Question: additional information ACCT-1071 Case Study #2 Vera's Magic Garden Ltd. Appendix B: Comparative Financial Statements (available in Excel) Vera's Magic Garden Ltd. Comparative Income Statement

additional information

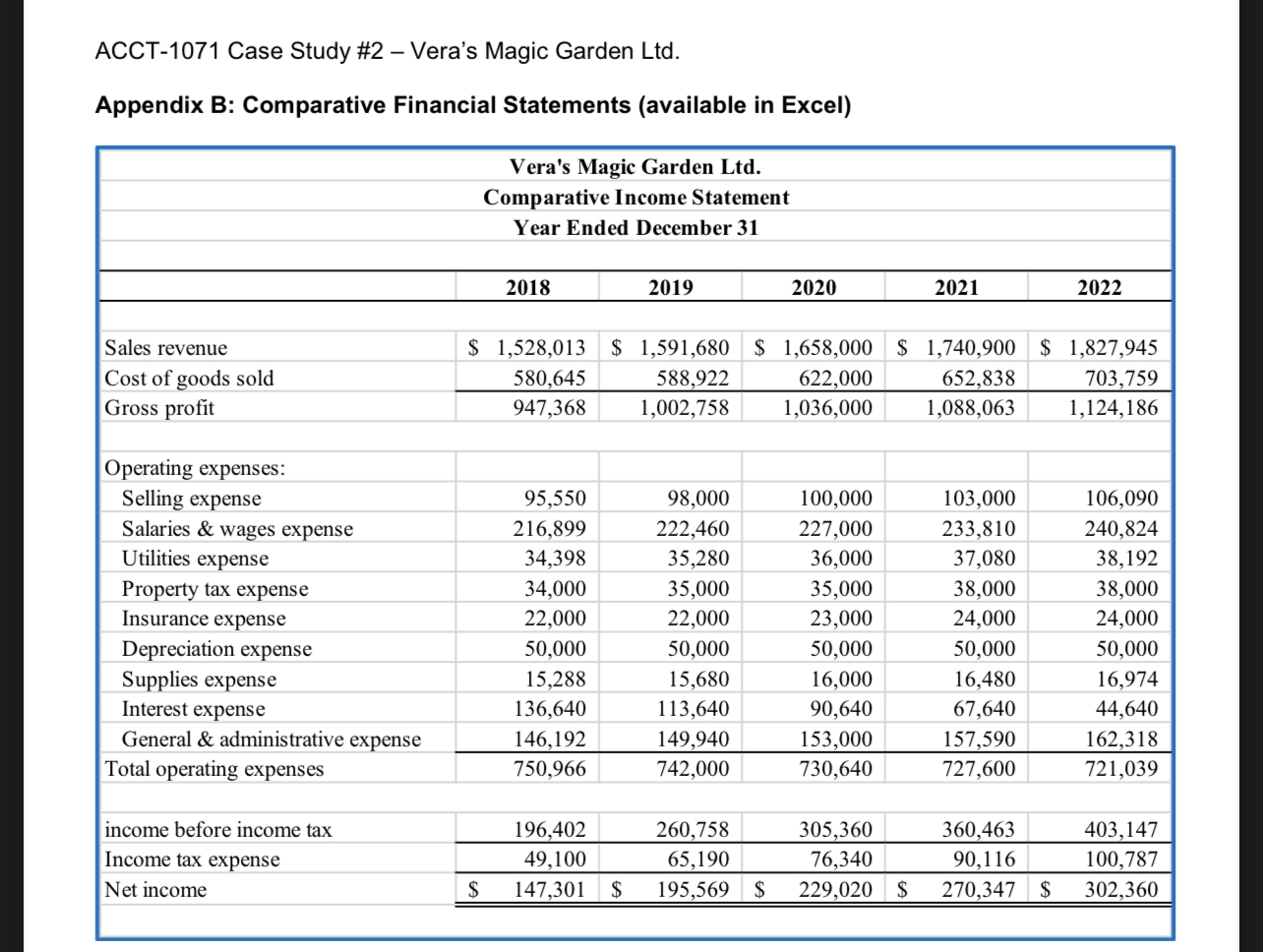

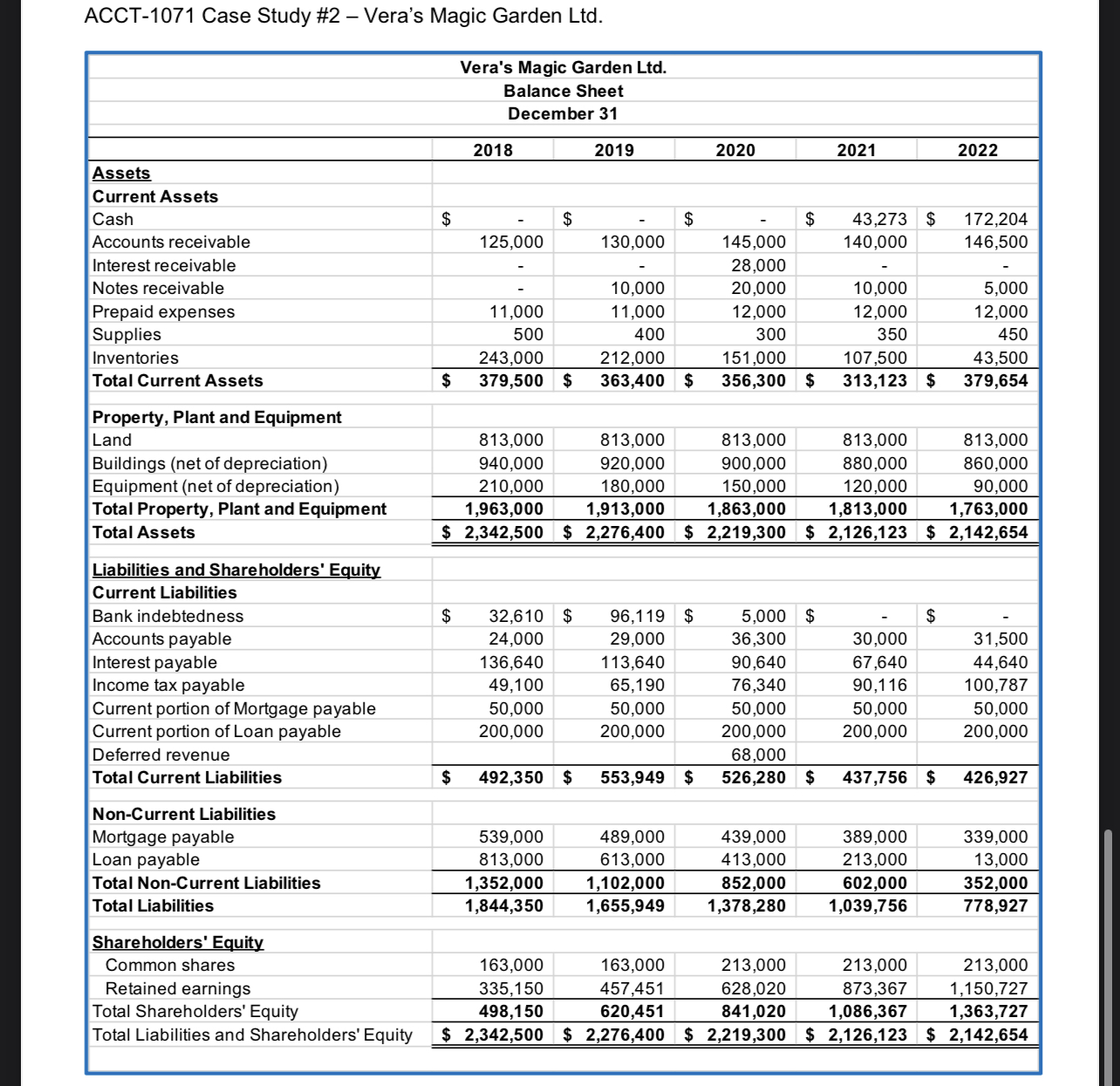

ACCT-1071 Case Study #2 Vera's Magic Garden Ltd. Appendix B: Comparative Financial Statements (available in Excel) Vera's Magic Garden Ltd. Comparative Income Statement Year Ended December 31 2018 2019 2020 2021 2022 Salesrevenue $ 1,528,013 $ 1,591,680 $ 1,658,000 $ 1,740,900 $ 1,827,945 Cost of goods sold 580 645 588 922 622 000 652 838 703 759 Gross prot 947,368 1,002,758 1,036,000 1,088,063 1,124,186 Operating expenses: Selling expense 95,550 98,000 100,000 103,000 106,090 Salaries & wages expense 216,899 222,460 227,000 233,810 240,824 Utilities expense 34,398 35,280 36,000 37,080 38,192 Property tax expense 34,000 35,000 35,000 38,000 38,000 Insurance expense 22,000 22,000 23,000 24,000 24,000 Depreciation expense 50,000 50,000 50,000 50,000 50,000 Supplies expense 15,288 15,680 16,000 16,480 16,974 Interest expense 136,640 1 13,640 90,640 67,640 44,640 General & administrative expense 146,192 149,940 153,000 157,590 162,318 Total operating expenses 750,966 742,000 730,640 727,600 721,039 income before income tax 196 402 260 758 305 360 360 463 403 147 Income tax expense 49,100 65,190 76,340 90,116 100,787 Net income 55 147,301 $ 195,569 229,020 270,347 302,360 ACCT-1071 Case Study #2 - Vera's Magic Garden Ltd. Vera's Magic Garden Ltd. Balance Sheet December 31 2018 2019 2020 2021 2022 Assets Current Assets Cash $ $ $ $ 43,273 $ 172,204 Accounts receivable 125,000 130,000 145,000 140,000 146,500 Interest receivable 28.000 Notes receivable 10,000 20,000 10,000 5,000 Prepaid expenses 11,000 11,000 12,000 12,000 12,000 Supplies 500 400 300 350 450 Inventories 243,000 212,000 151,000 107,500 43,500 Total Current Assets $ 379,500 $ 363,400 $ 356,300 $ 313,123 $ 379,654 Property, Plant and Equipment Land 813,000 813,000 813,000 813,000 813,000 Buildings (net of depreciation) 940.000 920,000 900,000 380.000 860,000 Equipment (net of depreciation) 210,000 180,000 150,000 120,000 90,000 Total Property, Plant and Equipment 1,963,000 1,913,000 1,863,000 1,813,000 1,763,000 Total Assets $ 2,342,500 $ 2,276,400 $ 2,219,300 $ 2,126,123 $ 2,142,654 Liabilities and Shareholders' Equity Current Liabilities Bank indebtedness $ 32,610 $ 96, 1 19 $ 5,000 $ $ Accounts payable 24,000 29,000 36,300 30,000 31,500 Interest payable 136,640 113,640 90,640 67,640 44,640 Income tax payable 49,100 65,190 76,340 90,116 100,787 Current portion of Mortgage payable 50,000 50,000 50,000 50,000 50,000 Current portion of Loan payable 200,000 200,000 200,000 200,000 200,000 Deferred revenue 68,000 Total Current Liabilities $ 492,350 $ 553,949 $ 526,280 $ 437,756 $ 426,927 Non-Current Liabilities Mortgage payable 539,000 489,000 439,000 389,000 339,000 Loan payable 813,000 613,000 413,000 213,000 13,000 Total Non-Current Liabilities 1,352,000 1,102,000 852,000 602,000 352,000 Total Liabilities 1,844,350 1,655,949 1,378,280 1,039,756 778,927 holders' Equity Common shares 163,000 163,000 213,000 213,000 213,000 Retained earnings 335,150 457,451 628,020 873,367 1,150,727 Total Shareholders' Equity 498,150 620,451 841,020 1,086,367 1,363,727 Total Liabilities and Shareholders' Equity $ 2,342,500 $ 2,276,400 $ 2,219,300 $ 2,126,123 $ 2,142,654ACCT-1071 Case Study #2 Vera's Magic Garden Ltd. Appendix A: Notes from Client Meeting The following information was provided by the owner of Vera's Magic Garden Ltd. detailing expected sales, collections, purchases, expenditures, payments and financing for the scal year, January 01 December 31 , 2023. Sales Sales are expected to increase by 5% over 2022 and historically have been earned as follows: _- Most sales are cash (30%) and credit card (60%); however, we do some corporate sales (10%) that are billed and collected the following month. Credit card sales are deposited directly to our bank account the next business day less a 4% transaction fee. The only exception to this pattern is December with sales of holiday wreathes and arrangements that are mainly corporate (80%) with the balance from cash sales. Purchases 8| Cost of Goods Sold Purchases are approximately 35% of total sales. Orders are made in February and a 20% deposit is payable in March. Approximately 60% of orders arrive during April and the balance arrive in early May with the balance owing paid 60 days following receipt. An additional purchase of $35,000 is planned for November for the holiday season and is payable the following January. Although purchases are approximately 35% of sales, cost of goods sold is approximately 38% of sales due to plant loss and end-of-season scrap. Annuals not sold during the season are scrapped as the cost of overwintering cannot be recovered; therefore, inventory consists of pots, soil. fertilizer, trees, shrubs, and perennials that are overwintered for sale next year. ACCT-1071 Case Study #2 Vera's Magic Garden Ltd. Exgenses 8: Financing 1. Principal payments of $200,000 plus 10% interest on the year-end loan balance is payable on January 01 each year. 2. Principal payments of $50,000 plus 6% interest on the year-end mortgage balance is payable on January 01 each year. 3. We have negotiated an increase of $450,000 to the existing loan to nance new greenhouses that will be built during the slow period of August October. 4. The insurance policy is renewed on July 1st each year at a cost of $24,000. 5. Property taxes for 2023 will be $38,000 paid in January. 6. Salaries and wages are expected to increase to $240,000, paid as follows: i. 50% of salaries and wages expense is incurred during peak season April - July, paid evenly throughout each month. ii. 30% of salaries and wages expense is incurred during March, August, September, and October, paid evenly throughout each month. iii. 20% of salaries and wages expense is incurred during January, February, November, and December, paid evenly throughout each month. 7. All other expenses, other than depreciation and income tax, are expected to increase by 3%. 8. Selling expense, supplies expense and generalfadministrative expense follow the same pattern as salaries and wages expense. 9. All other expenses, other than income tax are incurred and paid evenly throughout the year. Income tax is paid in June based on the prior year's corporate tax return. 10. Dividends of $30,000 will be paid in December. 11.The corporation plans to buyout the shares of one of the original investors at a cost of $200,000 in June. 12.Vera's has access to a $500,000 line of credit to cover short-term cash needs at an annual interest rate of 6%. Excess cash is immediately used to repay the line of credit balance and interest charges are payable the following month on the prior month's ending balance

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts