Additional information necessary for determining taxable income: The depreciation expense for the year under MACRS was $64,000The

Fantastic news! We've Found the answer you've been seeking!

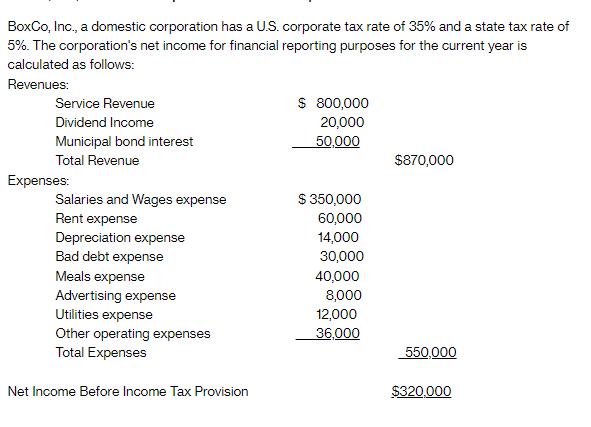

Question:

Additional information necessary for determining taxable income:

Additional information necessary for determining taxable income: The depreciation expense for the year under MACRS was $64,000The amount of accounts receivable written off as uncollectible during the year was $22,000BoxCo owns 24% of the corporation from which it received dividends

Required:

Determine the permanent book-tax differences (BTDs)

Organize the Effective Tax Rate ReconciliationFor homework:

Enter the company's Income Statement on an Excel spreadsheet

On a separate Excel worksheet (within the same document), organize a template for the Effective Tax Rate Reconciliation

Use this spreadsheet to complete the Effective Tax Rate Reconciliation assuming the same facts except that:

BoxCo contributed $15,000 to a political action committee

Federal Tax Rate is 40%

The state Tax Rate is 6%

Related Book For

Income Tax Fundamentals 2013

ISBN: 9781285586618

31st Edition

Authors: Gerald E. Whittenburg, Martha Altus Buller, Steven L Gill

Posted Date: