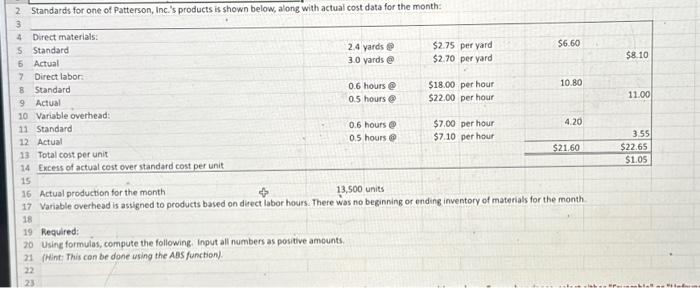

Question: add the fully equations Actual production for the month Variable overhead is assigned to products based on divect labor hours. There was no beginning or

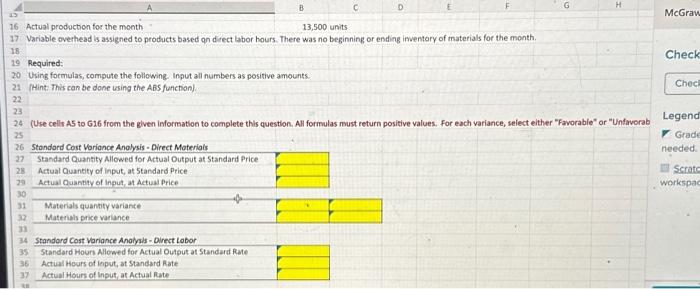

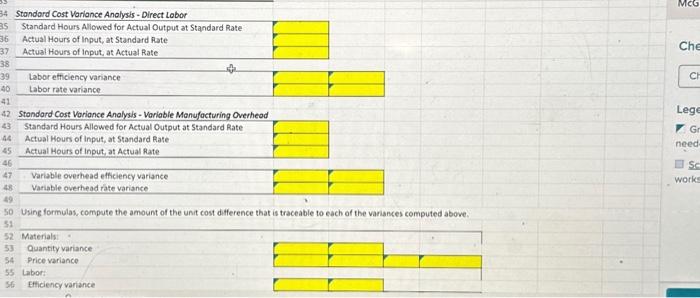

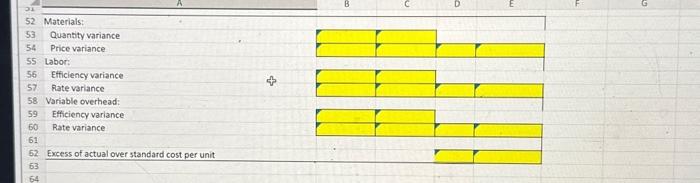

Actual production for the month Variable overhead is assigned to products based on divect labor hours. There was no beginning or ending inventory of materials for the month Recuired: Usinc formulas, compute the following. input all numbers as positive amounts. (Wint This con be done using the ABS function). Actual prodoction for the moeth 13,500 units Variable overhead is assigned to products based an direct labor hours. There was no beginning or ending imentory of materials for the month. Required: Using formulas, compute the following. Input all numbers as positive amounts. (Hint: This can be done using the ABS function). (Use celli A5 to G16 from the given information to complete this question. All formulas must return positive values, For each variance, select elther "Favorable" or "Unfavorab Stondord Cost Woriance Analysis - Direct Materials Standard Quantity Allowed for Actual Output at Standard Price Actual Quantity of inpat, at Standard Price Actual Quantisy of input, at Actual Price Materials quantity variance Materials price variance Standord Cost Variance Anolyals - Oirect Lobor Standord Cost Variance Anoiysis - Oirect Lobar Standard Houn Allowed for Actual Output at Standard Rute Actual Hours of liput, at Standard Rate Actual Hours of input, at Actual fute Standard Cost Variance Analysis - Direct Lobor Standard Hours Allowed for Actual Output at Standard Rate Actual Hours of Input, at Standard Rate Actual Hours of Input, at Actual Rate Labor efficiency variance Labor rate variance Standard Cost Voriance Analysis - Voriable Monufocturing Overheod Actual Hours of input, at Standard Rate Actual Hours of input, at Actual Rate Variable overhead efficiency variance Variable overhead rate variance Using formulas, compute the amount of the unit cost difference that is traceable to each of the variances computed above. Materials Quantity variance Price variance Labor: Etticiency variance Materials: Quantity variance Price variance. Labor: Efficiency variance Rate variance Variable overhead: Efficiency variance Rate variance. Excess of actual over standard cost per unit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts