Question: Activity It (page 7) Directions: Identify whether the statement is an underlying accounting assumption or a basic accounting principle. Put a checkmark (/) on the

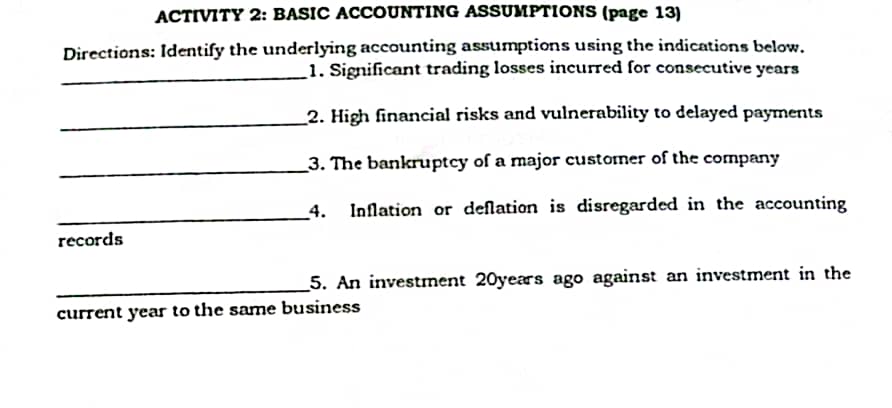

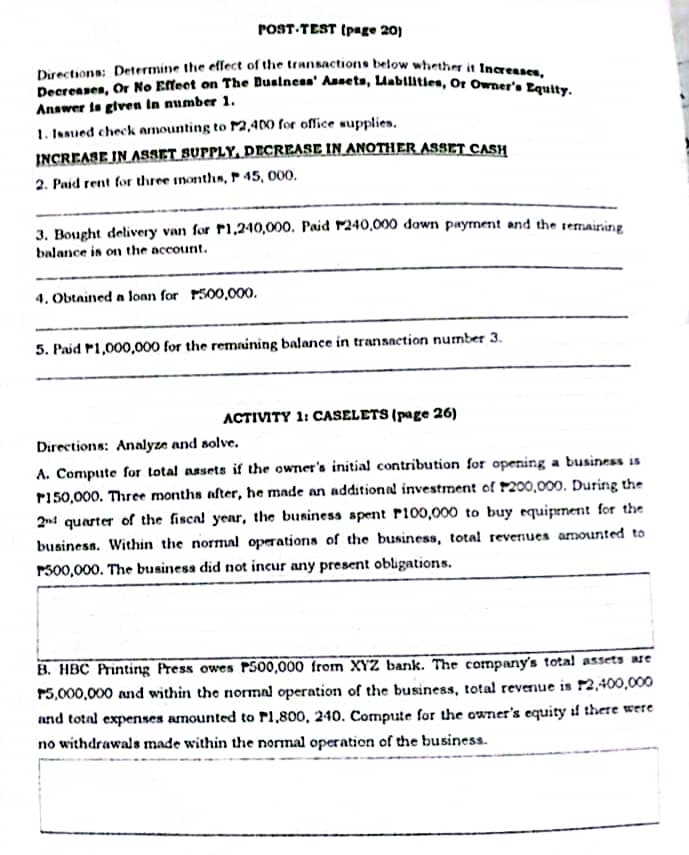

Activity It (page 7) Directions: Identify whether the statement is an underlying accounting assumption or a basic accounting principle. Put a checkmark (/) on the appropriate column. Statements Accounting Accounting Assumption Principle 1. All business transactions are separated from the owner's personal transactions. 2. This refers to the amount spent when an item was originally obtained. 3. The accountant should include sufficient information for users to make informed judgments. 4. Expenses must be matched with revenues. 5. Business transactions are recognized when they occur. 6. The relevance of the historical cost principle is dependent on-going concern assumption. 7. Economic activities in the Philippines are reported in Philippine peso. 8. Revenues are recognized as soon as goods have been sold. 9. Professional judgment is needed to decide whether an amount is insignificant or immaterial. 10. It leads accountants to anticipate or disclose losses.ACTIVITY 2: BASIC ACCOUNTING ASSUMPTIONS (page 13) Directions: Identify the underlying accounting assumptions using the indications below. 1. Significant trading losses incurred for consecutive years 2. High financial risks and vulnerability to delayed payments 3. The bankruptcy of a major customer of the company 4. Inflation or deflation is disregarded in the accounting records 5. An investment 20years ago against an investment in the current year to the same businessPOST . TEST (page 20) Directions: Determine the effect of the transactions below whether it Increases. Decreases, Or No Effect on The Business' Assets, Liabilities, Or Owner's Equity. Answer is given In number 1. 1. Issued check amounting to 12,400 for office supplies. INCREASE IN ASSET SUPPLY, DECREASE IN ANOTHER ASSET CASH 2. Paid rent for three months, P 45, 000. 3. Bought delivery van for P1.240,090. Paid 1240,090 down payment and the remaining balance is on the account. 4. Obtained a loan for $500,000. 5. Paid 1,000,000 for the remaining balance in transaction number 3. ACTIVITY 1: CASELETS (page 26) Directions: Analyze and solve. A. Compute for total assets if the owner's initial contribution for opening a business is 150,000. Three months after, he made an additional investment of 1200,000. During the 2nd quarter of the fiscal year, the business spent 100,000 to buy equipment for the business. Within the normal operations of the business, total revenues amounted to P500,000. The business did not incur any present obligations. B. HBC Printing Press owes P500,000 from XYZ bank. The company's total assets are P5,000,000 and within the normal operation of the business, total revenue is $2,400,000 and total expenses amounted to P1.800. 240. Compute for the owner's equity if there were no withdrawals made within the normal operation of the business

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts