Question: actuarial notation 3. A 40-year old was issued a 20-year endowment insurance with the following conditions: (i) Sum insured $250,000 to be paid at the

actuarial notation

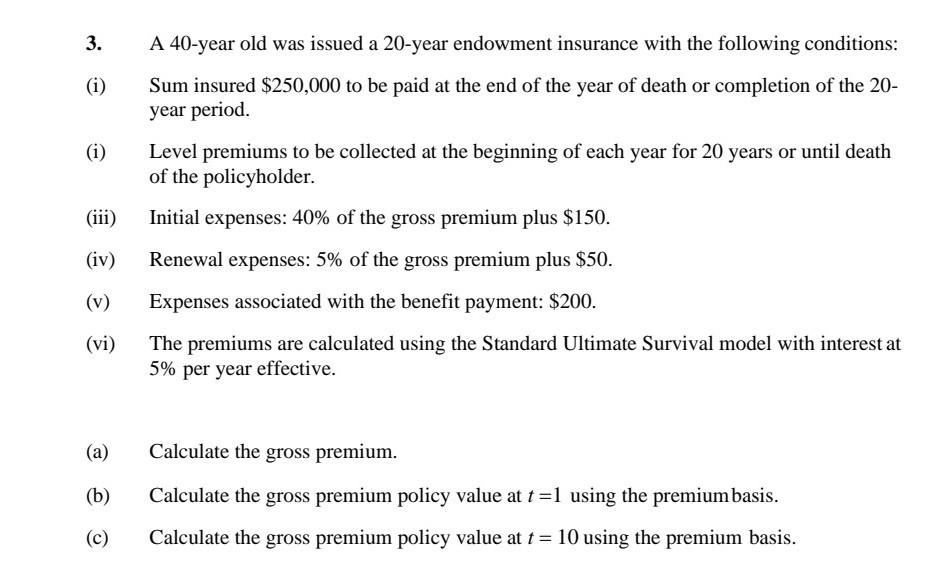

3. A 40-year old was issued a 20-year endowment insurance with the following conditions: (i) Sum insured $250,000 to be paid at the end of the year of death or completion of the 20- year period. (i) Level premiums to be collected at the beginning of each year for 20 years or until death of the policyholder. (iii) Initial expenses: 40% of the gross premium plus $150. (iv) (v) Renewal expenses: 5% of the gross premium plus $50. Expenses associated with the benefit payment: $200. The premiums are calculated using the Standard Ultimate Survival model with interest at 5% per year effective. (vi) (a) Calculate the gross premium. (b) Calculate the gross premium policy value at t=1 using the premium basis. (C) Calculate the gross premium policy value at t = 10 using the premium basis. 3. A 40-year old was issued a 20-year endowment insurance with the following conditions: (i) Sum insured $250,000 to be paid at the end of the year of death or completion of the 20- year period. (i) Level premiums to be collected at the beginning of each year for 20 years or until death of the policyholder. (iii) Initial expenses: 40% of the gross premium plus $150. (iv) (v) Renewal expenses: 5% of the gross premium plus $50. Expenses associated with the benefit payment: $200. The premiums are calculated using the Standard Ultimate Survival model with interest at 5% per year effective. (vi) (a) Calculate the gross premium. (b) Calculate the gross premium policy value at t=1 using the premium basis. (C) Calculate the gross premium policy value at t = 10 using the premium basis

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts