Question: actuarial mathematics question Exercise 4.22 Consider a five-year deferred, 20-year endowment insurance policy issued to (40). The policy pays no benefit on death before age

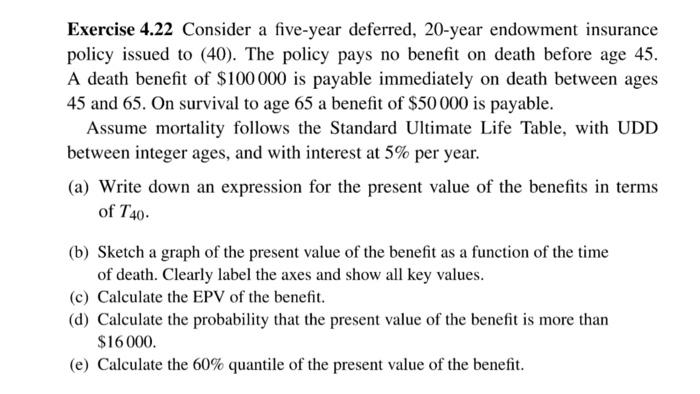

Exercise 4.22 Consider a five-year deferred, 20-year endowment insurance policy issued to (40). The policy pays no benefit on death before age 45. A death benefit of $100 000 is payable immediately on death between ages 45 and 65. On survival to age 65 a benefit of $50 000 is payable. Assume mortality follows the Standard Ultimate Life Table, with UDD between integer ages, and with interest at 5% per year. (a) Write down an expression for the present value of the benefits in terms of T40. (b) Sketch a graph of the present value of the benefit as a function of the time of death. Clearly label the axes and show all key values. (c) Calculate the EPV of the benefit. (d) Calculate the probability that the present value of the benefit is more than $16000. (e) Calculate the 60% quantile of the present value of the benefit. Exercise 4.22 Consider a five-year deferred, 20-year endowment insurance policy issued to (40). The policy pays no benefit on death before age 45. A death benefit of $100 000 is payable immediately on death between ages 45 and 65. On survival to age 65 a benefit of $50 000 is payable. Assume mortality follows the Standard Ultimate Life Table, with UDD between integer ages, and with interest at 5% per year. (a) Write down an expression for the present value of the benefits in terms of T40. (b) Sketch a graph of the present value of the benefit as a function of the time of death. Clearly label the axes and show all key values. (c) Calculate the EPV of the benefit. (d) Calculate the probability that the present value of the benefit is more than $16000. (e) Calculate the 60% quantile of the present value of the benefit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts