Question: - Additional fixed costs include US$3,000 per year for advertising and US$4,500 per year for maintenance, insurance, and other items. These costs will be incurred

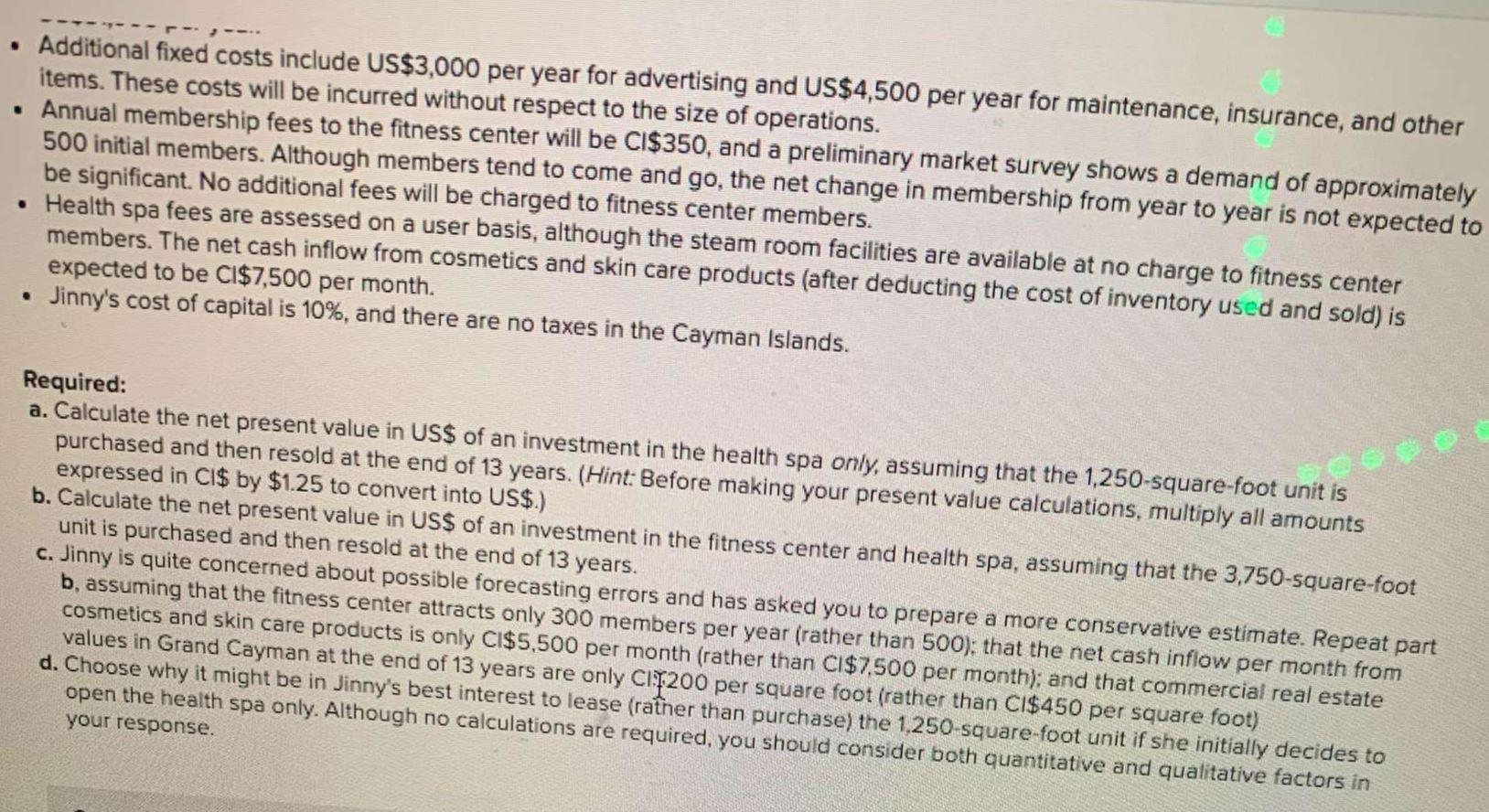

- Additional fixed costs include US\$3,000 per year for advertising and US\$4,500 per year for maintenance, insurance, and other items. These costs will be incurred without respect to the size of operations. - Annual membership fees to the fitness center will be Cl$350, and a preliminary market survey shows a demand of approximatel 500 initial members. Although members tend to come and go, the net change in membership from year to year is not expected t be significant. No additional fees will be charged to fitness center members. - Health spa fees are assessed on a user basis, although the steam room facilities are available at no charge to fitness center members. The net cash inflow from cosmetics and skin care products (after deducting the cost of inventory used and sold) is expected to be Cl$7,500 per month. - Jinny's cost of capital is 10\%, and there are no taxes in the Cayman Islands. Required: a. Calculate the net present value in US\$ of an investment in the health spa only, assuming that the 1,250 -square-foot unit is purchased and then resold at the end of 13 years. (Hint: Before making your present value calculations, multiply all amounts expressed in CI\$ by $1.25 to convert into US\$.) b. Calculate the net present value in US\$ of an investment in the fitness center and health spa, assuming that the 3,750 -square-foot unit is purchased and then resold at the end of 13 years. c. Jinny is quite concerned about possible forecasting errors and has asked you to prepare a more conservative estimate. Repeat part b, assuming that the fitness center attracts only 300 members per year (rather than 500 ); that the net cash inflow per month from cosmetics and skin care products is only CI\$5,500 per month (rather than CI\$7,500 per month); and that commercial real estate values in Grand Cayman at the end of 13 years are only Cli. 200 per square foot (rather than C1\$450 per square foot) d. Choose why it might be in Jinny's best interest to lease (rather than purchase) the 1,250 -square-foot unit if she initially decides to open the health spare. your response. - Additional fixed costs include US\$3,000 per year for advertising and US\$4,500 per year for maintenance, insurance, and other items. These costs will be incurred without respect to the size of operations. - Annual membership fees to the fitness center will be Cl$350, and a preliminary market survey shows a demand of approximatel 500 initial members. Although members tend to come and go, the net change in membership from year to year is not expected t be significant. No additional fees will be charged to fitness center members. - Health spa fees are assessed on a user basis, although the steam room facilities are available at no charge to fitness center members. The net cash inflow from cosmetics and skin care products (after deducting the cost of inventory used and sold) is expected to be Cl$7,500 per month. - Jinny's cost of capital is 10\%, and there are no taxes in the Cayman Islands. Required: a. Calculate the net present value in US\$ of an investment in the health spa only, assuming that the 1,250 -square-foot unit is purchased and then resold at the end of 13 years. (Hint: Before making your present value calculations, multiply all amounts expressed in CI\$ by $1.25 to convert into US\$.) b. Calculate the net present value in US\$ of an investment in the fitness center and health spa, assuming that the 3,750 -square-foot unit is purchased and then resold at the end of 13 years. c. Jinny is quite concerned about possible forecasting errors and has asked you to prepare a more conservative estimate. Repeat part b, assuming that the fitness center attracts only 300 members per year (rather than 500 ); that the net cash inflow per month from cosmetics and skin care products is only CI\$5,500 per month (rather than CI\$7,500 per month); and that commercial real estate values in Grand Cayman at the end of 13 years are only Cli. 200 per square foot (rather than C1\$450 per square foot) d. Choose why it might be in Jinny's best interest to lease (rather than purchase) the 1,250 -square-foot unit if she initially decides to open the health spare. your response

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts