Question: Additional Data: 1. Interest accrued but not paid $1200. 2. The company has to pay 20% tax on the profit it makes. 3. Prepaid rent

Additional Data: 1. Interest accrued but not paid $1200. 2. The company has to pay 20% tax on the profit it makes. 3. Prepaid rent was paid on January 1, 2021, for the next 2 years. 4. The company depreciates the equipment at the rate of 10% under the straight-line method. The equipment is expected to have a salvage value of $5,000. 5. 15% cash dividend was declared on Common Stock. Required: Prepare a Multistep income statement for the year ending June 30, 2021

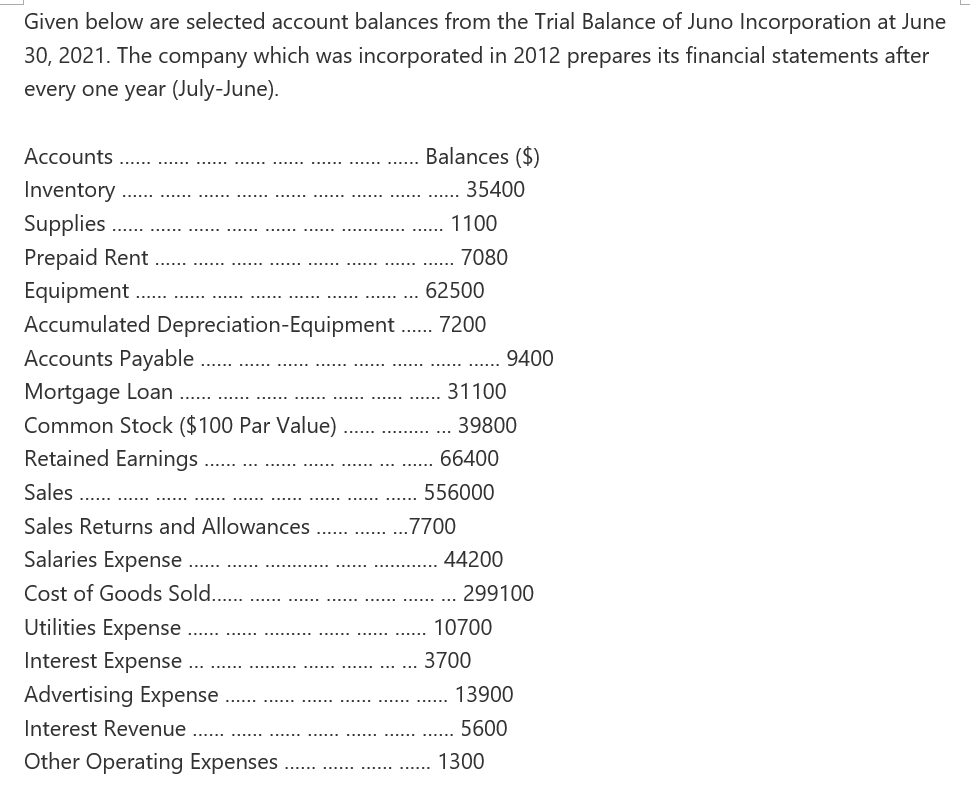

Given below are selected account balances from the Trial Balance of Juno Incorporation at June 30, 2021. The company which was incorporated in 2012 prepares its financial statements after every one year (July-June). Balances ($) 35400 1100 Accounts Inventory Supplies Prepaid Rent Equipment Accumulated Depreciation-Equipment Accounts Payable Mortgage Loan Common Stock ($100 Par Value) Retained Earnings 7080 62500 7200 9400 31100 39800 66400 556000 Sales ................ ... 7700 Sales Returns and Allowances Salaries Expense Cost of Goods Sold...... Utilities Expense Interest Expense Advertising Expense Interest Revenue Other Operating Expenses 44200 299100 10700 3700 13900 5600 1300

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts