Question: Answer the questions below where Pr is the prot at time 0 and Pr}; (t = 1, 2, . . ., 5) is the prot

Answer the questions below

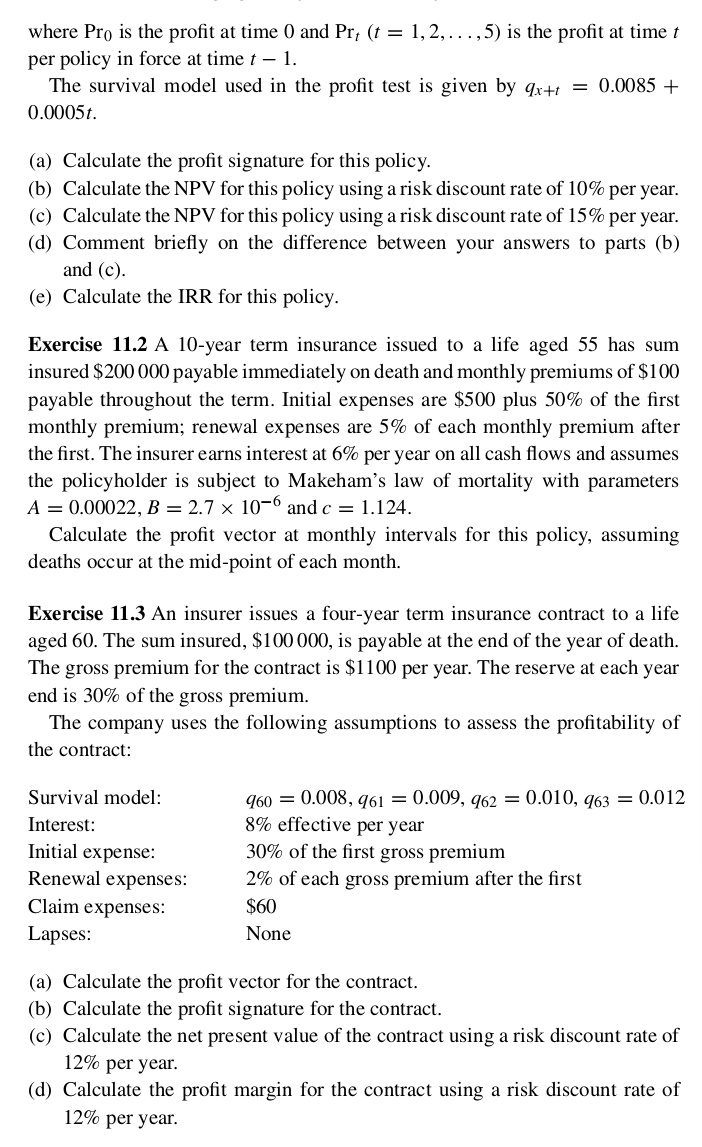

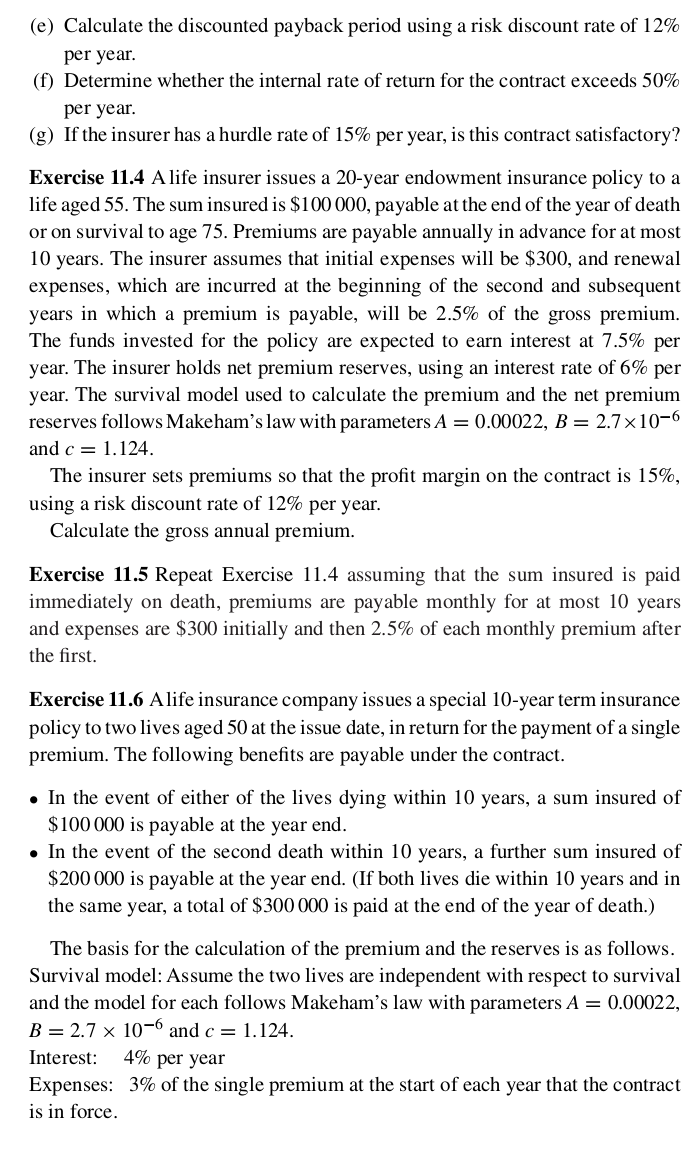

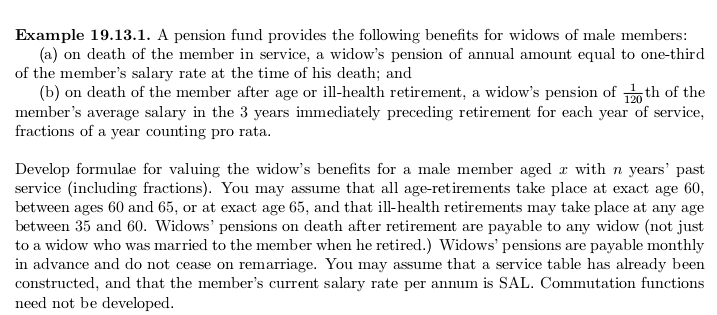

where Pr is the prot at time 0 and Pr}; (t = 1, 2, . . ., 5) is the prot at time I per policy in force at time t 1. The survival model used in the prot test is given by 131+; = 0.0035 + 0.00051: (a) Calculate the prot signature for this policy. (b) Calculate the NPV for this policy using a risk discount rate of 10% per year. (c) Calculate the NPV for this policy using a risk discount rate of 15 % per year. ((1) Comment briey on the difference between your answers to parts (b) and (c). (e) Calculate the IRR for this policy. Exercise 11.2. A 10-year term insurance issued to a life aged 55 has sum insured $200 000 payable immediately on death and monthly premiums of $100 payable throughout the term. Initial expenses are $500 plus 50% of the rst monthly premium; renewal expenses are 5% of each monthly premium after the rst. The insurer earns interest at 6% per year on all cash ows and assumes the policyholder is subject to Makeham's law of mortality with parameters A = 0.00022, 3 = 2.2 x 106 andc =1.124. Calculate the prot vector at monthly intervals for this policy, assuming deaths occur at the mid-point of each month. Exercise 11.3 An insurer issues a four-year term insurance contract to a life aged 60. The sum insured, $100 000, is payable at the end of the year of death. The gross premium for the contract is $1100 per year. The reserve at each year end is 30% of the gross premium. The company uses the following assumptions to assess the protability of the contract: Survival model: 9'50 = 0.008, (.161 = 0009, 9'62 = 0.010, 063 = 0.012 Interest: 8% effective per year Initial expense: 30% of the rst gross premium Renewal expenses: 2% of each gross premium after the rst Claim expenses: $60 Lapses: None (a) Calculate the prot vector for the contract. (b) Calculate the prot signature for the contract. (c) Calculate the net present value of the contract using a risk discount rate of 12% per year. ((1) Calculate the prot margin for the contract using a risk discount rate of 12% per year. (e) Calculate the discounted payback period using a risk discount rate of 12% per year. (t) Determine whether the internal rate of return for the contract exceeds 50% per year. (g) If the insurer has a hurdle rate of 15% per year, is this contract satisfactory\"? Exercise 11.4 Alife insurer issues a 20-year endowment insurance policy to a life aged 55. The sum insured is $100 000, payable at the end of the year of death or on survival to age 75. Premiums are payable annually in advance for at most 10 years. The insurer assumes that initial expenses will be $300, and renewal expenses, which are incurred at the beginning of the second and subsequent years in which a premium is payable, will be 2-5% of the gross premium. The funds invested for the policy are expected to earn interest at 7-5% per year. The insurer holds net premium reserves, using an interest rate of 6% per year. The survival model used to calculate the premium and the net premium reserves follows Makeham'slaw with parametersA = 0.00022, B = 2.7 X104 and c = 1.124. The insurer sets premiums so that the prot margin on the contract is 15%, using a risk discount rate of 12% per year. Calculate the gross annual premium. Exercise 11.5 Repeat Exercise 11.4 assuming that the sum insured is paid immediately on death, premiums are payable monthly for at most 10 years and expenses are $300 initially and then 2.5% of each monthly premium after the rst. Exercise 11.6 Alife insurance company issues a special 10-year term insurance policy to two lives aged 50 at the issue date, in return for the payment of a single premium. The following benets are payable under the contract. 0 In the event of either of the lives dying within 10 years, a sum insured of $100 000 is payable at the year end. i In the event of the second death within 10 years, a further sum insured of $200 000 is payable at the year end. (If both lives die within 10 years and in the same year, a total of $300 000 is paid at the end of the year of death.) The basis for the calculation of the premium and the reserves is as follows. Survival model: Assume the two lives are independent with respect to survival and the model for each follows Makeham's law with parameters A = 0.00022, 3 = 2.7 x10'6 and c =1.124. Interest: 4% per year Expenses: 3% of the single premium at the start of each year that the contract is in force. Ebcalnple 19.13.1. A pension fund provides the following benets for widows of male members: {a} on death of the member in service1 a widow's pension of annual amount equal to onethird of the members salary rate at the time of his death; and {b} on death of the member after age or illhealth retirement1 a widow's pension of th of the member's average salary in the 3 years immediately preceding retirement for each year of service1 fractions of a year counting pro rata. Develop formulae for valuing the widow's benets for a male member aged :r with 11 years' past service {including fractions]. You may assume that all ageretirements take place at exact age Ell}, between ages fail and 55, or at exact age , and that ill-health retirements may take place at any age between 35 and {it}. Widows' pensions on death after retirement are payable to any widow {not just to a widow who was married to the member when he retired.) Widows" pensions are payable monthly in advance and do not cease on remarriage. 1You may assume that a service table has already been constructed, and that the member's current salary rate per annum is SAL. Commutation functions need not be developed