Question: Excel Online Structured Activity: Historical Return: Expected and Required Rates of Return You have observed the following returns over time: Year Stock X Stock Y

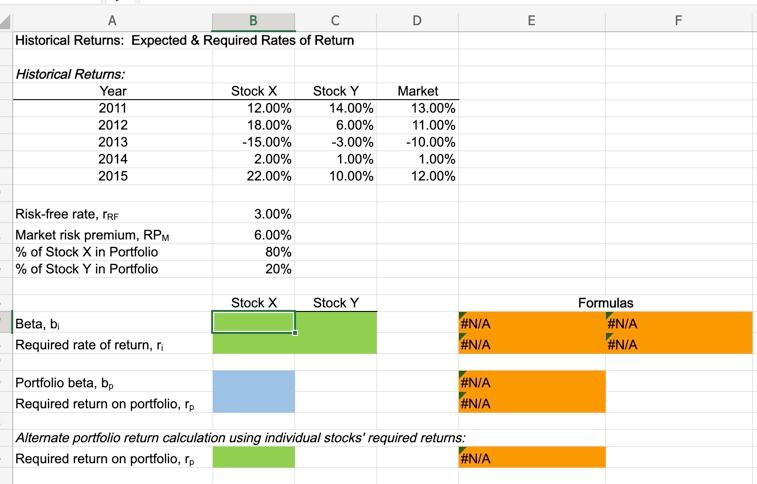

Excel Online Structured Activity: Historical Return: Expected and Required Rates of Return

You have observed the following returns over time:

| Year | Stock X | Stock Y | Market | |||

| 2011 | 12 | % | 14 | % | 13 | % |

| 2012 | 18 | 6 | 11 | |||

| 2013 | -15 | -3 | -10 | |||

| 2014 | 2 | 1 | 1 | |||

| 2015 | 22 | 10 | 12 | |||

Assume that the risk-free rate is 3% and the market risk premium is 6%. The data has been collected in the Microsoft Excel Online file below. Open the spreadsheet and perform the required analysis to answer the questions below.

-

What is the beta of Stock X? Do not round intermediate calculations. Round your answer to two decimal places.

-

What is the beta of Stock Y? Do not round intermediate calculations. Round your answer to two decimal places.

-

What is the required rate of return on Stock X? Do not round intermediate calculations. Round your answer to one decimal place.

-

What is the required rate of return on Stock Y? Do not round intermediate calculations. Round your answer to one decimal place.

-

What is the required rate of return on a portfolio consisting of 80% of Stock X and 20% of Stock Y? Do not round intermediate calculations. Round your answer to one decimal place.

D E m F Historical Returns: Expected & Required Rates of Return Historical Returns: Year 2011 2012 2013 2014 2015 Stock X 12.00% 18.00% -15.00% 2.00% 22.00% Stock Y 14.00% 6.00% -3.00% 1.00% 10.00% Market 13.00% 11.00% -10.00% 1.00% 12.00% Risk-free rate, PRF Market risk premium, RPM % of Stock X in Portfolio % of Stock Y in Portfolio 3.00% 6.00% 80% 20% Stock X Stock Y Beta, b Required rate of return, n #N/A #N/A Formulas #N/A #N/A Portfolio beta, bp Required return on portfolio, rp #N/A #N/A Alternate portfolio return calculation using individual stocks' required returns: Required return on portfolio, p #N/A

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts