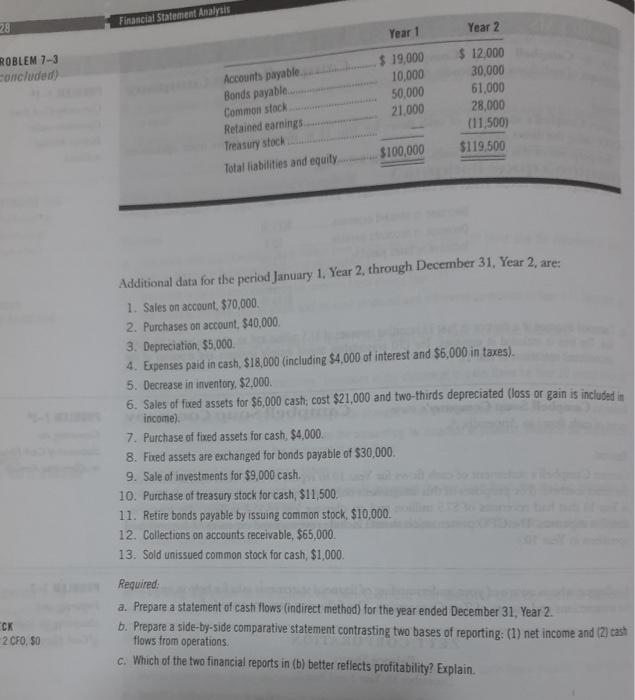

Question: Additional data for the period January 1. Year 2, through December 31, Year 2, are: 1. Sales - on account, $70,000. 2. Purchases on account,

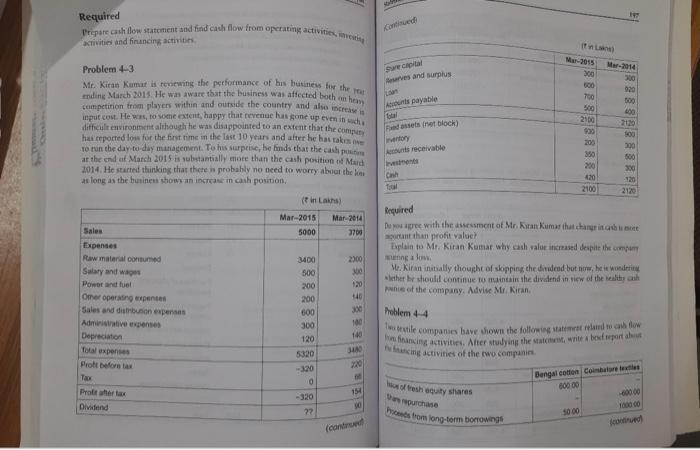

Additional data for the period January 1. Year 2, through December 31, Year 2, are: 1. Sales - on account, $70,000. 2. Purchases on account, $40,000 3. Depreciation, $5,000. 4. Expenses paid in cash, $18,000 (including $4,000 of interest and $6,000 in taxes). 5. Decrease in inventory, $2,000. 6. Sales of fixed assets for $6,000 cast; cost $21,000 and two-thirds depreciated (loss or gain is includat in income). 7. Purchase of fixed assets for cash, $4,000. 8. Fixed assets are exchanged for bonds payable of $30,000. 9. Sale of investments for $9,000 cash. 10. Purchase of treasury stock for cash, $11,500. 11. Retire bonds payable by issuing common stock, $10,000. 12. Collections on accounts receivable, $65,000. 13. Sold unissued common stock for cash, $1,000. Required: a. Prepare a statement of cast flows (indirect method) for the year ended December 31, Year 2. b. Prepare a side-by-side comparative statement contrasting two bases of reporting: (1) net income and (2) cast flows trom operations: c. Which of the two finarcial reports in (b) tetter reflects profitability? Explain. Pripare ash flow statcment and find cath flow from opcrating activitiex, inteatig. acrivitie and financing activities. Problem 43 Mr. Kirat Kumat is renewing the performance of his betines for the for rnding March 2013. He was aware tbat the business was affected boch ou hean cempetition from ployers within and ourside the country and also rocteak in inpot cost. He was, to soxne oxtent, happy that ferenue has gone up even in such, Required squerit thin profis value? pentes of the company. Advise Mtr kiran. Moblem 44 Additional data for the period January 1. Year 2, through December 31, Year 2, are: 1. Sales - on account, $70,000. 2. Purchases on account, $40,000 3. Depreciation, $5,000. 4. Expenses paid in cash, $18,000 (including $4,000 of interest and $6,000 in taxes). 5. Decrease in inventory, $2,000. 6. Sales of fixed assets for $6,000 cast; cost $21,000 and two-thirds depreciated (loss or gain is includat in income). 7. Purchase of fixed assets for cash, $4,000. 8. Fixed assets are exchanged for bonds payable of $30,000. 9. Sale of investments for $9,000 cash. 10. Purchase of treasury stock for cash, $11,500. 11. Retire bonds payable by issuing common stock, $10,000. 12. Collections on accounts receivable, $65,000. 13. Sold unissued common stock for cash, $1,000. Required: a. Prepare a statement of cast flows (indirect method) for the year ended December 31, Year 2. b. Prepare a side-by-side comparative statement contrasting two bases of reporting: (1) net income and (2) cast flows trom operations: c. Which of the two finarcial reports in (b) tetter reflects profitability? Explain. Pripare ash flow statcment and find cath flow from opcrating activitiex, inteatig. acrivitie and financing activities. Problem 43 Mr. Kirat Kumat is renewing the performance of his betines for the for rnding March 2013. He was aware tbat the business was affected boch ou hean cempetition from ployers within and ourside the country and also rocteak in inpot cost. He was, to soxne oxtent, happy that ferenue has gone up even in such, Required squerit thin profis value? pentes of the company. Advise Mtr kiran. Moblem 44

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts