Question: please indicate or highlight where is not clear/where there is omission there is nothing missing in that question. please answer . 40 Marks Ice Cream

please indicate or highlight where is not clear/where there is omission

there is nothing missing in that question. please answer

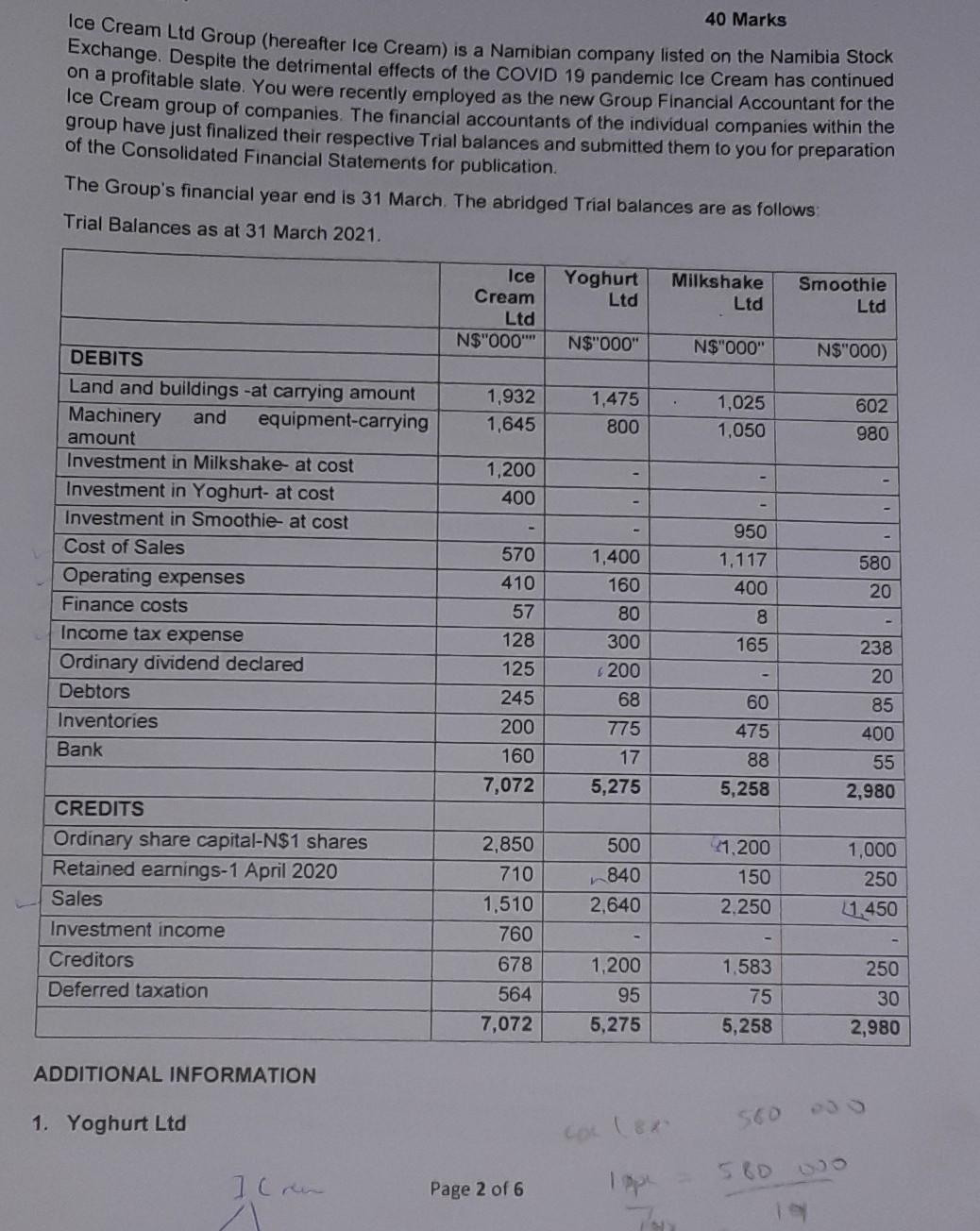

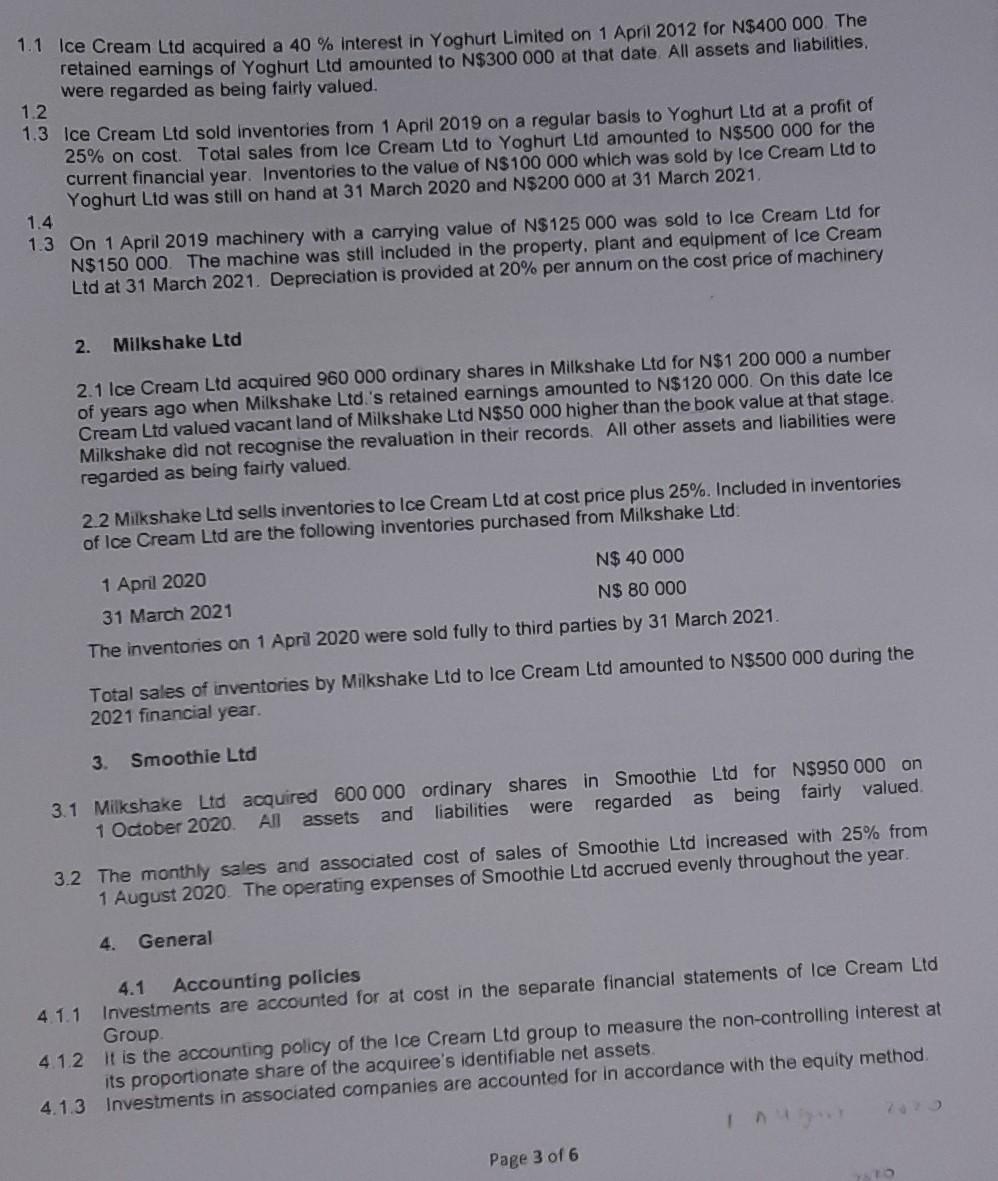

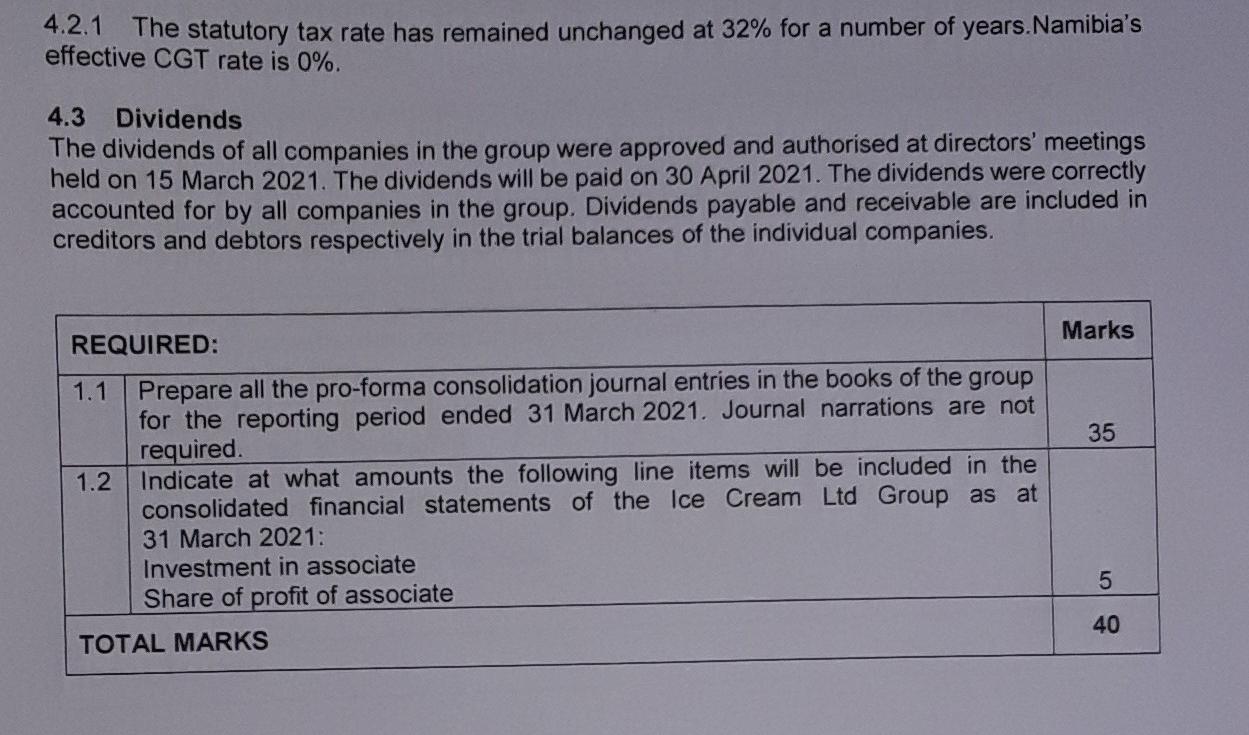

. 40 Marks Ice Cream Ltd Group (hereafter Ice Cream) is a Namibian company listed on the Namibia Stock Exchange. Despite the detrimental effects of the COVID 19 pandemic Ice Cream has continued on a profitable slate. You were recently employed as the new Group Financial Accountant for the Ice Cream group of companies. The financial accountants of the individual companies within the group have just finalized their respective Trial balances and submitted them to you for preparation of the Consolidated Financial Statements for publication The Group's financial year end is 31 March. The abridged Trial balances are as follows Trial Balances as at 31 March 2021. Ice Yoghurt Milkshake Smoothie Cream Ltd Ltd Ltd Ltd N$"000" N$"000" N$"000" N$"000) DEBITS Land and buildings -at carrying amount 1,932 1,475 1,025 602 Machinery and equipment-carrying 1,645 800 1,050 980 amount Investment in Milkshake at cost 1,200 Investment in Yoghurt- at cost 400 Investment in Smoothie at cost 950 Cost of Sales 570 1,400 1.117 580 Operating expenses 410 160 400 20 Finance costs 57 80 8 Income tax expense 128 300 165 238 Ordinary dividend declared 125 1200 20 Debtors 245 68 60 85 Inventories 200 775 475 400 Bank 160 17 88 55 7,072 5,275 5,258 2,980 CREDITS Ordinary share capital-N$1 shares 2,850 500 21,200 1,000 Retained earnings-1 April 2020 710 150 250 Sales 1,510 2,640 2.250 1,450 Investment income 760 Creditors 678 1,200 1.583 250 Deferred taxation 564 95 75 30 7,072 5,275 5,258 2,980 840 ADDITIONAL INFORMATION 1. Yoghurt Ltd 560 col (82 I (new Page 2 of 6 ippe 1.1 Ice Cream Ltd acquired a 40 % Interest in Yoghurt Limited on 1 April 2012 for N$400 000 The retained earings of Yoghurt Ltd amounted to N$300 000 at that date. All assets and liabilities. were regarded as being fairly valued. 1.2 1.3 Ice Cream Ltd sold inventories from 1 April 2019 on a regular basis to Yoghurt Ltd at a profit of 25% on cost. Total sales from Ice Cream Ltd to Yoghurt Lid amounted to N$500 000 for the current financial year. Inventories to the value of N$100 000 which was sold by Ice Cream Ltd to Yoghurt Ltd was still on hand at 31 March 2020 and N$200 000 at 31 March 2021 1.4 1.3 On 1 April 2019 machinery with a carrying value of N$125 000 was sold to Ice Cream Ltd for N$ 150 000. The machine was still included in the property, plant and equipment of Ice Cream Ltd at 31 March 2021. Depreciation is provided at 20% per annum on the cost price of machinery 2. Milkshake Ltd 2.1 Ice Cream Ltd acquired 960 000 ordinary shares in Milkshake Ltd for N$1 200 000 a number of years ago when Milkshake Ltd.'s retained earnings amounted to N$120 000. On this date Ice Cream Ltd valued vacant land of Milkshake Ltd N$50 000 higher than the book value at that stage. Milkshake did not recognise the revaluation in their records. All other assets and liabilities were regarded as being fairly valued 2.2 Milkshake Ltd sells inventories to Ice Cream Ltd at cost price plus 25%. Included in inventories of Ice Cream Ltd are the following inventories purchased from Milkshake Ltd. 1 April 2020 N$ 40 000 31 March 2021 NS 80 000 The inventories on 1 Apr 2020 were sold fully to third parties by 31 March 2021. Total sales of inventories by Milkshake Ltd to Ice Cream Ltd amounted to N$500 000 during the 2021 financial year 3. Smoothie Ltd 3.1 Milkshake Ltd acquired 600 000 ordinary shares in Smoothie Ltd for N$950 000 on 1 October 2020. All assets and liabilities were regarded as being fairly valued. 3.2 The monthly sales and associated cost of sales of Smoothie Ltd increased with 25% from 1 August 2020. The operating expenses of Smoothie Ltd accrued evenly throughout the year 4. General 4.1 Accounting policies 4.1.1 Investments are accounted for at cost in the separate financial statements of Ice Cream Ltd Group 4.12 It is the accounting policy of the Ice Cream Ltd group to measure the non-controlling interest at its proportionate share of the acquiree's identifiable net assets 4.1.3 Investments in associated companies are accounted for in accordance with the equity method Page 3 of 6 4.2.1 The statutory tax rate has remained unchanged at 32% for a number of years.Namibia's effective CGT rate is 0%. 4.3 Dividends The dividends of all companies in the group were approved and authorised at directors' meetings held on 15 March 2021. The dividends will be paid on 30 April 2021. The dividends were correctly accounted for by all companies in the group. Dividends payable and receivable are included in creditors and debtors respectively in the trial balances of the individual companies. Marks REQUIRED: 35 1.1 Prepare all the pro-forma consolidation journal entries in the books of the group for the reporting period ended 31 March 2021. Journal narrations are not required. 1.2 Indicate at what amounts the following line items will be included in the consolidated financial statements of the Ice Cream Ltd Group as at 31 March 2021: Investment in associate Share of profit of associate TOTAL MARKS 5 40 . 40 Marks Ice Cream Ltd Group (hereafter Ice Cream) is a Namibian company listed on the Namibia Stock Exchange. Despite the detrimental effects of the COVID 19 pandemic Ice Cream has continued on a profitable slate. You were recently employed as the new Group Financial Accountant for the Ice Cream group of companies. The financial accountants of the individual companies within the group have just finalized their respective Trial balances and submitted them to you for preparation of the Consolidated Financial Statements for publication The Group's financial year end is 31 March. The abridged Trial balances are as follows Trial Balances as at 31 March 2021. Ice Yoghurt Milkshake Smoothie Cream Ltd Ltd Ltd Ltd N$"000" N$"000" N$"000" N$"000) DEBITS Land and buildings -at carrying amount 1,932 1,475 1,025 602 Machinery and equipment-carrying 1,645 800 1,050 980 amount Investment in Milkshake at cost 1,200 Investment in Yoghurt- at cost 400 Investment in Smoothie at cost 950 Cost of Sales 570 1,400 1.117 580 Operating expenses 410 160 400 20 Finance costs 57 80 8 Income tax expense 128 300 165 238 Ordinary dividend declared 125 1200 20 Debtors 245 68 60 85 Inventories 200 775 475 400 Bank 160 17 88 55 7,072 5,275 5,258 2,980 CREDITS Ordinary share capital-N$1 shares 2,850 500 21,200 1,000 Retained earnings-1 April 2020 710 150 250 Sales 1,510 2,640 2.250 1,450 Investment income 760 Creditors 678 1,200 1.583 250 Deferred taxation 564 95 75 30 7,072 5,275 5,258 2,980 840 ADDITIONAL INFORMATION 1. Yoghurt Ltd 560 col (82 I (new Page 2 of 6 ippe 1.1 Ice Cream Ltd acquired a 40 % Interest in Yoghurt Limited on 1 April 2012 for N$400 000 The retained earings of Yoghurt Ltd amounted to N$300 000 at that date. All assets and liabilities. were regarded as being fairly valued. 1.2 1.3 Ice Cream Ltd sold inventories from 1 April 2019 on a regular basis to Yoghurt Ltd at a profit of 25% on cost. Total sales from Ice Cream Ltd to Yoghurt Lid amounted to N$500 000 for the current financial year. Inventories to the value of N$100 000 which was sold by Ice Cream Ltd to Yoghurt Ltd was still on hand at 31 March 2020 and N$200 000 at 31 March 2021 1.4 1.3 On 1 April 2019 machinery with a carrying value of N$125 000 was sold to Ice Cream Ltd for N$ 150 000. The machine was still included in the property, plant and equipment of Ice Cream Ltd at 31 March 2021. Depreciation is provided at 20% per annum on the cost price of machinery 2. Milkshake Ltd 2.1 Ice Cream Ltd acquired 960 000 ordinary shares in Milkshake Ltd for N$1 200 000 a number of years ago when Milkshake Ltd.'s retained earnings amounted to N$120 000. On this date Ice Cream Ltd valued vacant land of Milkshake Ltd N$50 000 higher than the book value at that stage. Milkshake did not recognise the revaluation in their records. All other assets and liabilities were regarded as being fairly valued 2.2 Milkshake Ltd sells inventories to Ice Cream Ltd at cost price plus 25%. Included in inventories of Ice Cream Ltd are the following inventories purchased from Milkshake Ltd. 1 April 2020 N$ 40 000 31 March 2021 NS 80 000 The inventories on 1 Apr 2020 were sold fully to third parties by 31 March 2021. Total sales of inventories by Milkshake Ltd to Ice Cream Ltd amounted to N$500 000 during the 2021 financial year 3. Smoothie Ltd 3.1 Milkshake Ltd acquired 600 000 ordinary shares in Smoothie Ltd for N$950 000 on 1 October 2020. All assets and liabilities were regarded as being fairly valued. 3.2 The monthly sales and associated cost of sales of Smoothie Ltd increased with 25% from 1 August 2020. The operating expenses of Smoothie Ltd accrued evenly throughout the year 4. General 4.1 Accounting policies 4.1.1 Investments are accounted for at cost in the separate financial statements of Ice Cream Ltd Group 4.12 It is the accounting policy of the Ice Cream Ltd group to measure the non-controlling interest at its proportionate share of the acquiree's identifiable net assets 4.1.3 Investments in associated companies are accounted for in accordance with the equity method Page 3 of 6 4.2.1 The statutory tax rate has remained unchanged at 32% for a number of years.Namibia's effective CGT rate is 0%. 4.3 Dividends The dividends of all companies in the group were approved and authorised at directors' meetings held on 15 March 2021. The dividends will be paid on 30 April 2021. The dividends were correctly accounted for by all companies in the group. Dividends payable and receivable are included in creditors and debtors respectively in the trial balances of the individual companies. Marks REQUIRED: 35 1.1 Prepare all the pro-forma consolidation journal entries in the books of the group for the reporting period ended 31 March 2021. Journal narrations are not required. 1.2 Indicate at what amounts the following line items will be included in the consolidated financial statements of the Ice Cream Ltd Group as at 31 March 2021: Investment in associate Share of profit of associate TOTAL MARKS 5 40

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts