Question: Adam, a mutual fund manager, is analyzing the cost structure of GameStop and AMC Theaters and its effects on profitability. He is deciding which company

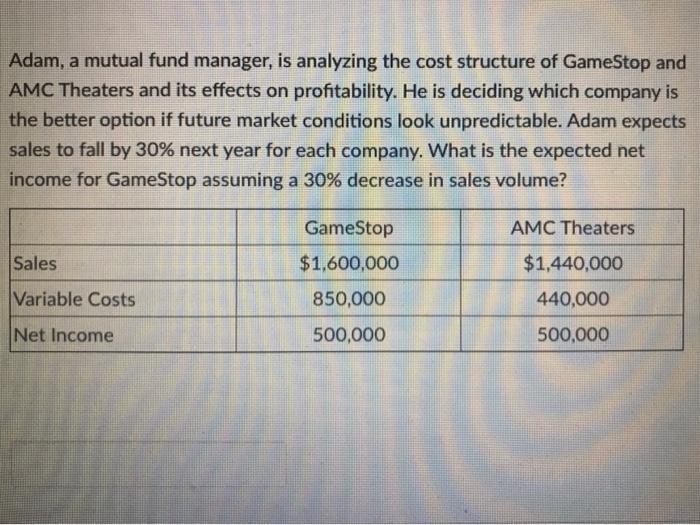

Adam, a mutual fund manager, is analyzing the cost structure of GameStop and AMC Theaters and its effects on profitability. He is deciding which company is the better option if future market conditions look unpredictable. Adam expects sales to fall by 30% next year for each company. What is the expected net income for GameStop assuming a 30% decrease in sales volume? GameStop $1,600,000 AMC Theaters $1,440,000 Sales Variable Costs 850,000 440,000 Net Income 500,000 500,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts