to two decimal places. What is the beta of Stock Y? Do not round intermediate caiculations. Round your answer to two decimal places. b. What is the required rate of retum on stcckx Do not round intermediate calculations. Round your answer to one decimal place. What is the required rate of retum on stock Y Do not round intermediate calculations. Round your answer to one decimal place. c. What is the required rate of return on a portfolio consisting of B0\% of Stock X and 20% of Stock Y ? Do not round intermediate calculations. Round your answer to one decimal place

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts