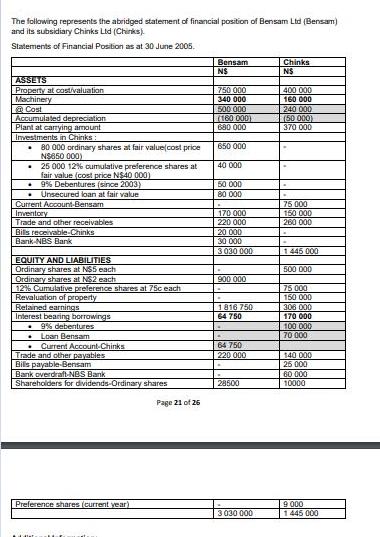

Question: The following represents the abridged staternent of financial position of Bensam Ltd (Bensam) and its subsidiary Chinks Ltd (Chirks). Statements of Financial Position as

The following represents the abridged staternent of financial position of Bensam Ltd (Bensam) and its subsidiary Chinks Ltd (Chirks). Statements of Financial Position as at 30 June 2005. Bensam Chinks NS ASSETS Property at cost/valuation Machinery @ Cost Accumulated depreciation Plant at carrying amount Investments in Chinks 750 000 340 000 400 000 | 160 000 500 000 L(180 000) 680 000 240 000 (50 000 370 000 80 000 ordinary shares at fair value(cost price NS650 000) 650 000 40 000 25 000 12% cumulative preference shares at fair value (cost price N$40 000) 9% Debentures (since 2003) Unsecured loan at fair value 50 000 80 000 Current Account-Bensam Inventory Trade and other receivables Bils receivable-Chinks Bank-NBS Bank 75 000 150 000 260 000 170 000 220 000 20 000 30 000 3 030 000 1 445 000 EQUITY AND LIABILITIES Ordinary shares at NS5 each Ordinary shares at N$2 each 12% Cumulative preference shares at 75c each Revaluation of property Retained earnings Interest bearing borrowings 9% debentures Loan Bensam Current Account-Chinks Trade and other payables Bils payable-Bensam Bank overdraft-NBS Bank Shareholders for dividends-Ordinary shares 500 000 900 000 75 000 150 000 306 000 170 000 100 000 70 000 1816 750 64 750 64 750 220 000 140 000 25 000 60 000 10000 28500 Page 21 of 26 Preference shares (current year) 9 000 1 445 000 3 030 000

Step by Step Solution

There are 3 Steps involved in it

Workings Smoothie Ltd acquired interest in Yoghurt Itd Date of Acquisiti... View full answer

Get step-by-step solutions from verified subject matter experts