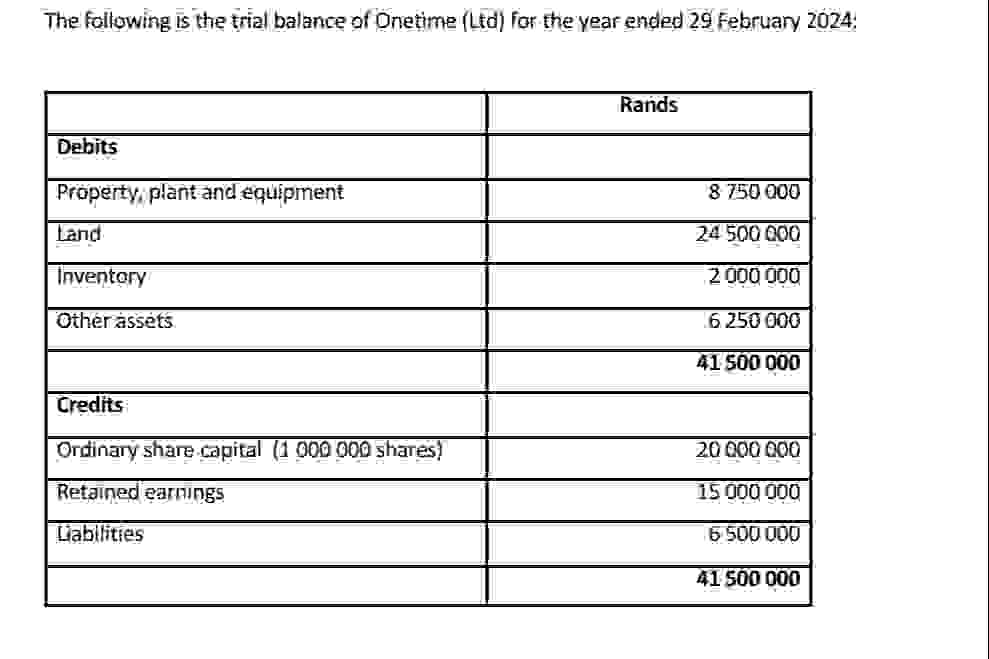

Question: Additional information: 1 . Unity Ltd acquired 8 0 0 0 0 ordinary shares in Onetime Ltd on 1 March 2 0 2 4 for

Additional information:

Unity Ltd acquired ordinary shares in Onetime Ltd on March for R The acquisition price would be paid on February Onetime Ltd manufactures exclusive furniture pieces.

The carrying amounts of all of the assets and liabilities of Onetime Ltd were equal to their fair values except for the following:

Inventory

Property, plant and equipment

Land

Onetime Ltd did not recognise a contingent liability of R on February This is of a capital nature and hence is not an allowable tax deduction. This amount meets the recognition criteria of IFRS

Onetime Ltd did not recognise an intangible asset with a fair value of R at the acquisition date.

An appropriate discount rate is per annum.

The fair value of Onetime Ltd shares was R on March

Noncontrolling interest is measured at fair value on the acquisition date.

Noncontrolling interest is measured at their share of net identifiable assets

Investments in subsidiaries are accounted for at cost in the separate records of Unity Ltd

The SA normal tax rate is and the effective capital gains tax rate is Land and intangible assets are subject to capital gains tax and all other assets are subject to normal tax

QCalculate the goodwill or gain on bargain purchase on the date of acquisition of Onetime LtdRound to the nearest Rand. In terms of International Financial Reporting Standards IFRS specifically IFRS Business Combinations.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock