Question: Please help me. I don't know how to do this. 6. Consider a five-year deferred whole life insurance policy issued to (60). Death benefits are

Please help me. I don't know how to do this.

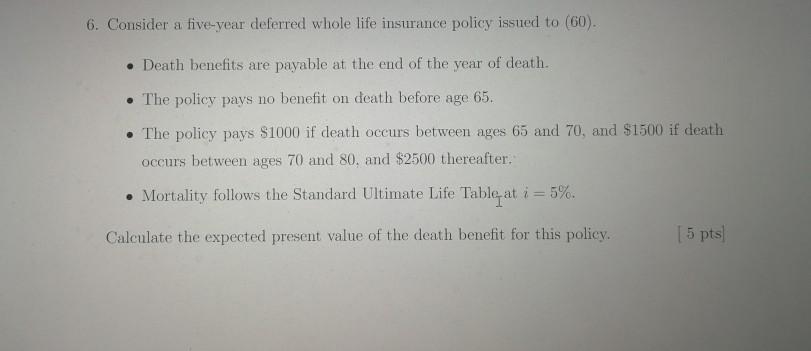

6. Consider a five-year deferred whole life insurance policy issued to (60). Death benefits are payable at the end of the year of death. . The policy pays no benefit on death before age 65. The policy pays $1000 if death occurs between ages 65 and 70, and $1500 if death occurs between ages 70 and 80, and $2500 thereafter. . Mortality follows the Standard Ultimate Life Table at i = 5%. Calculate the expected present value of the death benefit for this policy. [ 5 pts 6. Consider a five-year deferred whole life insurance policy issued to (60). Death benefits are payable at the end of the year of death. . The policy pays no benefit on death before age 65. The policy pays $1000 if death occurs between ages 65 and 70, and $1500 if death occurs between ages 70 and 80, and $2500 thereafter. . Mortality follows the Standard Ultimate Life Table at i = 5%. Calculate the expected present value of the death benefit for this policy. [ 5 pts

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts