Question: Activity rates and product costs using activity - based cost Idris Inc. manufactures entry and dining room lighting fixtures. Five activities are used in manufacturing

Activity rates and product costs using activitybased cost

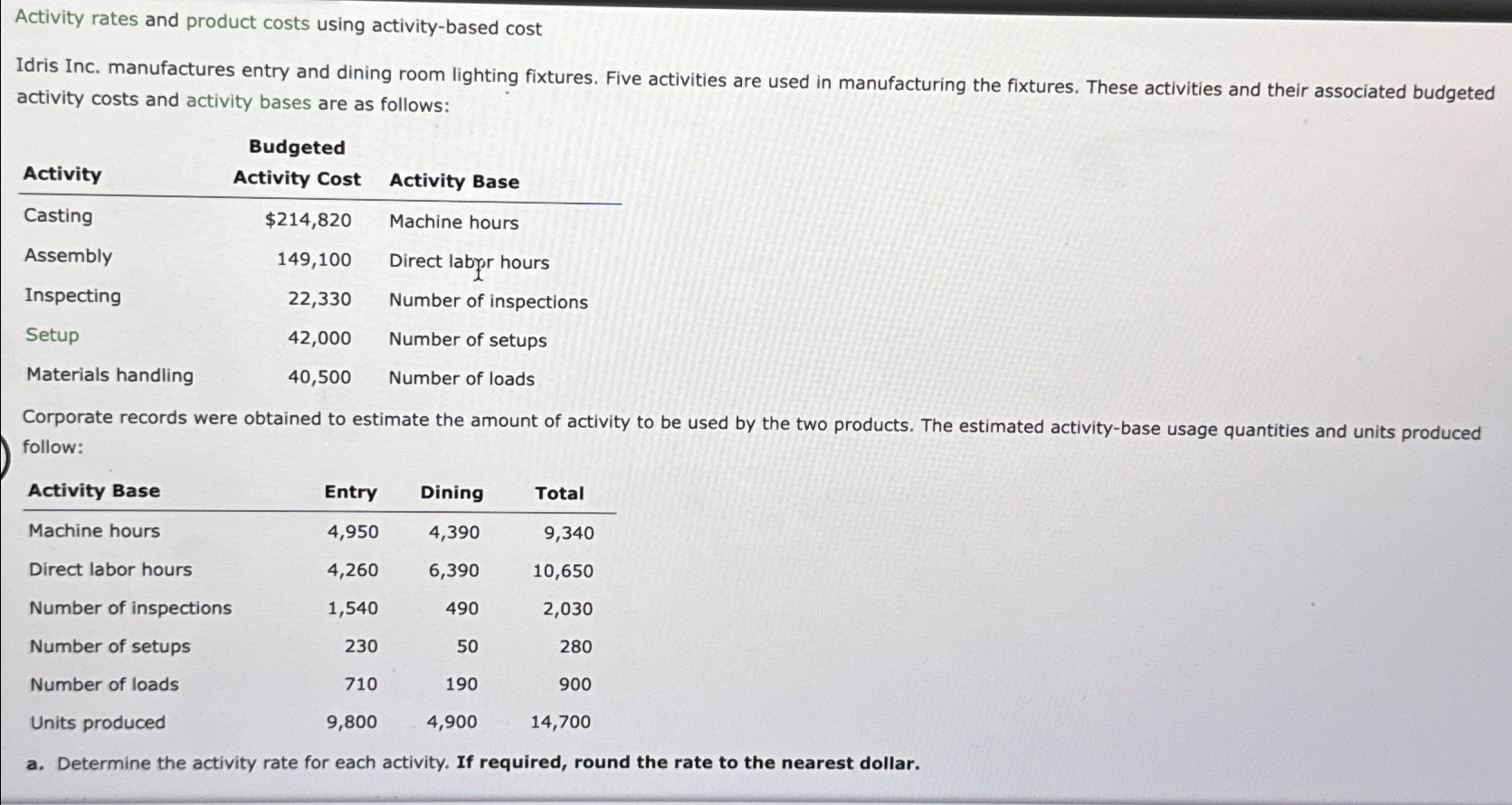

Idris Inc. manufactures entry and dining room lighting fixtures. Five activities are used in manufacturing the fixtures. These activities and their associated budgeted activity costs and activity bases are as follows:

tableActivitytableBudgetedActivity CostActivity BaseCasting$Machine hoursAssemblyDirect labfr hoursInspectingNumber of inspectionsSetupNumber of setupsMaterials handling,Number of loads

Corporate records were obtained to estimate the amount of activity to be used by the two products. The estimated activitybase usage quantities and units produced follow:

tableActivity Base,Entry,Dining,TotalMachine hours,Direct labor hours,Number of inspections,Number of setups,Number of loads,Units produced,

a Determine the activity rate for each activity. If required, round the rate to the nearest dollar.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock