Question: Activity-Based Customer-Driven Costs Suppose that Stillwater Designs has two classes of distributors: JIT distributors and non-JIT distributors. The JIT distributor places small, frequent orders, and

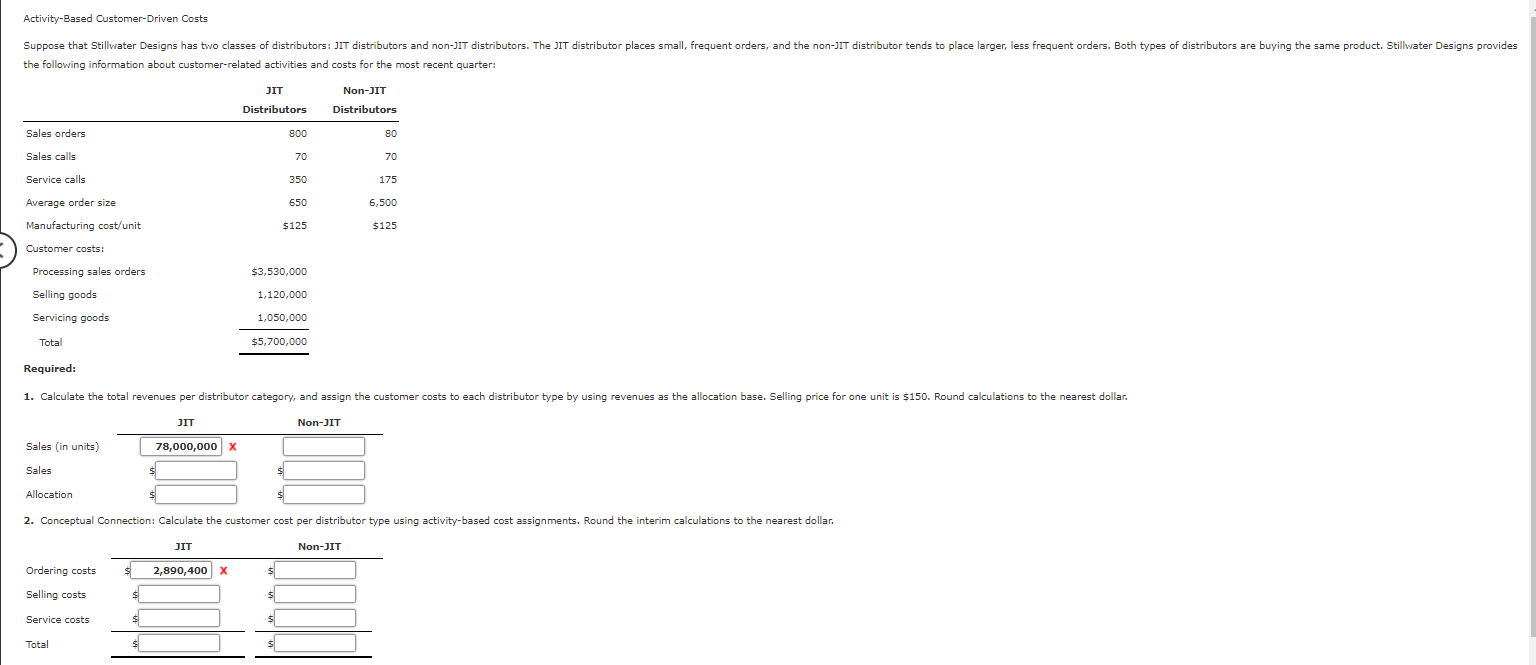

Activity-Based Customer-Driven Costs Suppose that Stillwater Designs has two classes of distributors: JIT distributors and non-JIT distributors. The JIT distributor places small, frequent orders, and the non-JIT distributor tends to place larger, less frequent orders. Both types of distributors are buying the same product. Stillwater Designs provides the following information about customer-related activities and costs for the most recent quarter: JIT Non-JIT - Distributors Distributors Sales orders 800 80 Sales calls 70 70 Service calls 350 175 650 6,500 $125 $125 Average order size Manufacturing cost/unit Customer costs: Processing sales orders $3,530,000 Selling goods 1,120,000 Servicing goods 1,050,000 Total $5,700,000 Required: 1. Calculate the total revenues per distributor category, and assign the customer costs to each distributor type by using revenues as the allocation base. Selling price for one unit is $150. Round calculations to the nearest dollar. JIT Non-JIT Sales (in units) 78,000,000 X Sales Allocation 2. Conceptual Connection: Calculate the customer cost per distributor type using activity-based cost assignments. Round the interim calculations to the nearest dollar. JIT Non-JIT Ordering costs 2,890,400 x s Selling costs $ S Service costs Total

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts